Cross-border supervision

To be resolved: the FDIC and the future of bank failure

Will Jelena McWilliams finally nail down the FDIC’s role as a resolution authority?

EU infighting blocks Basel recognition of banking union

Treating eurozone as single jurisdiction could slash G-Sib capital, but the 19 member nations have differences to settle first

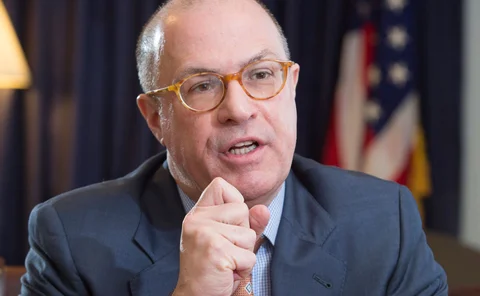

Oversight row could block EU firms from US clearing – Giancarlo

Europe’s planned post-Brexit CCP reforms “irreconcilable” with US rules, says CFTC chief

Hosting the world: HKMA on cross-border bank resolution

Hong Kong regulator supports 75% internal TLAC to boost international co-operation

The special one: a eurozone G-Sib waiver for BNP Paribas

Experts say French bank’s G-Sib buffer could fall to 1%, saving €3 billion in regulatory capital

Regulators rebuff fragmentation complaints

EC’s Guersent points to Fed hints that it would ease TLAC plans for foreign banks

StanChart hopes reg spending has peaked as costs drop 5%

Bank reports a $63 million quarter-on-quarter drop

Giancarlo expects to resolve EU-US CCP spat

CFTC chairman lauds relationship with EU’s Dombrovskis

Swinburne: post-Brexit financial services deal could work

Isda AGM: Idea of comprehensive EU-UK deal immediately worries CFTC official

Not waiving but drowning: EU banks face capital traps

Council and some MEPs try to kill cross-border capital and liquidity waivers in CRR II

BoE to authorise EU CCPs ‘at 00:01’ on Brexit day

Central bank hopes plan to preserve access for EU CCPs will be reciprocated

Foreign banks in US dismayed by Trump tax on internal TLAC

Coupons on IHC debt issued to foreign parents will face 10% base erosion tax under new rules

EU regulators urged to give guarantees on Brexit transition

UK banks and insurers want legal protection in case a political deal breaks down

HKMA offers fast-track model vetting in swaps hub pitch

Streamlined process could take just six months, says official

Icap European Sef faces axe as US, EU reach equivalence deal

Dual-registered venue no longer necessary under US-EU substituted compliance regime, say lawyers

Fed’s Powell on Libor reform, repo and clearing

Risk30: Market doesn’t need to “clear all US dollars in US and all euros in eurozone” says next Fed chair

Reporting rules key for EU-US swaps trading equivalence

Market participants welcome outcomes-based approach, but need clarity where rules differ

Deutsche Bank expects early 2018 decision on LCH exit

LSE chief slams clearing relocation proposals for trying to create captive European Union market

Treasury review not rollback of reforms – CFTC counsel

Trump order is a chance to ease some rules and promote cross-border regulatory deference

ECB and Esma would call shots on euro clearing

Proposals give central bank and regulator the power to bar biggest third-country CCPs

Banks fear fresh burden from new EU branch supervision plan

EBA insists enhanced supervision of largest branches will not bring additional requirements

Insurers cannot get round Brexit with ‘brass plaques’ – CBI

Firms will need a substantial presence in Ireland to sell into single market, says regulator

Forget your passport: London outside the single market

UK-based banks seek simplest way to retain EU access post-Brexit

SEC rule hikes cost of trading US CDS for non-US firms

CDS trades between non-US counterparties will be captured under Dodd-Frank