Credit derivatives

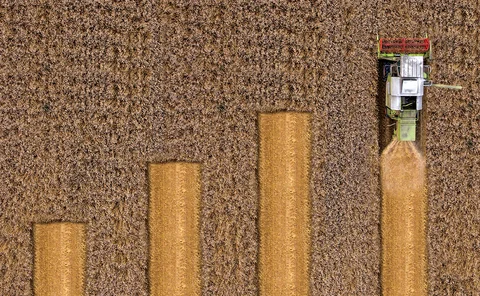

Credit swap portfolios contracted at systemic US banks in Q2

Sold notionals fell 8% over the three months to end-June

Barclays led UK banks in growing CDS book through Covid shock

Dealer saw credit derivatives notionals balloon £58.1 billion over the first half

XVA traders have no time to rest on laurels

Markets have calmed, but they may not be out of the woods yet

CVA desks arm themselves for the next crisis

March’s volatility forces dealers to fine-tune hedging strategies

ABN Amro crushes CVA charge with index hedges in H1

Risk-weighted assets for CVA drops 48% in six months to end-June

Stanford’s Duffie shakes up SOFR credit race with AXI index

Academics propose new credit index that ditches Libor tenors for a single funding spread

Common domain model needs infrastructure push, says Barclays

Bank wants market infrastructures to drive adoption of Isda CDM

Ice Europe’s CDS unit hit by almost 1,000 IM breaches in Q1

Peak breach was €100 million in size

Volatility scaling flops in credit alt risk premia

Strategies miss recovery from March plunge, prompting rethink on speed of mean reversion

Equity derivatives aided BlackRock funds in March

Flagship Strategic Income Opportunities fund posted $253 million in net derivatives gains at height of Covid crunch

Recent defaults lead to record credit derivatives payouts

CDS auctions have yielded historically low recovery rates this year, meaning swap sellers have had to pay more than normal

Sold CDS notionals climbed 16% at top US banks in Q1

Net fair value of credit protection positions vaults to $5.3 billion

Cleared sovereign CDS volumes build as pandemic spreads

South Korea and Italy CDS vols dominate Ice Clear Credit and Ice Clear Europe, respectively

CDX volumes roar upward on coronavirus panic

Notional traded volumes hit multi-year highs in each of the last three weeks

iTraxx volumes spike amid market panic

Volumes of Ice-cleared index contracts more than four times higher than average

The UK’s path to EU equivalence: détente or detour?

Race to meet post-Brexit cross-border trading requirements will go down to the wire

At US G-Sibs, rates derivatives notionals the lowest since 2014

Banks cut interest rate swaps notionals by -18% year-on-year

CDX on junk bonds jumped 65% in H1 2019

Notionals to which CCPs were counterparty increased +85%

EU derivatives markets highly concentrated

CCPs hold 41% of interest rate derivatives notional exposures

Hedge fund of the year: Hildene Capital Management

Risk Awards 2020: A high-return hedge fund weathers the storm in structured credit

Over five years, swaps plummet, options climb at US banks

Swap notionals down $45 trillion since Q2 2014

Credit derivatives house of the year: Barclays

Risk Awards 2020: UK bank showed flow strength in Thomas Cook default – and product range is growing

Competitive differentiation – Reaping the benefits of XVA centralisation

A forum of industry leaders discusses the latest developments in XVA and the strategic, operational and technological challenges of derivatives valuation in today’s environment, including the key considerations for banks looking to move to a standardised…

At Wells Fargo, derivatives exposures climb $13bn in Q3

Portfolio shifted further into-the-money in the third quarter