Credit derivatives

PGIM credit options binge lifts Barclays, Morgan Stanley

Counterparty Radar: Insurer’s AM arm doubled its market share in Q4 2021 as bought protection swells

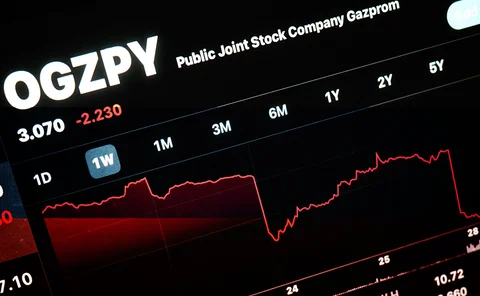

CDS users mull ‘uniform’ price as Russia fallback

Pricing agreement could replace dealer estimates if sanctions scupper default auctions

Morgan Stanley bests Goldman as top US fund single-name CDS dealer

Counterparty Radar: Single-name corporate volume hits record high as Pimco increases positions

US funds continue expansion of sold CDS protection

Counterparty Radar: Pimco leads charge with $57 billion in total sold positions

Norway oil fund’s derivatives book balloons 192% in H2 2021

Sovereign wealth fund GPFG piled up FX and IR contracts and tapped CDS for the first time

Pimco, Franklin Templeton affiliates top for Russia exposure

Counterparty Radar: Funds had biggest long exposures to Russia across credit, rates, FX at end of Q4

Credit default swaps on Russian companies face uncertain future

With CDS auctions on sanctioned companies unlikely, traders may have to rely on dealer estimates

Credit derivatives house of the year: BNP Paribas

Risk Awards 2022: Relative value trades propel French dealer into US top tier for index and single names

UK bank derivatives exposures rose by £38bn in Q3

FX contracts drove the overall increase

How derivatives management is changing post‑Covid‑19

Risk.net explores five derivatives trading themes discussed by experts in a recent webinar sponsored by Numerix

Evergrande exposes China’s lack of credit hedges

Onshore credit derivatives market has been little help during property giant’s recent woes, sources say

Defiant ECB urges ‘further work’ on clearing relocation

Policy-makers moot changes to Emir to tackle systemic risks of third-country CCPs

A pricing model with dynamic credit rating transition matrixes

This paper incorporates a stochastic credit rating transition matrix into the Acharya–Das–Sundaram model and implements a simulation based pricing method

UK bank derivatives exposures fall by £321bn in Q2

At £1.12 trillion, FX exposures are at their lowest levels for seven years

UK banks interest rate swap exposures fall £711bn

Credit derivatives exposures bucked the downward trend, growing 16% quarter on quarter

CDS market prepares to join Libor transition

Ice and LCH will switch to new rates for margin interest; Isda to follow in standard model update

CDS trading remains stubbornly human

Buy-siders sceptical of benefits of algo execution for credit derivatives

ESG derivatives – From equity to fixed income, what next for this market?

The fast-evolving ESG derivatives market, how these products are helping investment strategies and expectations for market development.

Credit derivatives traded volume up 15% in 2020

Week ending March 1 was the most active in dollar-denominated swaps

Credit derivatives house of the year: Credit Suisse

Risk Awards 2021: hedging before the crisis allowed bank to offer ample liquidity when markets tanked

ETF options: the market’s latest credit hedge

Investors look to derivatives on fixed income exchange-traded funds to manage credit risk exposure

Majority of EU funds’ CDSs are ‘naked’ exposures

Of more than 4,000 CDS positions assessed by Esma researchers, 71% were uncovered

Asia moves: HSBC appoints Apac CIO, Crédit Agricole names regional transaction banking head, and more

Latest job news across the industry

Cleared CDS volumes surged in H1 – BIS

CDX cleared contracts outstanding leapt 35% in H1