Volatility

Savers and funds grabbed MBSs as banks and Fed retreated

Central banks and commercial lenders became net sellers of bundled mortgages as rates rose, says BIS

Cross-sectional stock volatility lifts value factor

Dispersion in returns makes for ‘double alpha’

LCH’s fixed income and IRS units hit by record margin breaches

Peak breaches in Q3 were £924 million and £698 million in size, respectively

Next Generation ETD: a future-proof concept

In June, the infrastructure for Eurex’s next generation of exchange-traded derivatives (ETD) contracts went live. The concept meets changing market demand and is implemented across Eurex’s entire value chain, allowing more flexibility in the design of…

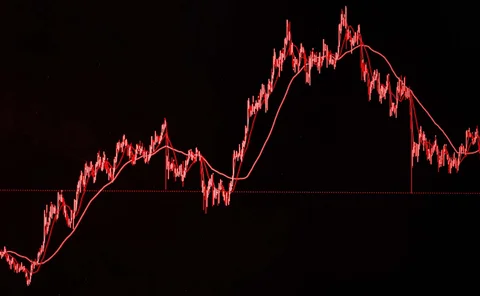

Degree of influence 2022: In the grip of volatility

Rough volatility, liquidity and trade execution were quants’ top priorities this year

FX primary venues seek reversal of fortunes

EBS and Refinitiv fight to restore market share – but bilateral trading may be too entrenched, dealers say

Fed hike behind $682m and $460m breaches at FICC

Clearing units for MBS and government securities hit by backtesting deficiencies on September 21

Norinchukin’s investment securities loss widens to $12bn

Lender is worst-hit by bond price crash among Japanese banks

Critical divergence in prices between Spikes and Vix after the Fed’s rate hike

In these uncertain times, when rates hikes and other structural drivers are giving rise to adverse market moves, reliable indicators of 30-day implied volatility are crucial

CME eyes retail growth with new weekly FX options

Exchange hopes to capture massive demand from the sector

Vega decomposition for the LV model: an adjoint differentiation approach

Introducing an algorithm for computing vega sensitivities at all strikes and expiries

RBI’s VAR gauges hit new record

Banking and trading book risk rose in Q3 amid shifts in risk factor mix

Equities clearing and CCP resilience: protecting post-trade from geopolitical turmoil

Headline-making events in 2022 have driven market volatility with sustained increases in trading and clearing volumes. With market participants under pressure, how do central counterparty (CCP) resilience and innovation in equities clearing provide…

Enhanced expected impact cost model under abnormally high volatility

The authors extend their impact cost model beyond the typical factors to address the larger transaction costs brought on by stock market crowding effects in times of market turbulence.

Strong dollar pushes ANZ’s CVA charges up 57%

Risk-weighted assets rose A$1.4 billion in three months; biggest quarterly increase since mid-2019

Crédit Agricole VAR hits highest since 2010

Trading risk gauge rose as high as €27 million during Q3

Who blew up gas prices? (It wasn’t just Russia)

Government buying, climate risk and short squeezes may have led to ‘horrendous’ gas market margin calls

Erste, RBI top up provisions with €258m in overlays

Austrian lenders remain reliant on model supplements as energy squeeze looms

Vol pushed HSBC’s modelled market risk up 37% in Q3

Erratic markets in Europe and Asia blamed for $6.4bn increase led by VAR and SVAR-based charges

NatWest’s modelled market RWAs up 10% on RNIV backstop

Bank sees higher charges while it reworks VAR engine

Forecasting the realized volatility of stock markets with financial stress

This paper investigates the impact of financial stress on the predictability of the realized volatility of five stock markets

Corporates rush to hedge emerging market currency risks

Falling forward points have reduced cost of hedging further drops in Chinese renminbi

BNY, State Street took $6.5bn fair-value hit to bonds in Q3

Eroding prices of RMBSs and govies keep widening unrealised losses

Sculpting implied volatility surfaces of illiquid assets

From the stock cumulative distribution function an arbitrage-free volatility surface is derived