Volatility

The haves and the ‘have bots’: can AI give vol forecasters an edge?

Firms look to machine learning and natural language processing to gain advantage over peers

CCP ‘skin in the game’ still dwarfed by member contributions

Even as markets churned in 2022, clearing houses coughed up only 2% of funds at end-September – the same as the previous year

Momentum transformer: an interpretable deep learning trading model

An attention-based deep learning model for trading is presented

‘Hung’ leveraged loans push Barclays’ VAR to 10-year high

Trading risk gauge hit a peak of £73 million in Q4, £2 million shy of 2012 peak

Risk.net’s top 10 investment risks for 2023

Geopolitical frictions, sticky inflation and a hard landing are among the hazards cited by investors

Options liquidation can be costly. How costly?

New model uses open interest and volume data to calculate the expense of selling an options portfolio during times of stress

‘Globalisation rewired’: what does it mean for investors?

After half a century of outsourcing production to developing nations, companies are changing tack – with long-term implications for investors

SocGen’s VAR up 33% in Q4

Gap with French rival BNP Paribas shrinks to just €9 million, the least since mid-2020

SEB’s market RWAs drop 20% as FX positions recede

Fall in currency exposures below EU’s threshold in Q4 reversed Skr5.3bn RWA hit from previous quarter

Navigating the volatility and complexity of commodity markets

Commodity markets have experienced significant challenges since the Covid-19 pandemic, the conflict in Ukraine and the subsequent sanctions imposed on Russia. These unprecedented events have caused fluctuations in supply and demand, disrupted global…

OTC share of EU gas derivatives surges to 25%

Energy price cap may supercharge flight from ETDs and affect CCPs’ ability to manage risks, Esma warns

Is low vol crowded? That depends who you ask

Equity drawdowns have pushed more investors into low volatility strategies, raising fears of a build-up of risk

BofA’s DVA losses inflated to $193m in Q4

Latest hit is largest since 2020, but still leaves positive result for 2022

OTC trading platform of the year: Tradeweb

Risk Awards 2023: Traders prized the platform’s convenience and flexibility during last year’s market turbulence

IRB risk-weights highest at smallest EU banks – ECB

Lenders with less than €30 billion in assets consistently report lower risk densities than bigger banks across all modelled portfolios

NSCC and OCC to enhance co-operation on large cash calls

New deal would improve management of options expiries, but will stop short of cross-margining

Repo clearing: trends, developments and outlook

Recent volatility in the UK gilt market has highlighted the repo market’s need for CCP stability, predictability and resilience. LCH RepoClear unpacks the trends and key developments of 2022, and shares an outlook for 2023

Optimising balance sheet management in today’s market conditions

Financial institutions are going to continue struggling with challenges and volatility in 2023

Uncleared, unrated CDS notionals boomed in H1 2022

Non-cleared trades up 21% in six months and 14% in twelve, BIS data shows

Client margin for swaps hits new record at four FCMs

Required funds at all-time high at BofA, Goldman, JP Morgan and Barclays in November as market turbulence persists

Rifts widen across EU banks’ trading results

Largest fair-value hits from HFT assets moved further from median in H1

UK banks’ CVA charges ballooned by £8bn in volatile Q3

Bank of England figures show capital requirements at highest since early pandemic readings

Ice Europe made $7.8bn VM call in Q3

Highest cash call on record triggered by higher commodity prices as Europe energy crisis persists

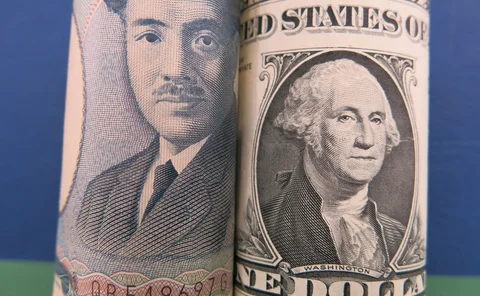

BoJ policy shift sends traders to hedge downside yen moves

Hedge funds and corporates rush to FX options following central bank move