Regulators

The problem with GRC

Boards may care more about products and profits than governance, risk and compliance (GRC). But without an effective GRC programme, the fun soon stops when trouble calls, says Michael Gibbs, chief executive of SureStep Risk + Analytics

The Fundamentals of market risk rules

With the 2022 Fundamental Review of the Trading Book (FRTB) deadline looming, banks are fast coming to grips with the amount of work still to be done to achieve a successful implementation

Competitive differentiation – Reaping the benefits of XVA centralisation

A forum of industry leaders discusses the latest developments in XVA and the strategic, operational and technological challenges of derivatives valuation in today’s environment, including the key considerations for banks looking to move to a standardised…

Opening the buy-side liquidity pool

Vikash Rughani, business manager at triReduce and triBalance, outlines a new approach enabling buy- and sell-side participants to optimise the transition of legacy Libor over-the-counter swaps contracts to alternative reference rates

HSBC’s Elhedery: banks must protect whistleblowers

Corporate culture must respect and reward complainants; compensation could help, says markets chief

Market participants question South African rate reform

Risk South Africa: Some urge caution as South Africa moves to reform Jibar

Seamless integration – Drivers of and barriers to cloud adoption

Siarhei Niaborski, executive vice-president of risk at CompatibL, discusses the rate of cloud adoption in the capital markets industry and its possible drivers and barriers, how firms can derive maximum value from cloud usage and the criteria on which…

Banks warn of trader crunch at CCP default auctions

Risk USA: dealers hope for more cross-CCP fire drills

NY Fed CRO urges banks to improve risk controls

Risk USA: Tangled web of controls threatens ability to recover from attacks, says Rosenberg

Stress-testing to improve strategic decision‑making

Banking regulators remain focused on expanding and developing the range of stress-testing regimes across the globe to maintain stability, monitor emerging risks and avoid another financial crisis. Here, a forum of industry leaders discusses the evolution…

Best CVA practices in Japan

At a recent roundtable in Tokyo, banks and regulators discussed progress on credit valuation adjustment (CVA). While, in many respects, the work towards implementing best practices in the country is on track, challenges remain in resourcing and…

UK swaps carrot for stick in Libor switch

BoE committee mulls policy action, which could include capital hikes on Libor exposures

Capital cut for synthetic securitisations splits regulators

European rulemakers wary of diverging from Basel standards

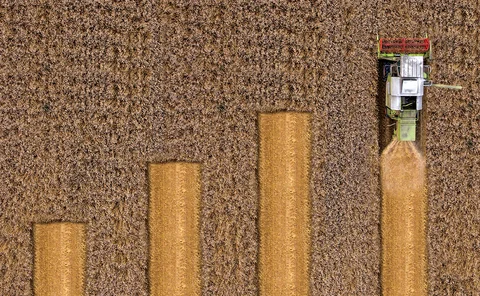

US bank minnows growing faster than giants

Banks $1 billion to $10 billion in size accumulated assets at faster rate than those over $10 billion in size in 2018

Realising opportunities while managing conduct risk

As efforts to transition from Libor to risk-free rates ramp up, Maria Blanco and Nassim Daneshzadeh, partners in PwC’s US and UK financial services practices, discuss two critical and interconnected strategies that are front and centre for PwC clients

We’ve been here before: LEIs take two

LEIs are catching on in Asia

Libor transition and implementation – Covering all bases

Sponsored Q&A

Q&A: CFTC’s Behnam on tackling market risk in climate change

Commissioner wants to see new derivatives products to help mitigate climate threat

Risk Technology Awards 2019: Making machines more helpful

Machine learning can be too efficient; now, vendors are looking for ways to make it more accurate. Clive Davidson looks at the stories behind this year’s Risk Technology Awards