UK swaps carrot for stick in Libor switch

BoE committee mulls policy action, which could include capital hikes on Libor exposures

UK regulators are losing patience with a growing stock of Libor exposures. The Bank of England’s Financial Policy Committee last week threatened policy action to more-forcibly detach participants from the discredited rate before the end of 2021, when it could vanish from view.

“In Q4, the FPC will consider further potential policy and supervisory tools that could be deployed by authorities to reduce the stock of legacy Libor contracts to an irreducible minimum ahead of end-2021,” says the FPC in its October report.

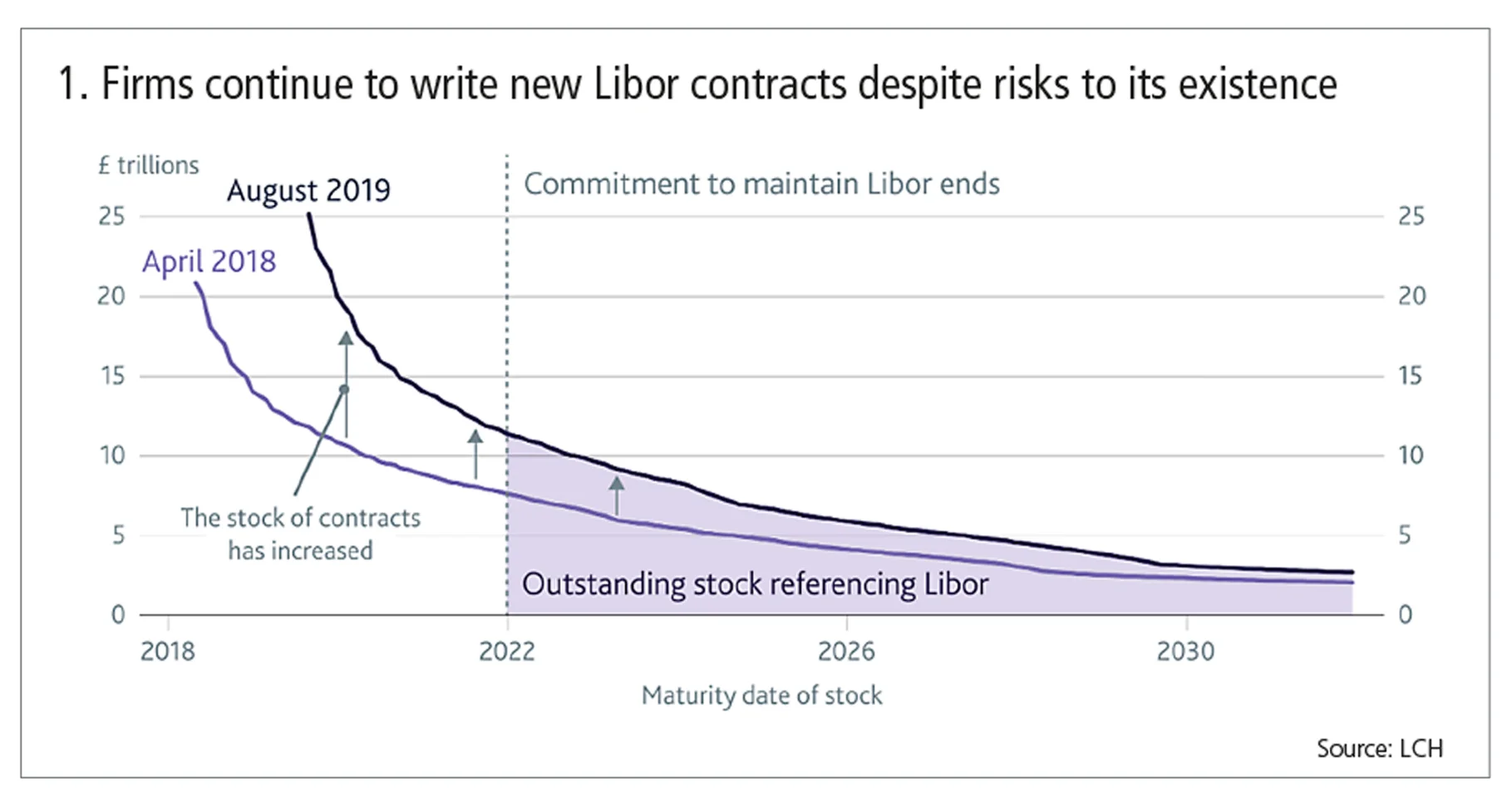

Participants may be dabbling in regulator-preferred risk-free rates (RFRs) such as Sonia in the UK and SOFR in the US, but there appears to be no let-up in firms writing new Libor contracts despite risks to the benchmark’s existence after 2021. The stock of Libor-linked instruments set to mature after the rate’s impending death jumped by around 50% to approximately £12 trillion ($15 trillion) between April 2018 and August 2019, according to LCH data included in the report (see figure 1).

The FPC warns there is “no justification” for firms to increase their Libor exposures. “The pace of market participants’ transition efforts to alternative benchmark rates now needs to accelerate,” it adds.

The latest bout of sabre rattling comes amid growing frustration among UK regulators at the slow pace of transition. The Prudential Regulatory Authority and Financial Conduct Authority are ramping up efforts to closely monitor Libor exposures and transition plans for more firms, starting with an expanded round of ‘Dear CEO’ letters. In September, the FCA called for banks to be making loans pinned to Sonia by the third quarter of 2020 and demanded dealers embed the rate as the norm when quoting sterling swaps.

When it comes to cranking up the pace of transition, regulators have a range of policy tools at their disposal – all of which are complex and time-consuming to implement. One well-flagged option is a hike in the risk weight of Libor-linked assets under Basel III capital rules. Another route is counterparty credit risk. If the regulator identifies a counterparty as a higher credit risk due to a weighty stock of Libor exposures, trading with that institution could attract higher credit valuation adjustment charges.

More likely, according to one London-based consultant, is a ‘skilled person review’ under Section 166 of the Financial Services and Markets Act. This permits the regulator to appoint a third party to perform a forensic assessment of a firm’s transition plans and activities to ensure there is an active winding down of positions.

It’s an intrusion most will be keen to avoid.

“Section 166 is the trump card as you have to throw so many resources at it and you’re under a microscope. Before that, there are a series of actions regulators could take. You could be fined privately or it could become a reputational risk issue. There are a lot of actions available before you need to make a policy change, which takes an inordinate amount of time,” says the consultant.

Other measures already under discussion include plans to restrict Libor collateral in the Bank of England’s sterling liquidity pool. The most radical option would effectively prohibit Libor assets from the sterling monetary framework – a £322 billion source of liquidity for more than 200 banks. The result would likely be to drive a wedge between Libor and Sonia-linked bond valuations, incentivising issuers to switch the rate underlying floating debt instruments through consent solicitation exercises.

Divergence

Participants in the sterling market may feel somewhat hard done by. No other market comes close in embracing Libor successor rates in both cash and derivatives markets. Sonia is already the standard benchmark for sterling floating rate note issuance, underlying £33 billion of debt. The unsecured overnight RFR represents half of sterling swaps notional cleared at LCH over the past year. That is an impressive haul, though growth has plateaued – a bugbear for the FCA.

Any UK policy action would have application beyond sterling contracts, likely impacting US dollar Libor and even Euribor exposures, where there is little or no pressure for local firms to transition.

The eurozone’s new €STR overnight rate, launched on October 2, is intended to replace Eonia – another overnight rate. Euribor, by contrast, is being kept alive indefinitely with support from European Central Bank.

In the current climate, it’s also difficult to imagine US regulators presenting a beefed-up plan to wipe out dollar Libor exposures in the near-term. After all, tough questions are being asked about the suitability of the new secured overnight financing rate since it went rogue on September 23, spiking to an unprecedented 5.25%.

If Libor was an easy target for manipulation, many participants are now scratching their heads over the viability of a benchmark whose stability is being buttressed by the Federal Reserve pumping billions of dollars of repo funding into the system.

At this stage, concrete policy action seems unlikely to be mirrored by global regulators. If the UK goes down that route, it may well be alone. Such a unilateral move could open a new door to regulatory arbitrage. For example, Libor assets traded by UK institutions could be hived into non-UK entities to escape higher charges. With the added spectre of Brexit, it could be a double whammy for market fragmentation.

Some hope the latest threat is more talk than action. But with just over two years until Libor’s possible demise – and seven years since the first Wheatley report put transition on the radar – it is little wonder that talk is turning tough.

“Regulators have to keep the thumbscrews on, otherwise this will just go on and on,” says the consultant.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Our take

Quants dive into FX fixing windows debate

Longer fixing windows may benefit clients, but predicting how dealers will respond is tough

Talking Heads 2024: All eyes on US equities

How the tech-driven S&P 500 surge has impacted thinking at five market participants

Beware the macro elephant that could stomp on stocks

Macro risks have the potential to shake equities more than investors might be anticipating

Podcast: Piterbarg and Nowaczyk on running better backtests

Quants discuss new way to extract independent samples from correlated datasets

Should trend followers lower their horizons?

August’s volatility blip benefited hedge funds that use short-term trend signals

Low FX vol regime fuels exotics expansion

Interest is growing in the products as a way to squeeze juice out of a flat market

Can pod shops channel ‘organisational alpha’?

The tension between a firm and its managers can drag on returns. So far, there’s no perfect fix

CDS market revamp aims to fix the (de)faults

Proposed makeover for determinations committees tackles concerns over conflicts of interest