Leverage

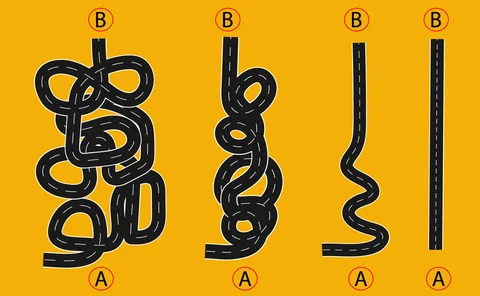

Keep risk parity simple, stupid

In times of volatility, simpler risk parity strategies may outperform more elaborate counterparts

BNY Mellon, Schwab would benefit most from SLR relief

A repeat of the pandemic carve-out would boost average ratio across US banks by 45bp

EU banks’ leverage ratios slip as ECB relief ends

Lenders still carving out central bank balances in March saw ratios drop 60bp on average

Top Fed watchdog supports non-bank Sifi designation

Vice-chair Barr complains regulators lack “even basic data” on some areas of shadow banking

Credit checks, what credit checks? How crypto lending ate itself

Collapse of hedge fund Three Arrows Capital exposes “sloppy and irresponsible” credit standards among crypto lenders

SEC commissioner wants power to block single-stock ETFs

Listings of funds that pay out when Tesla or Pfizer shares fall prompt call for tougher regulation

Hedge funds warn SEC dealer rule is ‘unenforceable’

Private funds say they are collateral damage of poorly drafted push to regulate PTFs

Fed ‘tailoring’ led to larger, less capitalised regional US banks

Lenders freed from toughest requirements in 2018 grew balance sheets but saw capital ratios slip

Credit Suisse goes off piste in latest DFAST

US unit of Swiss bank underestimated leverage hit in Fed stress test

HSBC exhausts leverage headroom in Fed stress tests

Goldman Sachs worst performer among US banks

FSB warns on Archegos-style leverage

Isda AGM: Knot takes dim view of banks piling up leverage blind

How to model potential exposure, post-Archegos

BofA quant’s model considers the correlation between market shocks and counterparty defaults

Credit Suisse cuts leverage exposure by $11.5bn

CET1 leverage ratio remained flat over Q1 as drop in capital more than offset cuts in prime brokerage business

Mind the gap

A default intensity model reveals the risk carried by a highly leveraged counterparty

Prime broker of the year: Barclays

Risk Awards 2022: Focus on risk management helps UK bank win client trust – and balances – in wake of Archegos collapse

Credit Suisse cuts leverage exposure by $52bn

Investment banking unit bears brunt of post-Archegos balance sheet trimming

Private companies ‘lack data transparency’

Investors held back over issues around data quality and availability

Investment fund leverage: the known unknowns

More work needed on first-mover redemption incentives and margin calls, says Iosco chief

Review of 2021: Default, revolt, reform

Archegos, GameStop, the last days of Libor – markets just about coped in a bleak and disorderly year

Source of systemic risk varies by region

European, Canadian and UK banks are too big to fail because of their cross-border activities, Chinese and Japanese banks because of their size

Global banks grow systemic footprint

Nine out of the 12 G-Sib indicators increased in 2020

EU banks’ derivatives exposures jumped 36% in H1

Top banks added €235bn since December, amid switch to SA-CCR and a new leverage ratio template

BNP Paribas leads EU banks on repo exposures

French bank increased securities financing transactions by €66bn in the first half of the year, the most among the bloc’s top lenders

Off-balance-sheet exposures at US systemic banks jump $42bn

JP Morgan, Goldman Sachs and Citi drove the overall increase in the second quarter