Interest rates

‘Globalisation rewired’: what does it mean for investors?

After half a century of outsourcing production to developing nations, companies are changing tack – with long-term implications for investors

SocGen’s VAR up 33% in Q4

Gap with French rival BNP Paribas shrinks to just €9 million, the least since mid-2020

Ice Clear Europe collateral spreads a ‘nightmare’, say banks

Risk.net spread analysis shows Ice pays little more than half the rate of other CCPs on cash margin

All outliers now: Europe’s unflattering IRRBB test

Banks, fearing overreaction from supervisors, urge European Commission to reject NII-based assessment

Wanted: radical ideas for inflation modelling

Hedge funds echo Mervyn King’s calls for a new approach to inflation modelling post-2022 crisis

More EU banks will fail new IRRBB test as rates push upwards

Half of all EU banks could cross outlier threshold for new test of net interest income

Bucking wider trend, Citi’s cash trove ends 2022 up 31%

Liquid balances surged 14% in the last quarter of the year alone

Why central banks shouldn’t ignore stablecoins

Rapid growth of stablecoins could impair monetary policy transmission

The real deal: the challenge of real interest rates

Understanding real interest rate dynamics as inflation transitions is vital, say Crédit Agricole traders

Goldman’s VAR drops 20% in Q4

Retreat led by commodities and interest rate risk

Cost of bank bail-in rules lower than expected – EBA

MREL pricing manageable for most banks, though troubled firms may struggle to meet targets

ECB group sounds alarm on ‘sluggish’ Euribor

Money market participants question robustness of key eurozone rate after methodology changes

Shadow banks grew net repo claims to record $2.1trn in 2021 – FSB

Non-bank intermediaries, led by money market funds, tapped Fed’s reverse repo window as rates began their ascent

Review of 2022: Fighting on all fronts

Macro headlines unleashed micro-horrors, as margins soared, correlations cracked and crypto markets imploded

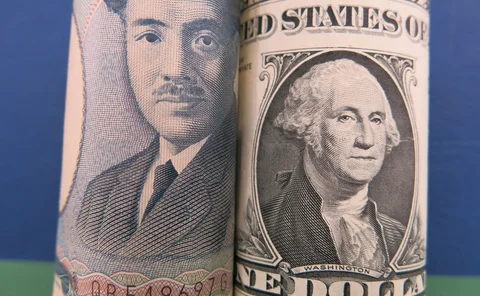

BoJ policy shift sends traders to hedge downside yen moves

Hedge funds and corporates rush to FX options following central bank move

Savers and funds grabbed MBSs as banks and Fed retreated

Central banks and commercial lenders became net sellers of bundled mortgages as rates rose, says BIS

FCA proposes using CME’s term SOFR for synthetic US Libor

IBA agrees to use rival’s ARRC-endorsed benchmark to avoid bifurcating the market

World Omni ditched term SOFR tranche in latest ABS

Toyota deal drew ARRC’s ire, but some bankers still see a case for using term SOFR in auto ABS

As interest rates surge, bankers fret over last year’s models

IRRBB modellers trying to predict client behaviour have little relevant data to fall back on

Barclays, Deutsche, Credit Suisse take $437m hit on leveraged loans

Higher interest rates eroded value of facilities stuck in pre-syndication during Q3

HSBC’s quarterly UK provisions rose 111% in Q3

Uncertainty around interest rates and political stability reflected in model overlays

Nordea marks down Danish mortgages by €29 million

House price declines mark ominous signal for other supercharged markets

New investor solutions for inflationary markets

Geopolitical risks, price volatility, clashing cycles, higher interest rates – these are tough times for economies and investors. Ahead of the 2022 Societe Generale/Risk.net Derivatives and Quant Conference, Risk.net spoke to the bank’s team about some…

Interest rate scenarios: skinny-dipping with the Fed

As US rates march upwards, Risk.net readers offer deeply diverging forecasts on the impact for markets through to 2024