Interest rates

Banks given conflicting guidance on Libor loan facilities

Some banks have been told they can continue to honour uncommitted dollar Libor lines in 2022

Interest rate ETD volumes drop in Q3

Shorter-dated contracts led the way, falling 9% quarter on quarter

JP Morgan, Goldman lead US banks in cutting VAR-based charges

On aggregate, requirements connected to commodity positions fell the most, down 28% from end-June

Loan markets call for clarity on scope of US Libor ban

Regulators must address “grey areas” in uncommitted facilities, urge participants

Buy-side rates traders staying on sidelines after wild October

Funds cautious after staggering collapse of the year’s steepener trade

Libor basis swaps jump amid rates uncertainty

Trading in the one-month, three-month basis highlights the market’s preference for Libor

Santander’s VAR surges 17% in Q3

Macroeconomic jitters push credit spread and interest rate risk up, but bank’s traders net income windfall

Early movers get better pricing on SOFR loans

Borrowers making the jump to SOFR before year-end are being offered more favourable spread adjustments

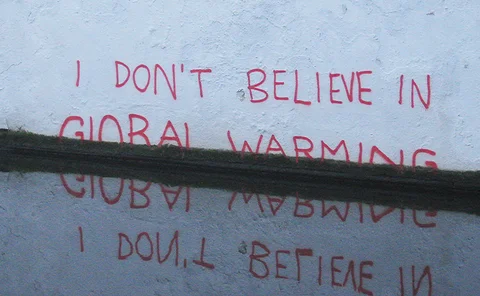

Climate risk: the writing is on the wall

For the EU financial sector, climate risk is inescapable, but it could be tamed

Risk management consultant of the year: Acies

Asia Risk Awards 2021

Interest rate ETD volumes up 40% from 2020 nadir

Shorter-dated contracts push total open interest higher

Iosco steps up scrutiny of credit-sensitive rates

Standard setter calls for rates to prove compliance through stress scenarios to retain hallmark

The relationship between oil prices, global economic policy uncertainty and financial market stress

This paper introduces two models: the first analyzes the impacts of global economic policy uncertainty, gold prices and three-month US Treasury bill rates on oil prices between 1997 and 2020, and the second examines the effects of oil prices and US…

Podcast: Colin Turfus on short-rate models and Libor’s end

Deutsche Bank quant proposes a lean model to quickly produce benchmark prices

Building forward-looking scenarios: why you’re doing it wrong

Rick Bookstaber and colleagues describe a process for constructing effective scenarios

Risky caplet pricing with backward-looking rates

The Hull-White model for short rates is extended to include compounded rates and credit risk

The curious case of backward short rates

A discretisation approach for both backward- and forward-looking interest rate derivatives is proposed

Libor is ending, and corporates need to know their options

Banks must speak to Main Street now if US Libor transition is to succeed, argue ARRC working group leaders

Fractured Libor transition halts US structured rates switch

Issuance of non-Libor caps and floors dries up as lending markets mull array of credit-sensitive SOFR rivals

Sharpening the tools – Preparation for UMR phase five

A forum of industry leaders discusses the suitability of Simm for phase five firms, how they can optimise portfolios to minimise margin costs and how the lessons learned from previous phases can help them prepare

SOFR alternatives remain on track despite regulatory warnings

Pointed criticism from FSOC has done little to dampen interest in credit-sensitive rates

Notionals for rates ETDs rise 26% in Q1

Confidence in rate hikes is on the rise, but the jury’s out on how fast

SEC’s Gensler takes aim at Bloomberg’s BSBY index

Credit sensitive SOFR alternative has “many of the same flaws as Libor”, regulator says

The Libor replacement stakes: runners and riders

Credit-sensitive rates Ameribor and BSBY nose ahead of Ice, Markit and AXI; regulators keep watchful eye