Exotic options

The credit market – Still many opportunities

Sponsored video: Societe Generale

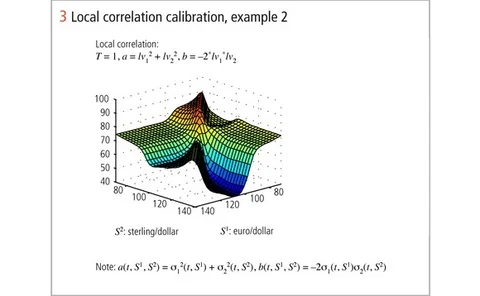

Local correlation families

Local correlation families

Filling the gaps

Filling the gaps

The value of a variance swap – a question of interest

Pricing equity variance swaps is well understood in the case of deterministic interest rates, but particularly for longer-dated swaps the stochastic nature of the rate cannot be ignored. Here, Per Hörfelt and Olaf Torné derive the fair strike when both…

Expanded smiles

Implementing models with stochastic as well as deterministic local volatility can be challenging. Here, Jesper Andreasen and Brian Huge describe an expansion approach for such models that avoids the high-dimensional partial differential equations usually…

Exploiting Japan's renegade repos

Japanese equities

Stock responses

Exotics

Introducing the consumption option

Sponsored Statement

Targeted hedging

Sponsored Statement

Sticky-strike and sticky-delta Greeks – casualties of the subprime crisis?

Sponsored Statement

The creative hedge

Equity derivatives

Maximum draw-down and directional trading

Maximum draw-down measures the worst drop in a market in a given time period. Jan Vecer shows how to price and replicate this event. Replication can be naturally linked to existing popular trading strategies, such as momentum or contrarian trading

Maximum draw-down and directional trading

Maximum draw-down measures the worst drop in a market in a given time period. Jan Vecer shows how to price and replicate this event. Replication can be naturally linked to existing popular trading strategies, such as momentum or contrarian trading

Variance swaps and non-constant vega

Variance swaps have gained in popularity due to their ability to provide investors with purevolatility exposure – a fairly stable gamma exposure despite changes in the value of theunderlying. The vega exposure of this product, however, varies linearly…

Smile dynamics

Traditionally, smile models have been assessed according to how well they fit market option prices across strikes and maturities. However, the pricing of most recent exotic structures, such as reverse cliquets or Napoleons, is more dependent on the…

Smile at the uncertainty

Smile-consistent alternatives to the Black-Scholes model are often too cumbersome to be used for large portfolios of exotic options. Damiano Brigo, Fabio Mercurio and Francesco Rapisarda propose an intuitive stochastic volatility model that is easy to…

An arbitrage-free interpolation of volatilities

Nabil Kahalé describes a new construction of an implied volatilities surface from a discrete set of implied volatilities that is arbitrage-free and satisfies some smoothness conditions. His method provides an excellent fit to the smile of the local…

Unifying volatility models

This article introduces a method for building analytically tractable option pricing models that combine state-dependent volatility, stochastic volatility and jumps. The eigenfunction expansion method is used to add jumps and stochastic volatility to…

Pricing exotics under the smile

Masterclass – with JP Morgan

Asian basket spreads and other exotic averaging options

Giuseppe Castellacci and Michael Siclari of OpenLink introduce a class of exotic options that simultaneously generalises both Asian and basket options. They develop approximate analytic models for real-time pricing of complex instruments that average…