Default risk

Liquidity risk triples at Nasdaq in second quarter

Updated model extends time horizon to seven-plus days

Deutsche’s IRC peaks at record high during H1

€905m charge for trading book default and migration is largest among global dealers

Worst-case double default would have caused breach at CME

Stress loss based on hypothetical scenario was $390m higher than prefunded resources

Inside Blackstone’s $150bn private credit business

Talking Heads 2023: Alts giant has around 10% of global market and hopes to expand its reach by porting quant insights from liquid credit

US banks see net charge-offs up 21% in Q2

Synchrony and Discover lead rise, predicting rates might peak in 2024

Like your CSA dirty? It’ll cost more

Buy-side firms have to pay up if they want to post corporate bonds to their dealers, but prices vary

The strange effect of US clampdown on FRTB models

Ban on internal models for trading book default risk could provide some banks with unexpected capital relief

Creaky credit sparks ‘high’ dispersion in CLO pricing

Investors are becoming more particular when it comes to tranches and managers

Default forecasting based on a novel group feature selection method for imbalanced data

The authors construct a group feature selection method which combines optimal instance selection with weighted comprehensive precision in an effort to improve the performance of prediction models in relation to defaulting firms.

IRC capital charges surge at Deutsche and Intesa

Risk-weighted assets covering default and downgrade of traded bonds all but double at Italian lender

Eurex scrambles to avert Treasury collateral ban on US default

Current policy prevents CCP from selectively excluding eligible collateral

Small and medium-sized enterprises’ time to default: an analysis using an improved mixture cure model with time-varying covariates

The authors put forward a method using a support vector machine to enhance the exploration of nonlinear covariate effects if SMEs never default while also considering time-varying and fixed covariates for the incidence and latency of an event.

Synchrony and Discover lead US banks on rising net charge-offs

Executives expect trend to continue as credit normalisation proceeds apace

Banking on personality: psychometrics and consumer creditworthiness

This paper uses empirical methods to investigate how psychometric data can be used to augment traditional credit models.

How banks can avoid bad haircuts on hedge fund trades

HSBC quant makes case for looking at collateral and funding rates in concert

Was Archegos default a one-in-a-million event?

BoE quant says neglecting high leverage and WWR may create conditions for similar blow-ups

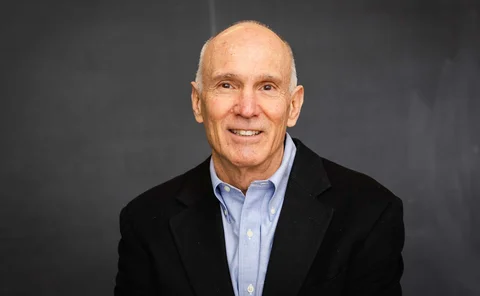

Lifetime achievement award: Stephen Kealhofer

Risk Awards 2023: KMV co-founder helped usher in a new era of credit risk analysis – at banks and investors

Collateralised exposure modelling: bridging the gap risk

Concentration, leverage and correlations may affect a collateralised equity swap portfolio

Liquidity risk at OCC up 34% in Q3

Internal stress-testing of a clearing member’s portfolio triggered upward revision

Assessing systemic fragility: a probabilistic perspective

Using new measure of systemic fragility, the author ranks euro area banks and sovereigns and according to their systemic risk contribution.

Leaked EC clearing proposal leaves question mark over LCH

UK CCPs expected to secure equivalence, but “vague” active accounts mandate sparks fears

Sovereign probabilities of default in the euro area

This paper decomposes credit default swap spreads of euro area members into their risk premium and default risk elements and forecast one year probabilities of default.

BoE official signals tough stance on CCP skin in the game

Default waterfalls must include a second tranche of CCP capital, says Cunliffe

SA-CCR’s sacrifice: who stands to lose from new capital rules

Risk.net research shows the potential for dealers to be left at a disadvantage to their foreign rivals