Banks

The management traits of problem banks

Former Bank of Spain supervision head discusses how to stop dangerous activities before they take hold

Complying with regulatory initial margin and automating the collateral management process

Since the introduction of uncleared margin rules, collateral management has been thrust into the regulatory spotlight, becoming a priority for firms with over-the-counter derivatives portfolios

To be resolved: the FDIC and the future of bank failure

Will Jelena McWilliams finally nail down the FDIC’s role as a resolution authority?

Mifid II, RFQs and the future of Europe’s G-Sibs

The week on Risk.net, August 11-17, 2018

Unlocking value from risk and finance data

For banks facing squeezed margins and increasingly agile competitors, a lack of consistent data quality and insight is a significant hurdle for risk and finance teams trying to transform the organisation. Innovative banks have brought the two functions…

Branching out: foreign banks seek shelter from Fed rules

Foreign banks stashing repo businesses within their branches, outside Fed’s full gaze

No escape from climate change tail risks

Harsh decisions need to be made on the future of energy financing now, before we run out of time

Bank risk committees: desperately seeking risk managers

Most boards still lack career risk specialists despite tighter governance requirements

Large non-systemic US banks call for tailored liquidity rules

Two banks urge lawmakers to provide LCR relief because they do not fall into G-Sib category

Japanese cross-border claims on European countries hit all-time high

Loans to entities in developed European countries outpace those to other western nations in Q1 2018

Asia Risk Interdealer Rankings 2018: The winners

Societe Generale and BGC top the tables

Mark Yallop on conflicts in fixed income

Banks and their clients need protocol on information sharing, says FMSB chair

Actionable data breach insights from op risk modelling

Thomas Lee, chief executive at VivoSecurity, and Martin Liljeblad, operational risk manager at MUFG Americas, examine how a data breach cost model can replace an advanced measurement approach in a structured scenario

IBM and Promontory on stress testing – A valuable exercise making its way in the world of regtech

Sponsored video: Peter Curley and Curt Burmeister, IBM Watson Financial Services

Rethinking XVA sensitivities – Making them universally achievable

Content provided by IBM

Regulatory and economic pressures argue for banks to embrace new approaches to technology

Video Q&A: Neil Dodgson, IBM Watson Financial Services

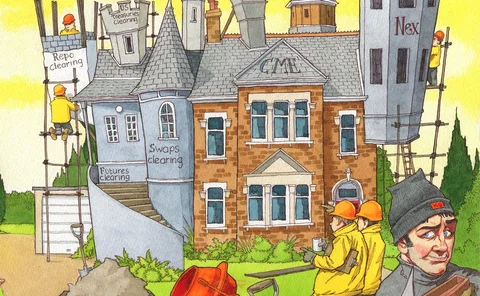

CME has chance to rule US rates after Nex deal

Market expects exchange to unite bond, repo, futures and swaps clearing – eroding grip of banks and DTCC

Safeguarding liquidity in a changing environment

Nick Gant, head of fixed income prime brokerage for Europe, the Middle East, Africa and Asia-Pacific at Societe Generale Prime Services, discusses banks’ evolving responsibilities for providing liquidity in a post-financial crisis environment in which…