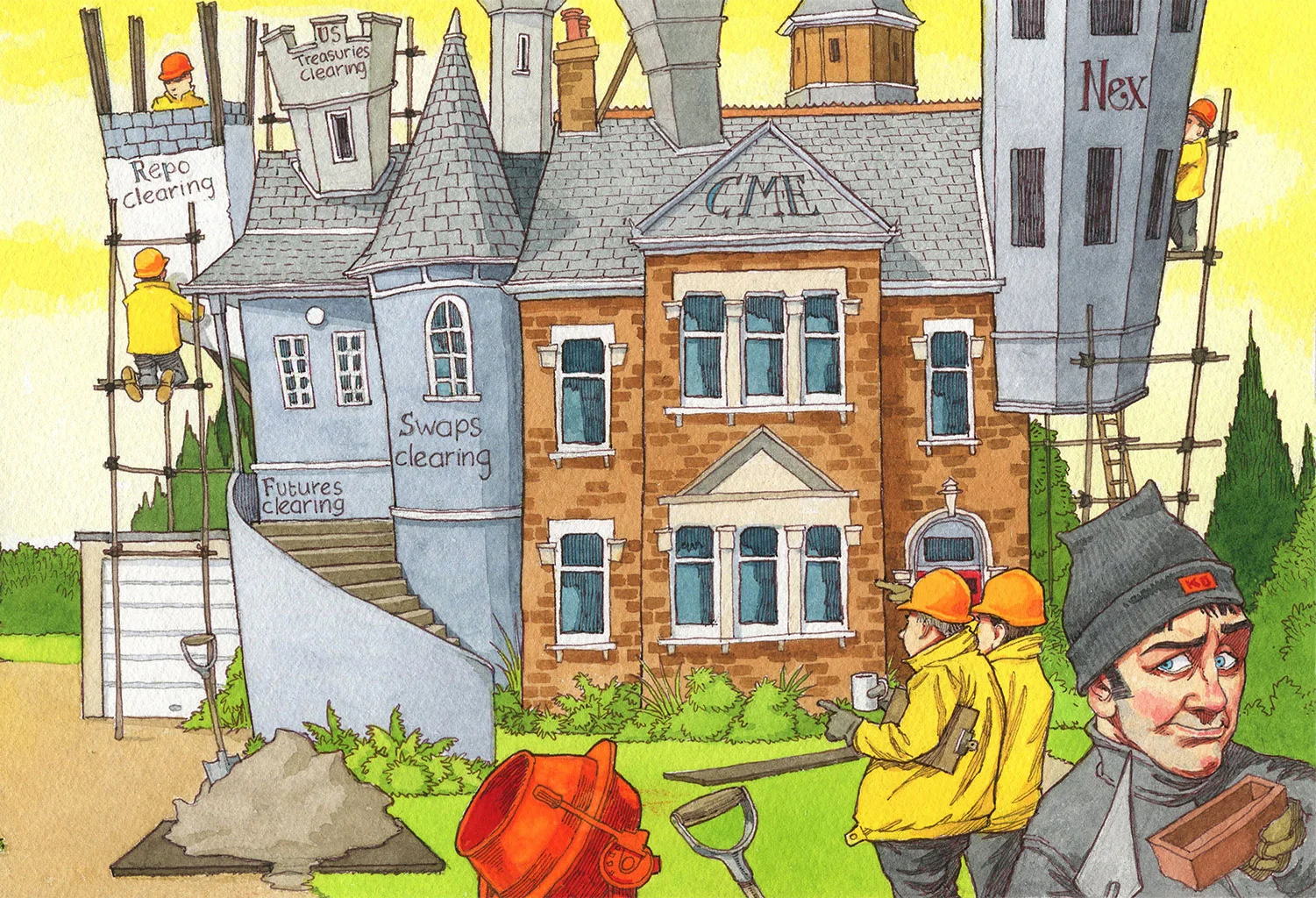

CME has chance to rule US rates after Nex deal

Market expects exchange to unite bond, repo, futures and swaps clearing - eroding grip of banks and DTCC

A battle is brewing in a historically quiet corner of the US fixed-income market. Since 1986, the clearing of US Treasuries and Treasury-backed repurchase agreements has been controlled by Wall Street, via the member-owned Depository Trust & Clearing Corporation. In 2003, clearing of these transactions switched to a DTCC subsidiary, Fixed Income Clearing Corporation, which gives its members billions of dollars in rebates and fee reductions.

Some believe greater efficiencies could be unlocked

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Markets

BofA sets its sights on US synthetic risk transfer market

New trading initiative has already notched at least three transactions

BNPP ups efforts to weed out skew sniffers

French bank deploys skew sensitivity algo to help identify predatory behaviour

BlackRock exec pushes for FX swaps Clob

FX head Chaudhry says all-to-all venue could boost TCA, price discovery and spur algo trading

FXGO eyes platform upgrades with new fee model

Bloomberg’s brokerage charges will fund upcoming automation and TCA projects

EU bonds favoured over swaps as hedge for European debt

Hedge funds are increasingly using the bonds to hedge Bunds and OATs as swap correlations decline

Canada benchmark shaken by T+1 hedge fund influx

Shortened settlement cycle swept hedge fund trades into Corra, making the rate more volatile

Basis swaps surge amid US repo concerns

Fed funds-versus-SOFR swap volumes nearly quadruple as declining Fed reserves impact funding rates

India delays initial margin go-live date

RBI communicated putting off initial margin rules one day before planned November 8 implementation