US Department of the Treasury

Non-banks push direct liquidity streams in US Treasuries

Dealers could save millions in broker fees and transaction costs, non-banks claim

Exchange of the year: CME Group

Chicago exchange found fixes for five-year issuance gap in US Treasury bonds

US Treasury calls for more transparency in cash markets

Officials seek better data "to understand the dynamics of these markets"

FSOC in 'no rush' to regulate HFTs

More work to be done in understanding market structure changes, says Pinschmidt

SEC's White urges rules rethink for US Treasury venues

Current regime gives platforms easier ride on transparency

US tax rules attacked by equity derivatives dealers

Testing criteria for equity-linked products branded a “joke”

Client list reveals HFT dominance on BrokerTec

Barclays and JP Morgan only banks on list of top interdealer firms for US Treasuries

Citadel shut out of Tradeweb as it makes US Treasury move

Firm is first non-bank on Bloomberg, but primary dealer catch means it cannot join Tradeweb

Hidden price pressures grow in euro swap market

Clients face wider bid/offer spreads, as dealers struggle to find liquid hedges

Liquidity events becoming more common, buy-siders claim

US Treasury market has seen eight intraday moves exceeding five standard deviations since 2012

'Gamma trap' theory features in US Treasury meltdown report

Official post-mortem considers claims that options hedging amplified October 15 move

Dealers vent frustration at Section 871(m) hold-up

US dividend-equivalent tax change will hit high-delta products with withholding tax

Forex algos revive US rates trading at UBS

Rejigged algo behind doubling in volumes - Swiss bank aims to repeat trick in swaps

CME has “no plans” to corner invoice spread market

Dealers still worried exchange has motive and means to create monopoly

Tucker: regulators knew reforms might create 'bumpy' markets

Prudential rules sought to bring about new market structure, says ex-BoE deputy governor

VAR limits: dislocations put focus on other lines of defence

Wild moves in the Swiss franc and US Treasuries blindsided VAR models

Bank risk manager of the year: Deutsche Bank

Risk Awards 2015: Teamwork allowed bank to cut VAR by $30 million in three days

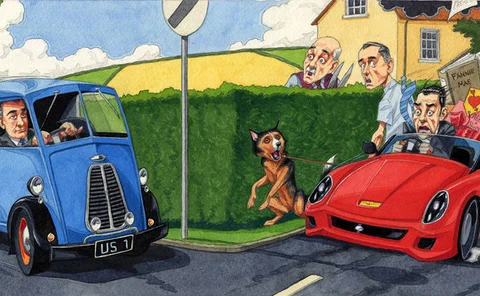

No flash crash: Paulson, Pimco and the US Treasury meltdown

Market’s big beasts played a part in wild and weird October 15 volatility

EU-US trade talks won't tackle swaps reform – Risk.net poll

Roughly two-thirds believe trade talks would help fix swaps problems

Structured products demand in Taiwan hit by low volatility

Taiwan insurers shun structured products amid low volatility and rates

Questions remain over US CCP liquidity rules

CME has been waiting seven months for its liquidity plans to be approved

Equity strategy launches turn post-crisis corner

Reversal of three-year negative alternative equity sentiment

Credit unions wish Fatca 'did not exist'

Fatca compliance burden stretching further

CFTC correct in row over US Treasury liquidity - Risk.net poll

A poll of Risk readers finds that 56% agree the CFTC should require CCP holdings of US Treasuries to be backed by committed liquidity facilities