US Department of the Treasury

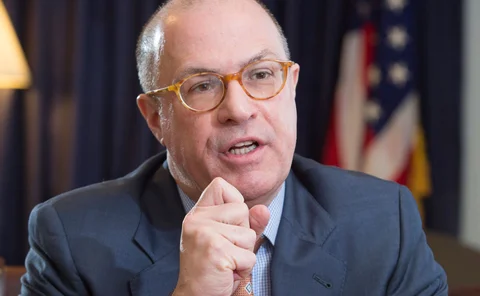

Giancarlo: SLR change would cut clearing capital by 70%

Isda AGM: netting of clearing collateral would boost activity without weakening banks, claims CFTC chair

Critical Mass: why US Treasury swallowed unloved Volcker rule

Bank prop trading ban drafted in a lunch break after Democrat defeat in Massachusetts

Mnuchin: FSOC working on revised Volcker rule

US Treasury secretary wants revamp of prop trading ban; not repeal

OFR leads US push for mandatory adoption of LEIs

Berner says his bureau could use repo-reporting project to drive uptake of legal entity identifiers

Treasury: SLR 'reducing stability' in US repo markets

Treasury study found leverage ratio is making bank repo funding “fragile”

Exchange innovation of the year: CME Group

Risk Awards 2017: Patience pays off with spectacular success of Ultra 10 Treasury futures

Citadel exec laments fragmentation of US Treasury liquidity

Risk USA: New trading venues decrease price transparency, says Nicola White

Huge Brexit margin calls stoke intra-day funding fears

Calls on June 24 may have topped $40 billion; critics urge regulators to review episode

Clamour grows for US Treasuries clearing mandate

HFT default could destabilise interdealer markets, participants fear

US Treasury: prepare for a post-Libor world

Senior official urges participants to adopt new benchmark

Interview: US Treasury CRO on credit risk, Tarp and cyber threats

Ken Phelan stresses importance of credit risk management in key Treasury role

Bank prop indexes threatened by US tax changes

IRS’s Section 871(m) rule places burdensome requirements on non-qualified indexes sold to non-US persons

HFT firm Teza said to be eyeing prop trading retreat

Big US Treasury trader has seen hedge fund add $1.5bn this year

L’exception française: why French banks dominate US repo trading

French banks are exploiting a quirk in the leverage ratio rules to expand repo trading

Buy side backs call for US Treasury new-for-old scheme

A programme of bond exchanges could revive liquidity in off-the-runs

DTCC’s Murray Pozmanter on repo clearing and HFT

Buy-side clearing a top priority following suspension of interbank GCF repo

Start-up UST trading venues face clearing hurdles

Gaps in central clearing are stifling the emergence of all-to-all trading venues for US Treasuries

Tradeweb: US Treasuries clearing should be mandatory

Senior executive says move would help foster all-to-all trading in cash Treasuries

Interdealer brokers embrace buy side as bank dominance slips

Tradeweb considers integrating interdealer and client liquidity pools

DTCC coaxing HFTs to become clearing members

US Treasuries CCP concerned about contagion risk threat to existing members

SEC leverage ratio meetings alarm broker-dealers

US Treasury spread trades could face 850-fold jump in capital requirements

MetLife Sifi win leaves G-Sii status meaningless – US lawyers

Federal court decision brings whole Sifi and G-Sii designation process into question

US end-users risk tax hit in move to daily settled swaps

Changing treatment of variation margin could benefit banks, but hurt clients

Voltaire Capital and the prop shop that changed its spots

London-based start-up joins liquidity contest via buyout of Chicago HFT firm