European Systemic Risk Board (ESRB)

BoE warns over risk of system-wide cyber attack

Senior policy official Carolyn Wilkins also expresses concern over global fragmentation of bank regulation

Some euro banks modelled lower mortgage risk in H1

Italian and Belgian lenders reported steepest drops in risk density despite recessionary threat

Europe’s countercyclical buffers buck recession trends

Almost half of EBU’s members have set out CCyB hikes; five plan two or more before mid-2023

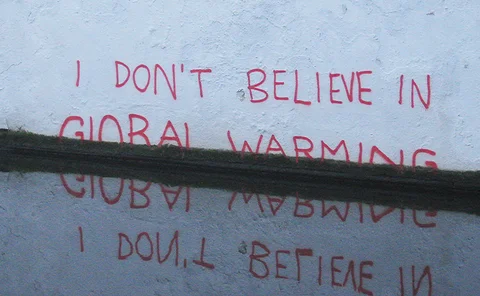

Climate risk: the writing is on the wall

For the EU financial sector, climate risk is inescapable, but it could be tamed

EU stress tests: market risk cuts 107bp off average bank’s CET1

SocGen, Deutsche and UniCredit the hardest hit among EU systemic banks

Nordea faces higher capital requirement following ESRB recommendation

A decision by the Finnish Financial Supervisory Authority may add 95bp to the bank’s CET1 capital ratio requirement

Wobblier eurozone banks most exposed to climate change

Lenders with lower CET1 ratios and weaker returns could face more credit defaults from global warming

Don’t blame CCPs’ models for Covid margin spikes – WFE

Lobby group counters popular view that tools could ease procyclicality; puts focus on liquidity management

EU banks’ reliance on ECB loans has grown in Covid’s wake

Central bank funding accounted for 14.5% of Greek banks’ liabilities in September

Covid disrupted sale of bail-in bonds by EU banks

Top banking groups are short €146.5 billion of MREL-eligible instruments

European lawmakers urged to prevent CCP contagion risk

Watchdog says carve-out needed in new recovery and resolution rules to avoid cascading default of clearing houses

EU’s 2020 stress tests are toughest to date

Real GDP projected to contract –4.3% over three-year scenario horizon

Denmark, Slovakia hike countercyclical buffers

Eight countries have increased their CCyB year-to-date

Czech National Bank raises countercyclical buffer to 2%

Increase takes effect from July 2020

Germany plans countercyclical buffer hike

Iceland, Bulgaria and France have also increased add-ons year-to-date

Luxembourg is latest EU state to hike countercyclical buffer

In total, EU states hiked CCyB rates 13 times last year, up from six in 2017

EU countries accelerate countercyclical buffer increases

Eleven EU members currently apply CCyBs, with Bulgaria the most recent country to join the club

Denmark, Sweden hike countercyclical buffers

Swedish banks now subject to highest add-ons among European Union lenders

Shadow banking risks still unclear, EU watchdog warns

Gaps in data prevent full assessment of almost half the shadow system, says ESRB report

French countercyclical buffer lowest in EU

0.25% surcharge the lowest of nine CCyBs across member states

EC official: focus on bad loans will drive bank consolidation

Supervisory and market pressure to tackle NPLs will force some banks out of market