European Commission (EC)

EU prop trader regime could capture foreign firms

Group capital rules may be applied to third-country arms of EU market-makers

EU seeks US-style freedom to delay rules

Power to grant “no-action relief” appears in proposals from EU Council and Parliament

Basel to propose IM offset in leverage ratio

Four sources say draft will make concession; it could also revive EU-US segregation drama

Brexit OTC mutation, chaperones and SA-CCR

The week on Risk.net, October 6–12, 2018

EU lawmakers open to delaying ban on critical benchmarks

MEPs propose two-year reprieve for Eonia and Euribor if contractual continuity is at risk

Stuck in traffic: EU turf war holds up CCP resolution rules

Unsuitable rules for failed banks could be used to resolve French and German clearing houses

Brexit: listed derivatives face OTC mutation

No-deal would flip EU27 users into different regime for UK-listed trades

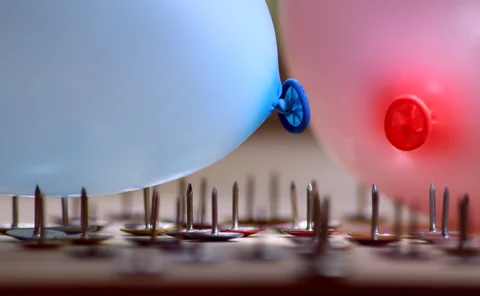

Moving the goalposts: EU fights over prop trader rules

French proposals could drive larger non-banks out of fixed income futures and options

EU may let UK insurers break law to pay clients after Brexit

Member states likely to choose protecting policy-holders over suing firms, if UK leaves with no deal

Term versions of RFRs will work – FCA official

Schooling-Latter backs plan to build curve from swaps and futures; others have doubts

Banks to ask EC for delay of benchmarks rule

New ECB rate may appear only months before rules bar use of Eonia and Euribor

EU talks on prop firms leave door open to harsher pay rules

Final law could subject many firms to bonus cap, but even those that escape could struggle

EU power balancing faces major changes

Three upcoming pieces of legislation will have significant effects on balancing trades for the UK, says energy expert

EU deadlock set to delay CCP resolution rules

Lawmakers disagree over whether Esma should be given new powers to tackle distressed CCPs

Corporates fear EU will spike Emir Refit reporting relief

Delegated reporting threatened by policy-maker objections to use of foreign banks

Optimisation services edge closer to EU clearing exemption

Lawmakers ask European Commission to consider if offsetting non-cleared trades could be exempt

Time running out for EU Brexit temporary permissions regime

UK clearing houses may need to eject EU member positions if BoE scheme is not reciprocated by year-end

EU drops reporting relief for exchange-traded derivatives

Exemption removed from Emir Refit, but Parliament moots future legislative changes for ETDs

EU infighting blocks Basel recognition of banking union

Treating eurozone as single jurisdiction could slash G-Sib capital, but the 19 member nations have differences to settle first

Staying alive: the EU’s stubborn CVA exemption

Delayed Pillar 2 capital charge could help US banks take EU market share in corporate hedging

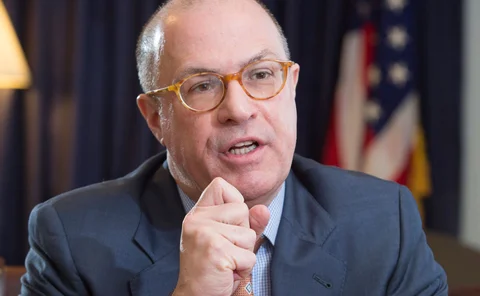

Oversight row could block EU firms from US clearing – Giancarlo

Europe’s planned post-Brexit CCP reforms “irreconcilable” with US rules, says CFTC chief

EU must think big to overcome Brexit’s impact on markets

Post-trade reforms offer lessons for Capital Markets Union project, writes EU lawmaker Kay Swinburne

Q&A: French regulator defends bank rules for prop traders

ACPR official wants to set asset threshold for full CRR application below current €30 billion

French regulator: we are not the Brexit bogeyman

AMF denies pursuing relocations from UK, but calls on EU27 to build its financial markets