European Central Bank (ECB)

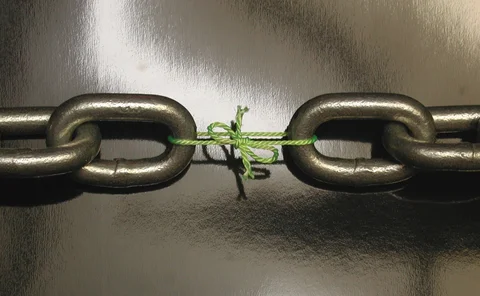

Time to talk about settlement risk

Quants are proposing netting or the use of CLS Bank to remove Herstatt risk in margined trades

EU capital revamp paves way for corporate CVA charge

Draft directive offers national regulators power to override controversial exemption

ECB rate risk stress test renews fears over internal models

Banks alarmed by short timeline and opaque supervisory use of IRRBB stress test

Model risk managers eye benefits of machine learning

Ramp-up in regulatory scrutiny of model validation sees banks turn to black boxes

Banks calm on Eurex-LCH basis volatility

Past basis blowouts prepared banks for movements, say traders

Regulatory blitz weakening model risk management, say banks

Smaller banks’ modelling practices under growing scrutiny, but ability to comply is stretched

CCP margining not procyclical, research suggests

Excess collateral acts as buffer in 10 years of data at unnamed CCP

Draghi’s euro-exit redenomination hedge

Marcello Minenna says new ECB policy effectively hedges QE bond purchases

EC rebuffs euro clearing relocation policy in Emir review

UK pushes back against French demands to shift CCP business post-Brexit

Why EU banks still refuse to die

A year on since BRRD came into force, the debate on taxpayer bailouts is far from resolved

National authorities rebel against BRRD state aid limits

EU single resolution board will “never have any work to do”, lawyers predict

EC could use thresholds to squeeze London euro clearing

Most euro clearing could be repatriated after Brexit without hitting other jurisdictions

Basel III completion date pushed back

Disagreement on output floors continues

EU could impose negative rate shocks via IRRBB rules

Banking Book Risk Summit: EBA guidance on shocks is “outdated”, says ECB official

European bail-in buffers may stretch market-making capacity

New Basel capital exemptions could be too small if all EU banks have to issue bail-in bonds

ECB's bank watchdog warned on NPL clean-up drive

SSM may need clearer enforcement process to boost bad loan provisioning, says regulator

Emir review could enable EU clearing land grab

Experts say 2015 ECJ ruling may not protect London euro clearing if the UK leaves the European Union

Lawmakers rush to double Euribor panel membership

Benchmark designated “critical” to stem departures and enable transaction-based methodology

UK repo decline sparks NSFR tussle in Europe

BoE and EC concerned about repo liquidity, but Basel Committee unlikely to budge

European NSFR ‘will change’, say HSBC and Deutsche Bank

Conference hears claims of an EC change in the treatment of derivatives

Deutsches Risk Rankings 2016

Derivatives dealers offer simplicity as regulatory change continues apace

Liquidity stress testing ‘essential’, says ECB supervisor

Supervisor warns conference banks will need to shape up their Ilaap responses for 2017

Data challenges in IFRS 9

Sponsored webinar: Oracle

CCPs and Brexit: don’t forget the rest of the world

Losing equivalence with the US could be more serious than arguments over the location of euro clearing