Banks calm on Eurex-LCH basis volatility

Past basis blowouts prepared banks for movements, say traders

Volatility in the price of a euro interest rate swap cleared at Eurex relative to LCH has jumped since mandatory clearing began in Europe last year, but banks say they’re now more comfortable managing clearing house basis moves than in the past.

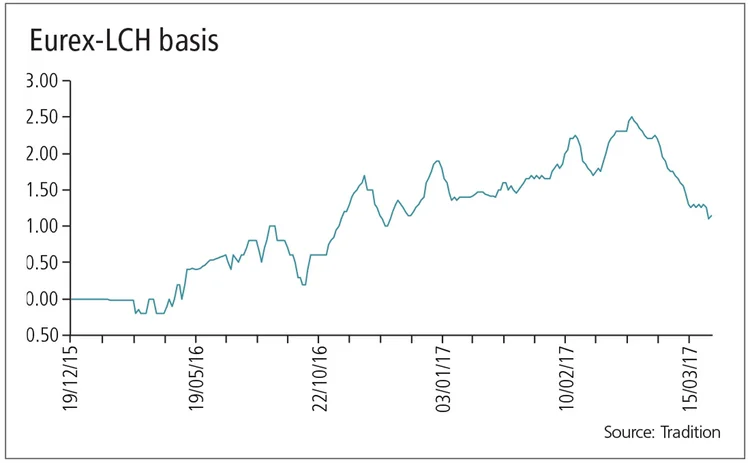

The price difference, known as the Eurex-LCH basis, went from flat to around 1.5 basis points in 10-year swaps by the end of April 2016, due to an imbalance of flows stemming from the start of mandatory clearing for small banks and large buy-side firms. It peaked at 2.5bp in February, then fell to 1bp, but is expected to rise again as the European Central Bank’s (ECB) financing programme comes to an end.

Banks were caught off guard in May 2015, when the basis between CME and LCH for 10-year US dollar swaps suddenly jumped from 0.15 basis points to nearly 2bp, which traders estimated caused $20 million losses for each dealer at the time. This led large asset managers such as Pimco to declare the basis “material”. A similar effect was seen in Japan, when an oversupply of receive-fixed yen interest rate swaps from Japanese banks at the Japanese Securities Clearing Corporation saw the basis jump nearly five-fold in April last year.

But as banks now have experience with central counterparty (CCP) basis under their belt, traders say they were prepared for the initial jump and subsequent volatility in the Eurex-LCH basis.

“Dealers aren’t surprised any more. Even if you have a relatively balanced client book at a CCP, you’re going to get flows from time to time that will push things in one direction or the other. So it’s another basis we need to be aware of,” says a senior rates source at a European bank in New York.

When two CCPs clear the same instrument, an imbalance of pay and receive-fixed swaps at one of the clearing houses can create a basis. A lack of receive-fixed flow at one CCP, for instance, would force a dealer to hedge a client’s pay fix swap at a second clearing house, requiring two sets of initial margin. This creates an extra funding cost, reflected in the CCP basis, which makes it more expensive for clients to clear at the first CCP.

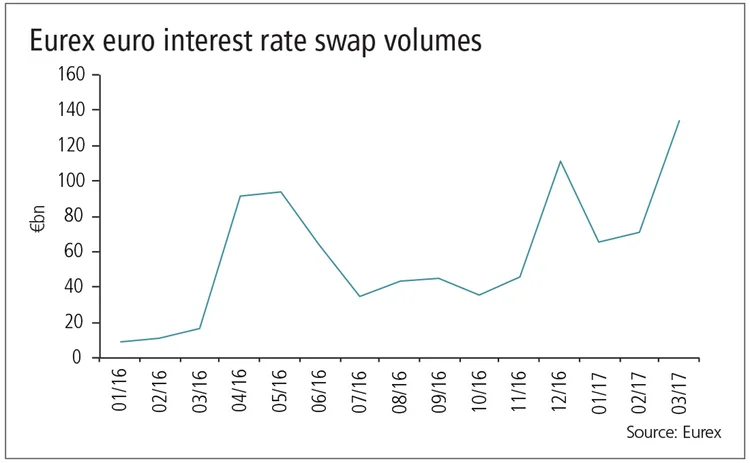

Eurex cleared €155 billion ($164 billion) of interest rate swaps in March – a record month for the CCP – but it still lags behind LCH, which dominates the space. The London-based clearing house has cleared €22.3 trillion of euro swaps since the start of the year. LCH has a stranglehold on the interdealer market, which makes it harder for other CCPs to gain market share, leading to an inevitable basis, say traders.

“One of the issues with Eurex is it doesn’t have market-wide sponsorship in euro swaps. The activity tends to be concentrated in German banks and financial institutions. This domestic nature of the CCP at this stage means that for some periods of time, flow can be biased and uneven in one direction,” says Jan Lundstrom, head of euro rates trading at Barclays in London.

The CCP declined to give out market share data, but confirmed the largest number of its customers are from Germany, with France, Spain, Switzerland and the UK making up the remainder of the top five.

The basis for 10-year euro interest rate swaps traded at Eurex compared with LCH had been trading flat until the first quarter of 2016, before slowly widening out at the end of April, as Europe’s category two frontloading period approached. This period, which began on May 21, required small European banks and large European buy-side entities entering certain bilateral interest rate swaps after that date to eventually clear those positions when the clearing mandate came into force on December 21.

Eurex is said to have attracted pay-fixed positions from local banks and buy-side entities, but less opposing flow, forcing up the basis initially. Part of this is to do with the clearing exemptions for pension funds, which would normally bring in receive-fixed swaps but do not have to clear until August 16, 2018.

However, the spread has narrowed since the end of February. A senior European rates strategist at a bank in London says this might be a result of dealers taking on more receive-fixed positions as a result of the ECB’s targeted longer-term refinancing operation (TLTRO), which allows banks to borrow cash at practically interest-free rates or even negative rates if certain terms are met. On March 23, 474 banks borrowed €234 billion from the ECB under the programme.

The bigger the open interest builds, the more balanced the different books are, as it’s easier to find people that have positions the opposite way round

Philip Simons, Eurex

This would bring more receive-fixed swaps into the CCP, making it easier for dealers to hedge out pay-fixed swaps directly at Eurex instead of going to LCH and funding more initial margin.

“A lot of European banks that clear at Eurex have been receiving fixed rates on the back of the TLTRO to lock in their funding and borrow at a very cheap funding from the ECB. They receive on the swap curve to do the carry trade, and that way of receiving fixed has been the main driver of the narrowing that you have seen since February,” says the strategist.

But with the TLTRO programme winding down, he expects the basis to widen out again. “The basis is more likely to move back to 2bp than down to 1bp.”

Philip Simons, global head of fixed income and forex derivatives trading and clearing sales at Eurex in London, says that while the pension fund exemption makes it more difficult for dealers to net down their exposure at the CCP, the increasing volume being cleared at Eurex will only help flatten the basis in the long run.

“The bigger the open interest builds, the more balanced the different books are, as it’s easier to find people that have positions the opposite way round,” he says.

Simons also expects more active inter-CCP margin management by dealers, which can also help keep the basis tight.

“We’ve had many conversations with the dealers, and they don’t want the basis to blow out. Quite a few of the big dealers want to make sure there is adequate liquidity, know the business they can do with us and which of their clients are active with Eurex so the basis doesn’t blow out. Given many of the clients are category three and not subject to mandatory clearing yet, they have more flexibility in how they manage the basis in a way that it doesn’t blow out. They are being proactive in managing that now, which is what they learned from their previous experiences,” he says.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Interest rate markets

New benchmark to give Philippine peso swaps a fillip, post-Isda add

Isda to include new PHP overnight rate and Indonesia’s Indonia in its next definitions update

SABR convexity adjustment for an arithmetic average RFR swap

A model-independent convexity adjustment for interest rate swaps is introduced

NatWest Securities US Treasury trading head departs

Jason Sable joined the UK bank in January 2022 from BNP Paribas

CME in talks to clear term SOFR basis swaps

US clearing house has held discussions with some dealers about clearing term SOFR-SOFR packages

Risky caplet pricing with backward-looking rates

The Hull-White model for short rates is extended to include compounded rates and credit risk

The curious case of backward short rates

A discretisation approach for both backward- and forward-looking interest rate derivatives is proposed

Cross-currency swaps will use RFRs on both legs, says JP exec

Despite slow start, all-RFR swaps will become the market standard within a year, according to Tom Prickett

June mid-month auctions – Coupon and yield trends

As Treasury issuance amounts set new records, coupons at the front end of the curve have marched downward, while back-end coupons have lagged. Yield spreads across each popular measure show a consistent steepening of the curve through the first half of…