Luke Clancy

Editor-at-large, Emea

Luke Clancy is the London-based editor-at-large for Risk.net.

Over the past 20 years spent in financial journalism, his previous positions have included: supplements editor, Risk magazine; editor of Hedge Funds Review, ETF Risk and Custody Risk (all formerly published by Incisive Media (now Infopro Digital)); senior investment writer, Investment Week (published by Incisive Media); deputy editor, Global Investor (Euromoney); managing editor, Engaged Investor and Pensions Insight (Newsquest Specialist Media); editor, World Mining Stocks (Aspermont UK); editor, Global Pensions and deputy editor, Professional Pensions (MSM International); online editor, Private Wealth Advisor and Offshore Red (Camden Publishing).

Luke was the 2023 Headline Money investment journalist of the year (B2B), and has been journalist of the year in four categories at the State Street Institutional Press Awards (regulation, 2023; investment, 2022; active investment, 2019; data & innovation, 2016). In 2022, Luke won Infopro Digital’s ‘feature/research article of the year’ award.

Follow Luke

Articles by Luke Clancy

Deep XVAs and the promise of super-fast pricing

Intelligent robots can value complex derivatives in minutes rather than hours

EC drafting proposal for derivatives consolidated tape

Commission official says beta version ready for testing in 2023 will also include equities, bonds and ETFs

Quantum trading and the search for the perfect clock

Government push to overhaul satellite technology could improve time-stamping accuracy for trading firms – and for regulators

Banks invest in futures utility to guard against tech snafus

FCMs, including Goldman and JP, stump up $44 million to fund FIA Tech push to standardise trade processing

Quantum computing experts voice explainability fears

Risk Live: big speed-ups for quantum-powered models could prompt bigger questions from regulators

Quantum kit offers HFTs ‘100-fold’ speed boost

After spotting FX arbitrage opportunities, new tech faces real-world test in Japanese stocks

BlackRock faces an early climate change test in China

The firm is the main Western investor in three of the worst emitters. It has yet to change their ways

The bond venue using blockchain technology to plug leaks

LedgerEdge trading system aims to stop prices moving against users requesting quotes in larger sizes

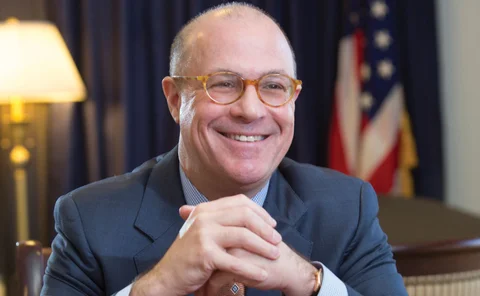

‘Crypto Dad’ Giancarlo says DLT could have aided in Archegos

Former CFTC chair says managing collateral by distributed ledger technology would enable better oversight of risks

Users clash with ASX over changes to its DLT settlement system

Industry groups and tech experts worry that proposed last-minute changes will introduce new risks

Refuge of ‘chancers’: Spacs draw criticism from big investors

Poor disclosure, sub-par returns and share dilution are highlighted as risks of so-called ‘blank-cheque’ companies

Ethical ratings stir debate over saints and sinners

Asset manager Aegon hits out at “flawed” ESG ratings methodologies

Cracks start to show in US reflation bets craze

Some hedge funds believe popular bets on rise in US inflation have run out of steam

Deutsche Börse eyes quantum computing

Pilot application to model enterprise risks cuts computation time from 10 years to 30 minutes

Utility is success? Row brews over futures post-trade workflows

Industry confronts competing models and hard questions in search of better allocations workflow

All roads lead to Bergamo: Euronext eyes new home for its tech

Market participants fear a “horrible” relocation project and more room for latency arbitrage

UK snuffs out hopes of end to midpoint trading ban

Financial Conduct Authority resists calls to diverge from EU’s tick size regime

Held in suspense: late futures orders blamed for Covid meltdown

Buy-side use of average pricing contributed to rash of failed trades and give-ups last March

Futures industry weighs need for new post-trade utility

Three large FCMs say standardising trade allocations could prevent a repeat of breaks seen during Covid volatility

End ‘senseless’ ban on midpoint trading, asset managers urge

Investors decry European rule that forces them to trade some equities in whole tick sizes

US pension fund teams up with academics to cut through ESG fog

State fund and MIT’s business school look to improve ESG data and to reflect all investors’ views

Trading heads call for reform of double volume caps

Asset managers endorse UK move on caps and back changes to EU’s unloved share trading restrictions

UK offers unlimited dark trading on lost EU stocks

FCA gives London dark pools an edge over EU rivals, but will fund managers use it?

Inconsistent ESG scores force USS to make its own decisions

Pension fund needs ESG alternatives to bonds to help close its funding deficit