Luke Clancy

Editor-at-large, Emea

Luke Clancy is the London-based editor-at-large for Risk.net.

Over the past 20 years spent in financial journalism, his previous positions have included: supplements editor, Risk magazine; editor of Hedge Funds Review, ETF Risk and Custody Risk (all formerly published by Incisive Media (now Infopro Digital)); senior investment writer, Investment Week (published by Incisive Media); deputy editor, Global Investor (Euromoney); managing editor, Engaged Investor and Pensions Insight (Newsquest Specialist Media); editor, World Mining Stocks (Aspermont UK); editor, Global Pensions and deputy editor, Professional Pensions (MSM International); online editor, Private Wealth Advisor and Offshore Red (Camden Publishing).

Luke was the 2023 Headline Money investment journalist of the year (B2B), and has been journalist of the year in four categories at the State Street Institutional Press Awards (regulation, 2023; investment, 2022; active investment, 2019; data & innovation, 2016). In 2022, Luke won Infopro Digital’s ‘feature/research article of the year’ award.

Follow Luke

Articles by Luke Clancy

Relative value trades face Treasury clearing squeeze

SEC’s clearing proposals may hurt levered basis trades and worsen illiquidity in off-the-run bonds

Brokers slam CME over ‘conflict of interest’ in FCM plan

Clearing members question how CME could be quasi-regulator as well as direct competitor

Low pricing of inflation swaps takes buy side by surprise

Dealers expect inflation to peak sooner, but investors remain sceptical

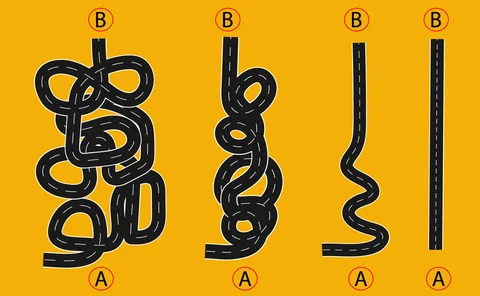

Keep risk parity simple, stupid

In times of volatility, simpler risk parity strategies may outperform more elaborate counterparts

More trading venues face extra supervision under FCA plan

“Woolly” rules fuel concern that bulletin boards and tech providers could be swept in

Shifting rates throw bond investors off balance

Dearth of bond liquidity forces some traders to offload positions – but, as ever, others are waiting to pounce

Bypassing consent may aid CCP porting – report

CPMI-Iosco report says clearing houses cannot reasonably accommodate client preference; brokers favour rule book harmony

Margin costs leap on Simm rejig and rates hikes

Acadia finds roughly one-third jump in exposure following Simm recalibration, with higher funding costs adding to burden

Pick a lane: Anna DSB to rival CDM coded swaps reporting?

Dual machine-executable rules are set to create choice – and maybe bifurcation – for swaps reporting

Archegos revives Lehman-era trade booking controversy

Experts debate whether defaulted TRS positions should have become house exposures immediately

Amid macro storm clouds, a silver linings playbook for fintech

Banks and VCs believe inflation and rising interest rates will result in winners as well as losers

Banks may spend ‘billions’ to stop quantum hacking threat

Quantum-proof algo standards nearing completion, but enhanced cryptography won’t come cheap

Growing use of ‘carte blanche’ keeps FCMs ‘awake at night’

Executing brokers want to speed up trade processing, but practice is deemed risky by clearers

Is DLT post-trade a solution without a problem?

Sources question landmark projects' ability to use technology at scale as further delay besets ASX deployment

Standard risk measures low-balled Archegos exposures

When a potential blow-up doesn’t show up, what use are VAR, SA-CCR and stress tests?

BlackRock calls for blockchain to fix futures processing snags

Asset manager wants industry to move faster in adopting “single source of truth” model

Emir data may have exposed Archegos, but not in real time

Entity-level reports were limited to supervisors, leaving counterparty banks in the dark

How banks got caught in Archegos’s web of lies

Risk managers quizzed and confronted the firm, but lawsuits claim they were “systematically misled”

US pension fund sues Credit Suisse over Archegos failures

Lawsuit alleges top execs breached fiduciary duties; Credit Suisse shareholders block board exoneration

Basel rules mean banks can’t compete with Coinbase – Goldman

Proposed 1,250% risk weight for crypto holdings undercuts banks’ push into burgeoning market

Credit Suisse CFO steps down ahead of crucial shareholder vote

David Mathers was also CEO of the swap dealer entities that housed the bank’s trades with Archegos

Archegos revisited: the gaps in Credit Suisse’s story

Ahead of shareholder vote, former execs point to gaps in key report – raising new questions about accountability

Russia’s foreign currency debt pile at risk of default

Sanctions could block coupon payments on $200bn of externally held foreign currency bonds

Banks strive for machine learning at quantum speed

Embryonic work on quantum neural networks raises hope of faster, more accurate models