Standardised approaches

BMO sees $6.3bn RWA increase from capital floor add-on

The bank is the first of Canada’s big five to be bound by the floor as implemented in 2018

How will US regulators perform the Basel III balancing act?

Largest banks seek offsets for higher capital requirements caused by possible end of IRB, IMM

Standardised market RWAs surge at EU banks

UniCredit and BNP Paribas among dealers affected by new FX risk guidelines

Credit risk capital models hanging by a thread in the US

Industry insiders expect Fed to drop IRB and IMM when adopting Basel III, but market risk models may survive

RBI’s market risk gauges go haywire on Ukraine war fallout

Portfolio reshuffling helps Austrian bank contain RWA impact

Standardised approach extends reach over US banks’ RWAs

Gap between standardised and advanced RWAs at its widest ever for BofA, BNY Mellon, Morgan Stanley and Wells Fargo

Isda broadens FRTB carbon trading study to win over sceptics

New study shows risk weights too high for US markets, but data from 2008 still missing

UniCredit cuts market RWAs by 9%

Removal of capital requirements for FX risk sheds standardised RWAs by 68% in three months

HSBC’s SA market RWAs double on new structural FX rules

Move from Pillar 2 to Pillar 1 for unhedged FX risk adds $6.8bn of RWAs

Smaller EU nations stare down giants in capital floor standoff

EU member states clash over severity of internally modelled output floors for cross-border bank groups

EU lawmakers’ demand for local capital floors alarms banks

Multiple output floors applied to each entity raises fears of capital increase for large groups

FRTB capital quirk for sovereign bonds bewilders banks

EU treatment of govvies under internal models is worse than standardised approaches

Innovation in technology: International Swaps and Derivatives Association

Risk Awards 2022: Isda takes a fintech turn with quant analysis tool Perun, leveraging data standards legacy

CBA sees minimum CET1 up 225bp under Basel III

Apra’s review of the country’s capital framework leaves less wiggle room from January 2023

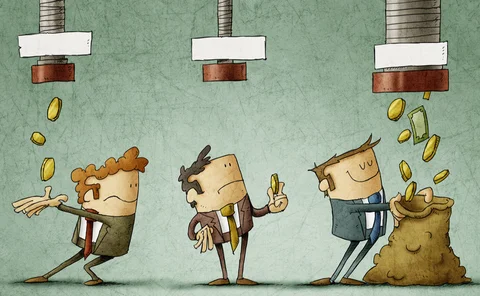

The Collins flaw: backstop turned binding constraint

US legislative tweak was meant to prevent banks from using their own capital models too liberally. It’s now something different

EU regulators warn Basel III deviations could last forever

CRR III allows European Commission to extend transitional rules for SA-CCR

Regulatory straitjacket adds $7bn to Danske’s credit RWAs

Remedials to improve internal models push total RWAs up 5%

All top US banks below Collins floor

None of the eight systemic banks in the country above the threshold for the first time since 2015

Morgan Stanley curbs SA-CCR impact on core ratio

Impact of early implementation far below original estimates thanks to mitigatory action

SA-CCR switch pushes Goldman below Collins floor

Early adoption at the end of 2021 adds $15 billion of RWAs

Wells Fargo RWAs drift apart

Standardised RWAs have increased for three consecutive quarters, putting pressure on the bank’s CET1 capital ratio

Citi bolstered CET1 ratio on eve of SA-CCR switch

Standardised RWAs dropped 5% in Q4, boosting the bank’s core ratio by 55bp

SA extends reach over EU banks’ market and op risk

Regulator-devised models have been capturing a bigger chunk of RWAs through the pandemic

EU offers reprieve for fund-linked derivatives trades

Banks hope FRTB draft allowing fund managers to supply standardised inputs will cut risk weights