Risk

SFC’s Alder looks to shake up liquidity rules post-Covid

Asia Risk 25: HK regulatory head says central banks must “never have to step in again” to bail out investors

Back to school: BlackRock uses quant quake lessons on Covid

Pandemic prompts a switch in approach from strategic to tactical

Solid foundations – Bridging the transition gap

Phil Whitehurst, head of service development, rates, SwapClear at LCH, explores the potential parallels between forward-looking term Sonia rates and term SOFR rates. He presents his thoughts on the recent announcement of increased powers for the…

Hammer time? Clearers mull co-operation on default auctions

Some CCPs are mooting joint auctions to resolve large defaults – but critics deem them unworkable

The impact of corporate social and environmental performance on credit rating prediction: North America versus Europe

The authors quantify the extent to which the quality of credit rating predictions improves by integrating measures of corporate social performance (CSP) in an established credit risk model. Their analysis provides comprehensive evidence of the…

Derivatives house of the year, Asia ex-Japan: UBS

Asia Risk Awards 2020

Fund size and the stability of portfolio risk

This paper examines the relationship between portfolio size and the stability of mutual fund risk measures, presenting evidence for economies of scale in risk management.

Letting go of Libor – How banks and buy-side firms are navigating the road to transition

Libor’s demise as a trusted benchmark presents a seismic challenge to the financial services industry. As time ticks down to its planned replacement in 2021 and alternative rates and new products emerge, market participants must determine the risks to…

Economic policy uncertainty, investors’ attention and US real estate investment trusts’ herding behaviors

Using a quantile regression model, this study examines economic policy uncertainty and investors’ attention for policy risk on US real estate investment trusts’ (REITs’) herding behaviors.

How the Covid-19 pandemic is furthering understanding of crisis management frameworks

This webinar explores what can be gleaned from Covid-19, and how it can help inform recovery

The econophysics of asset prices, returns and multiple expectations

The author models interactions between financial transactions and expectations and describe asset pricing and return disturbances.

Stress-testing amid Covid‑19

The Covid‑19 pandemic has proved to be a real-life stress test for the banking sector as firms adjust to new ways of working. Here, SAS explores how the pandemic has magnified the importance of stress-testing, scenario analysis and contingency planning…

Confidence in pricing data is essential in a distressed market

Jason Waight, head of regulatory affairs, Europe at MarketAxess, explores the key role of reliable data sources in offering a commercial advantage to traders during the March crisis

Covid-19 and the credit crisis

This webinar discusses the credit risk challenges facing energy intensive industrials, energy producers and traders

Strategic and technology risks: the case of Co-operative Bank

This paper studies the growth by acquisition strategy embarked upon by a mid-sized UK bank, the Co-operative Bank; this strategy was a disaster, leaving a heretofore successful bank in dire trouble and on the block for buyers at a substantial discount to…

Elevating enterprise resiliency practices in a crisis

Patrick Potter, digital risk strategist at RSA, shares insights into how financial institutions – some already heavy with digitalisation – need to elevate their business recovery and resiliency strategies to navigate through the global pandemic and…

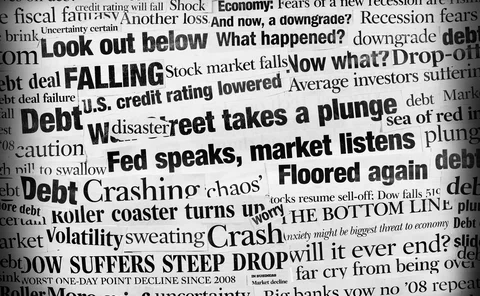

Studies test investors’ risk aversion after crash

Researchers use March tumult to investigate psychology of risk-taking

Volatility spillover along the supply chains: a network analysis on economic links

The analysis in this paper reveals that additional fundamental risk gets transferred along supply chains, and that suppliers are exposed to additional fundamental risk that is not captured by their market beta. Suppliers are therefore exposed to…

Integrating macroeconomic variables into behavioral models for interest rate risk measurement in the banking book

This paper proposed a nonparametric approach to decompose a macroeconomic variable into an interest-rate-correlated component and a macro-specific component.

Range-based volatility forecasting: a multiplicative component conditional autoregressive range model

This paper proposes a multiplicative component CARR (MCCARR) model to capture the "long-memory" effect in volatility.

Quant firm deploys new metric for Covid sensitivity

Los Angeles Capital debuts new factor for measuring stocks’ sensitivity to the pandemic

The Libor countdown – Focusing on derivatives and the impact of Covid-19

Considering the Libor transition is beyond the halfway stage, staying current with updates, information and insights are crucial to organisations’ preparation efforts. When it comes to derivatives, the route to the finish line is not evenly paved, but…

Doyne Farmer’s next big adventure: capturing the universe

Quant fund pioneer plans to build an economic super-simulator on a global scale

Fitch Solutions Pulse Survey – The economic impact of Covid-19

The global health crisis precipitated by the Covid‑19 pandemic has dealt a sharp, swift blow to the global economy. As companies emerge from the initial shock, Fitch Solutions surveyed its global client base to understand how business leaders view the…