Risk management

The impact of corporate social and environmental performance on credit rating prediction: North America versus Europe

The authors quantify the extent to which the quality of credit rating predictions improves by integrating measures of corporate social performance (CSP) in an established credit risk model. Their analysis provides comprehensive evidence of the…

Bank of the year, Thailand: CIMB Thai Bank

Asia Risk Awards 2020

Market risk management product of the year: FIS

Asia Risk Technology Awards 2020

How financial Institutions can manage risk for business recovery

Hosted by Asia Risk, this webinar – ahead of this October's Risk Hong Kong conference – addresses the latest market trends and challenges faced by Hong Kong’s risk management practitioners

The top risk management trends in the Asean region

Setting the scene in preparation for the Risk Asean conference in October, a group of industry experts debate and discuss the top trends in risk management the Asean region will need to look out for in 2021 and beyond

Revised FRTB deadline poses further challenges for Asia‑Pacific banks

Essan Soobratty, product manager for regulatory data, New York; Eugene Stern, global head of product, market risk, New York; and Vicky Cheng, head of government and regulatory affairs, Asia‑Pacific, Hong Kong, at Bloomberg explore the additional…

The changing shape of buy-side risk technology

Buy-side risk managers and FactSet’s global head of quantitative analytics gathered for a Risk.net webinar to discuss topical risk management trends for asset managers and to consider the industry challenges posed by the recent Covid‑19 pandemic

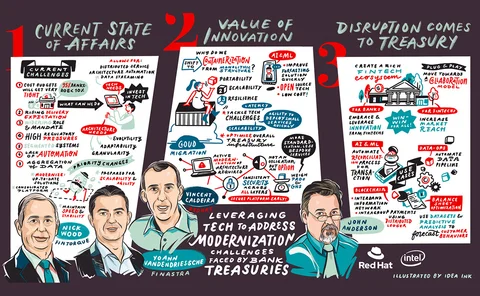

Leveraging technology to address modernisation challenges faced by bank treasuries

Bank treasurers and technologists convened for a Risk.net webinar in association with Red Hat to consider how technological innovation could help treasury functions meet rising expectations

Lessons from the past – The evolving importance of historical tick data (Part I)

A recent Risk.net webinar in association with Refinitiv examined the opportunities and challenges for using historical tick data in today’s volatile markets. Panellists outlined the variety of ways the industry is harnessing historical tick data, but…

Inside the Fed’s secret liquidity stress tests

Lobbyists and Quarles train sights on horizontal exams that can shape bank risk appetite

Op risk data: Goldman 1MDB settlement swells 2020 loss tally

Also: Deutsche fined over Epstein KYC failings; collateral fraud in focus. Data by ORX News

Managing financial risk in cross-border emerging markets M&A

BNP Paribas’ Djamel Bruimaud, strategic sales lead for foreign exchange and local markets for European corporates, and Stephane Benhamou, head of forex and rates solutions sales, France, discuss the creation and execution of a hedging solution designed…

Funds turn to stress-testing in fast-forward and reverse

Buy-side risk survey: Covid-19 is changing the way investors think about stress tests

Preparation paid off for funds during Covid liquidity crunch

Buy-side risk survey: how asset managers weathered the liquidity crisis in March

How the Covid-19 pandemic is furthering understanding of crisis management frameworks

This webinar explores what can be gleaned from Covid-19, and how it can help inform recovery

Why investors are stuck with flawed VAR models

Buy-side risk survey: VAR wasn’t much use in March, but it is ingrained in the industry

Pimco’s Mariappa on iterating through the Covid-19 crisis

Buy-side risk survey: bond giant’s risk head is paying closer attention to idiosyncratic risks

What is essential is invisible to the eye: prioritizing near misses to prevent future disasters

Near misses represent a primary information source to analyze the operational risk exposure of a company, since they can reveal gaps in the control environment. The model proposed in this paper aims at identifying the most dangerous events that could…

Rethinking compliance – New approaches to conduct risk and surveillance

Improper behaviour by employees of a financial institution that has the potential to contribute to market instability – known as conduct risk – can have severe financial, regulatory, legal and reputational ramifications. This Risk.net webinar, in…

Podcast: mental health and the role of the CRO

Energy company CRO discusses how her firm is dealing with workplace stress as lockdowns ease

Lawmakers have to sort ‘tough legacy’ Libor products – survey

Challenges agreeing contract amendments and lack of term rates for the risk-free alternatives are also barriers to transition

Strategic and technology risks: the case of Co-operative Bank

This paper studies the growth by acquisition strategy embarked upon by a mid-sized UK bank, the Co-operative Bank; this strategy was a disaster, leaving a heretofore successful bank in dire trouble and on the block for buyers at a substantial discount to…

An emergent taxonomy for operational risk: capturing the wisdom of crowds

In this paper, the author takes a data-driven approach and combines the individual active taxonomies of sixty large financial institutions (fifty-eight for construction and two for validation) to create a coherent new reference taxonomy: the ORX…

The changing shape of buy-side risk technology

This webinar shares insights into the emerging strategies shaping firms’ investment, compliance and technology risk decisions, and how Covid-19 is causing a rethink in priorities