Portfolio optimisation

Margin matters – A smarter approach to margin risk

Michael Hollingsworth, head of financial risk analytics in the Data and Access Solutions division at Cboe Global Markets, reveals how trading firms are calculating margin in real time to manage pre- and post-trade risk and end-of-day clearing-house…

Powering through tough times

Hitachi ABB Power Grids’ dominant position in Energy Risk’s 2021 Software Rankings reflects its deep understanding of current market challenges

Simm template to be expanded for SA-CCR and FRTB

Crif-plus will capture risk exposures for all instruments, boosting optimisation potential

Optimisation firms prep for SA-CCR boom

Flush with new cash, vendors ready rebalancing services ahead of risk-sensitive leverage framework

Optimization of systemic risk: reallocation of assets based on bank networks

In this paper, the authors investigate the optimization of systemic risk based on DebtRank by considering two contagion channels: interbank lending and common asset holdings.

Mixed response to Esma’s clearing carve-out for optimisation

Long-awaited proposal must be replicated by US and UK to be effective, participants say

Smaller drawdowns, higher average and risk-adjusted returns for equity portfolios, using options and power-log optimization based on a behavioral model of investor preferences

The authors use a power-log utility optimization algorithm based on a behavioral model of investor preferences, along with either a call or a put option overlay, to reverse the negative skewness of monthly Standard & Poor’s 500 (S&P 500) index returns…

Fulcrum hangs ESG designs on honing hard numbers

ESG risks will become part of investment and risk management processes across all funds at the firm

Quant funds look to AI to master correlations

Machine learning shows promise in grouping assets better, predicting regime shifts

Stock-picking finds unlikely champion in ex-Winton CIO

Matthew Beddall’s Havelock restyles value investing for the big data age

The standard market risk model of the Swiss solvency test: an analytic solution

This paper derives an alternative fast Fourier transform-based computational approach for calculating the target capital of the SST that is more than 600 times faster than a Monte Carlo simulation.

Factor investing: get your exposures right!

This paper is devoted to the question of optimal portfolio construction for equity factor investing. The authors discuss the question of multifactor portfolio construction and show that the simplistic approaches often used by practitioners tend to be…

Risk premia strategies – Lessons learned for the future

After a difficult 2018, investors are increasingly wary of risk premia, concerned that factors leading to underperformance might be a recurring problem. Imene Moussa, executive director at UBS, clarifies this issue

From log-optimal portfolio theory to risk measures: logarithmic expected shortfall

In this paper, the authors propose a modification of expected shortfall that does not treat all losses equally. We do this in order to represent the worries surrounding big drops that are typical of multiperiod investors.

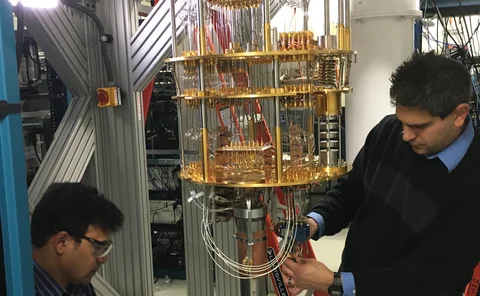

Time to put real problems to the quantum machines

There is a lot to learn before quantum computers can be applied to specific financial problems

Skewed target range strategy for multiperiod portfolio optimization using a two-stage least squares Monte Carlo method

In this paper, the authors propose a novel investment strategy for portfolio optimization problems.

Portfolio optimization for American options

In this paper, the authors construct strategies for an American option portfolio by exercising options at optimal timings with optimal weights determined concurrently.

Risk Markets Technology Awards 2019: Vendors enter the pick-and-mix era

Modular tech and micro-services – plus new risk and regulatory needs – are creating openings for insurgents and incumbents

Value-ranked equity portfolios via entropy pooling

This paper demonstrates how to directly incorporate common value-investing idea into the portfolio optimization process.

Genetic algorithm-based portfolio optimization with higher moments in global stock markets

This paper investigates the distributional characteristics of stock market returns and analyzes the significance of higher moments.

The Kelly criterion in portfolio optimization: a decoupled problem

This paper examines how the Kelly criterion can be implemented into a portfolio optimization model that combines risk and return into a single objective function using a risk parameter.

Equity derivatives now biggest consumer of initial margin

Fragmented product set is 1.3% of OTC notional but attracts more margin than rates and forex

StanChart and Nasa join forces for quantum computing project

Bank is exploring quicker ways to solve portfolio optimisation

Efficient trading in taxable portfolios

This paper determines life-cycle trading strategies for portfolios subject to the US tax system.