Market risk

Deutsche’s SVAR window update adds €2.2bn to RWAs

First-quarter surge comes after four consecutive reductions

China’s top banks slashed market RWAs by $15bn in 2021

Aggregate market RWAs at top five lenders down 17% in year marred by domestic and overseas volatility

Standardised approach extends reach over US banks’ RWAs

Gap between standardised and advanced RWAs at its widest ever for BofA, BNY Mellon, Morgan Stanley and Wells Fargo

Isda broadens FRTB carbon trading study to win over sceptics

New study shows risk weights too high for US markets, but data from 2008 still missing

Goldman’s VAR climbs to $98 million in Q1

Commodity and interest rate risk push average VAR to its highest reading since 2020

What drives the convertible bond market?

Dmitry Pugachevsky, director of research at Quantifi, provides an overview of the burgeoning convertible bond market, including approaches to modelling and its outlook in the current inflationary environment

Adapting to the new normal

The current interest rate environment and need to adapt to changing technology and regulatory mandates is keeping insurers on their toes, Nakul Nayyar, head of investment risk at Guardian Life, tells Risk.net

EU banks racked up VAR breaches in 2021

Crédit Agricole and ING Bank hit with higher multipliers after exception count rises

UniCredit cuts market RWAs by 9%

Removal of capital requirements for FX risk sheds standardised RWAs by 68% in three months

Lloyds’ IMA RWAs up 43% in run-up to Ibor switch

VAR multiplier and RNIV charges rose in 2021 on account of transition risk

US unit of Barclays close to a VAR breach in Q4

Largest loss-to-VAR ratio at the firm was highest among 10 US intermediate holding companies

HSBC’s SA market RWAs double on new structural FX rules

Move from Pillar 2 to Pillar 1 for unhedged FX risk adds $6.8bn of RWAs

US watchdog urges banks to uphold cross-border trust

Federal regulators assess financial spillover from Russian offensive as volatility surges and sanctions bite

Barclays’ modelled RWAs jump 71%

SVAR pinned to Covid-19 panic drives latest quarterly increase

Machine learning models: the new standard in capital markets

Zoi Fletcher speaks to Alexander Sokol, founder and executive chairman at CompatibL, about why he believes machine learning technology will be used to calculate risk measures across the industry going forward

Citi leads US banks in cutting market risk

Aggregate market RWAs across systemic banks down $26 billion, despite Bank of America bucking the trend

FRTB capital quirk for sovereign bonds bewilders banks

EU treatment of govvies under internal models is worse than standardised approaches

US banks see highest number of loss-making days in six years

Wells Fargo, Citi and JP Morgan the worst performers in record-breaking Q4

Top US banks record 14 VAR breaches

JPM, Morgan Stanley, BofA, Citi, Goldman and State Street wrong-footed in volatile end to 2021

JP Morgan incurs eight VAR breaches, triggering capital hike

Largest trading loss in Q4 reached 207% of the bank’s VAR limit

EU banks fear outlier status on non-modellable risk charges

Dealers face disadvantage if EU implements more granular and costly version of FRTB than US, UK

SocGen cut trading VAR by a third in Q4

Trading risk gauge shrinks to lowest in 17 years

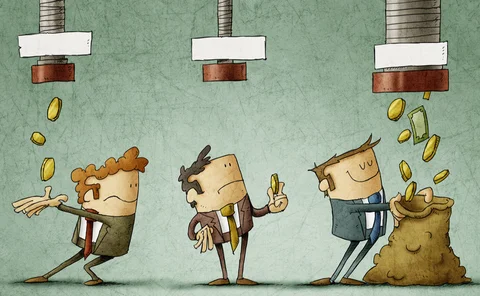

The Collins flaw: backstop turned binding constraint

US legislative tweak was meant to prevent banks from using their own capital models too liberally. It’s now something different

Netting challenges push ING’s market RWAs up 64%

A regulatory issue left the bank unable to consolidate cross-border positions in Q4