Loans

Ahead of collapse, SVB’s interest expense climbed 1,700%

Lending income failed to keep pace with higher deposit costs as Fed reshaped rates environment

Term SOFR trading ban remains as easing talks collapse

Fed working group resolute on interdealer trading restrictions despite looming capacity crunch

UK banks added £1.6bn to loan allowances in 2022

Increase in set-asides driven by stage-two and stage-three credit-loss reserves

US insurance regulators move to kill CLO arbitrage

Capital charges on collateralised loan obligations will be model-based after 2024

Why risk managers don’t trust the EU’s new IRRBB test

And why there may never be a perfect way of assessing the risks of changes in net interest income

ECB promises ‘proportionate’ approach to interest rate risk

But banks still fear regulatory and investor response if many are classed as outliers

NY Fed paper warns of systemic risks from SOFR credit lines

Stress tests need to account for credit facilities being “drawn to the limit”, says Stanford’s Duffie

Capital One’s loan charge-offs surge 54% in Q4

Amount of credit cards and consumer loans getting written off approaches pre-pandemic levels

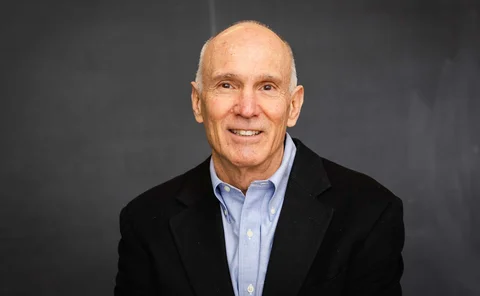

Lifetime achievement award: Stephen Kealhofer

Risk Awards 2023: KMV co-founder helped usher in a new era of credit risk analysis – at banks and investors

Derivatives client clearer of the year: BNP Paribas

Risk Awards 2023: When gas prices spiked, French bank provided much-needed credit to clients hit by jumbo margin calls

More EU banks will fail new IRRBB test as rates push upwards

Half of all EU banks could cross outlier threshold for new test of net interest income

Covid-forborne and state-backed loans keep creaking louder

Share of non-performing ex-moratoria and guaranteed exposures at EU banks balloons amid energy crisis, EBA data shows

Top US lenders book $6.2bn in provisions in Q4

Loan-loss charges at Bank of America, Citi, JP Morgan and Wells Fargo hit highest since pandemic outset

Canada approves term Corra rate

CARR restricts use cases but mulls allowing interdealer hedging of derivatives on new benchmark

Libor Act leaves door open for synthetic rate in US contracts

Absence of proposed limit protects borrowers from sky-high prime rate but may irk some investors

ECB ratchets up Pillar 2 charges across top lenders

UniCredit, BNP Paribas, SEB and Swedbank worst-hit in latest SREP round

ARRC’s trivial fight over term SOFR use

Toyota’s ABS deal should not derail effort to expand use of term rate in derivatives

Performance validation of representative sample-balancing methods in loan credit-scoring scenarios

The authors validate 12 of the most representative sample-balancing methods used for credit-scoring models, finding that a combined SMOTE and Editor Nearest Neighbor method is optimal.

FCA’s synthetic Libor plan could trigger US legal disputes

Tough legacy solution threatens to override existing fallbacks in some US law contracts

CLO equity investors stung by Libor basis

Growing mismatch between one- and three-month tenors slashes payouts by a third

Isda docs saved crypto start-up that lent to Alameda

Early termination clause allowed Cega to recover $13.6 million in loans to failed trading firm

As interest rates surge, bankers fret over last year’s models

IRRBB modellers trying to predict client behaviour have little relevant data to fall back on

Barclays, Deutsche, Credit Suisse take $437m hit on leveraged loans

Higher interest rates eroded value of facilities stuck in pre-syndication during Q3

HSBC’s quarterly UK provisions rose 111% in Q3

Uncertainty around interest rates and political stability reflected in model overlays