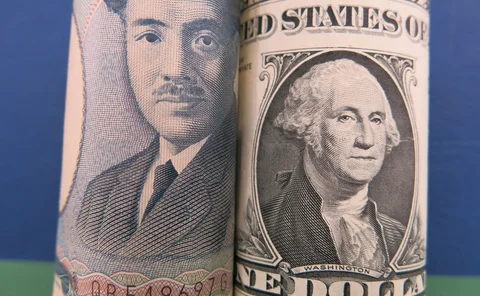

Japanese yen

Funds tap options on FX vol amid tariff disruptions

Dealers say vanillas, digitals and knockouts on realised vol increasingly used to navigate Trump news flow

US senators press CFTC on Japan swap clearing

Boozman and Hagerty urge action on yen swap clearing access to JSCC in letter to US regulator

Exotic FX derivatives bets in play as US election vol jumps

Forward volatility agreements see profits for funds; new trades include vol knockouts

Triggers of August market ‘flare-up’ still in place, BIS warns

Leveraged positions remain at risk of sudden unwinding, as margin calls play amplifying role

Dealers bruised by surprise renminbi vol surge

Rush to re-hedge USD/CNH exotics left banks in grip of painful short gamma squeeze

Anticipating rate hike, MUFG offloaded ¥4trn of Japan government bonds

Lender reduces holdings to lowest in over a decade

Nomura’s market risk jumps ¥800bn in Q2

Yen depreciation and rising default risk drive RWAs to record high

Franklin Templeton steps back into FX options

Former biggest user of the instrument among US mutual funds returns with $7.6bn of USD/JPY strategies

Is JSCC-CFTC stalemate about to be broken?

Japan CCP gains allies in battle to clear yen swaps for US clients, but CFTC shakeup could dash hopes

JSCC presses for US client clearing exemption

Heightened yen rate risk adding urgency to US funds’ calls for swaps clearing access

FX books bulge in quant investment field

Carry strategies attract bulk of interest; banks eye growth in volatility, intraday and emerging market replication

LCH-JSCC basis turns negative on BoJ policy shift

Changes in hedge fund positioning at LCH seen as driver of inversion on 20-year swaps

Managing Japanese interest rate risk and creating trading opportunities

With an anticipated rise in Japanese interest rates, 3-Month TONA Futures have attracted the interest of investors worldwide since debuting on the Osaka Exchange (OSE) in May. Kensuke Yazu, general manager for derivatives business development at OSE,…

JSCC and the future of clearing and settling yen-denominated trades

The Japanese Securities Clearing Corporation (JSCC) explores how market participants can benefit from a wide array of yen products while accessing robust risk and margin management frameworks with a high level of transparency

Behnam comments fan JSCC hopes for US client clearing

Japan clearing exec welcomes CFTC chair’s pledge to keep discussing OTC clearing status for non-US houses

Data shines light on Tibor fragility

Lack of actual transactions in D-Tibor should be considered in fallback discussions

Hedge funds push yen options bets to next BoJ meeting

Target shifts as vol punts on change to rates policy fall flat

LCH Japan plan signals new fight for global clearing model

UK-based clearing house faces “uphill struggle” against JFSA location policy on yen derivatives

BoJ policy shift sends traders to hedge downside yen moves

Hedge funds and corporates rush to FX options following central bank move

BoJ action to strengthen yen spurs FX options traders

Traders turn bearish on USD/JPY FX vol over further central bank intervention

Power-reverse to the future: falling yen revs up PRDCs again

Pressure on Japanese unit sparks revival in power-reverse dual currency notes