This article was paid for by a contributing third party.More Information.

JSCC and the future of clearing and settling yen-denominated trades

The Japanese Securities Clearing Corporation (JSCC) explores how market participants can benefit from a wide array of yen products while accessing robust risk and margin management frameworks with a high level of transparency

When the market was caught off-guard by the Bank of Japan’s (BoJ’s) December 2022 yen rate shock, JSCC’s risk management remained robust and supported the wider financial system.

Following more than 25 years of interest rates being held at (or near) zero by Japan’s central bank, JSCC’s risk management framework was suddenly and severely tested. In December 2022, the BoJ announced a surprise change to the level of its yield curve control policy, doubling the range for Japanese Government Bond (JGB) yields from 0.25% to 0.5%. This seemingly small change caught the markets completely unaware – with economists surveyed at the time having expected no change from the BoJ at the December meeting – and occurred at a time when many interest rate trading desks worldwide were short-staffed because of end-of-year holiday leave. This event triggered JSCC to issue an intraday emergency margin call – a contingency prescribed in JSCC’s rule book and therefore fully anticipated by its clearing participants, even during the usually quiet time of year. Despite the seismic nature of the event to Japanese interest rates and foreign exchange markets, JSCC’s tried-and-tested risk management framework performed flawlessly, once again proving the value of central clearing.

Clearing and settlement are increasingly important functions in today’s global financial markets. The margin and risk management associated with trade clearing are key regulatory components for managing volatility, liquidity and, ultimately, market stability. JSCC plays a leading role in clearing and settling yen-denominated transactions in one of the world’s most important financial markets and is the primary global clearing house for yen-denominated markets. The average daily cleared value from all products for JSCC – which covers exchange cash and derivatives, over-the-counter (OTC) swaps, and JGB repo – exceeded JPY100 trillion in 2022.

JSCC is a subsidiary of Japan Exchange Group, a publicly listed company and home to the fifth-largest share of listed companies globally by market capitalisation. Its role is to manage the clearing and settlement of yen-denominated products, including cash securities, OTC and listed derivatives, and repos. JSCC is licensed as a clearing house to operate in all of the major financial centres. It offers world-class services, driving recent improvements to its risk management systems. These include the expansion of its settlement service and coverage to adopting new risk management methods consistent with global standards.

JSCC’s OTC yen derivatives clearing service is backed by a variety of compression services, proprietarily and in collaboration with TriOptima and Quantile Technologies. These offer clearing members significant operational and capital efficiencies by reducing the volume of outstanding cleared swaps based on the preference of each clearing member. Additionally, for the mark-to-market of positions, clearing members using JSCC’s OTC yen interest rate swap (IRS) clearing service can opt for cash settlement in lieu of variation margin. These services allow clearing members to proactively manage their outstanding exposures in terms of the leverage ratios and associated capital costs.

“JSCC has introduced and expanded post-clearing compression services for listed derivatives and interest rate products with proprietary solutions. The goal is to offer clearing members and their customers expanded services with maximum operational efficiency, while understanding their costs, including capital exposure against JSCC,” says Tetsuo Otashiro, senior head of global policy and regulation at JSCC.

In light of future moves anticipated for the yen’s interest rate policy, alongside increasing customer interest in accessing JSCC clearing, JSCC plans to clear short-term interest rate derivatives to be listed on its affiliated Osaka Exchange (OSE).

Kensuke Yazu, general manager of OSE’s derivatives business, says: “We are very excited with the launch of new short-term interest rate futures on OSE, as it will give JSCC’s clearing members and their customers an opportunity to increase margin efficiencies by offsetting exposures with the long-standing 10-year JGB futures.”

The opportunities for margin efficiencies will be further extended into yen IRS. “We are already providing cross-margining between yen IRS and 10-year JGB futures, and the addition of short-term rate futures to this cross-margining programme will increase opportunities for margin efficiency, benefiting our users even further as they need to manage yen rate risk during important future events, such as the transition of the BoJ’s leadership from the current governor Kuroda in April,” added Otashiro.

Risk management during volatile times

Predictability of margin is important as its volatility puts pressure on intraday margin requirements. With JSCC, collateral to cover an intraday margin call is accepted in cash or other securities, such as JGBs. JSCC calculates at least one variation margin call per day at 5:30pm Japan Standard Time, which must be deposited by 11am on the following business day.

“While we are mindful of the impact of our own risk management on our clearing members, the flexibilities built into our intraday margin framework should significantly mitigate any negative effect of margin procyclicality, as the funding burden on our clearing members and their customers is reduced,” says Otashiro.

Case study: VAR for futures and options contracts

JSCC is planning to migrate its risk calculation methodology from the Standard Portfolio Analysis of Risk – a method developed by CME Group known as Span – to value-at-risk (VAR) for the purposes of determining initial margin (IM). The new methodology will cover margin requirements for JGB futures, options on JGB futures, index futures, options on index contracts relating to securities, commodity futures and options on commodity futures. Implementation of this new VAR margin model is expected to be complete by November 2023.

VAR relies on historical data to generate reliable calculations. JSCC only clears products denominated in Japanese yen. JSCC will enhance the robustness of the upcoming VAR calculation by incorporating historical stress events into the risk calculation, rather than eliminating all historical data simply because it falls outside of the standard lookback period.

Shun Yanagisawa, head of futures, clearing and FX prime brokerage at Citi Japan, says: “The introduction of VAR for exchange-traded derivatives is encouraging for many segments of market participants. This helps mitigate sudden fluctuation of margin and helps provide efficiencies for spread and high correlation products, such as Nikkei 225 and Topix. It also factors in stress periods in the historical lookback, ensuring margins don’t drop materially during low-vol environments.”

Steady growth of cleared products

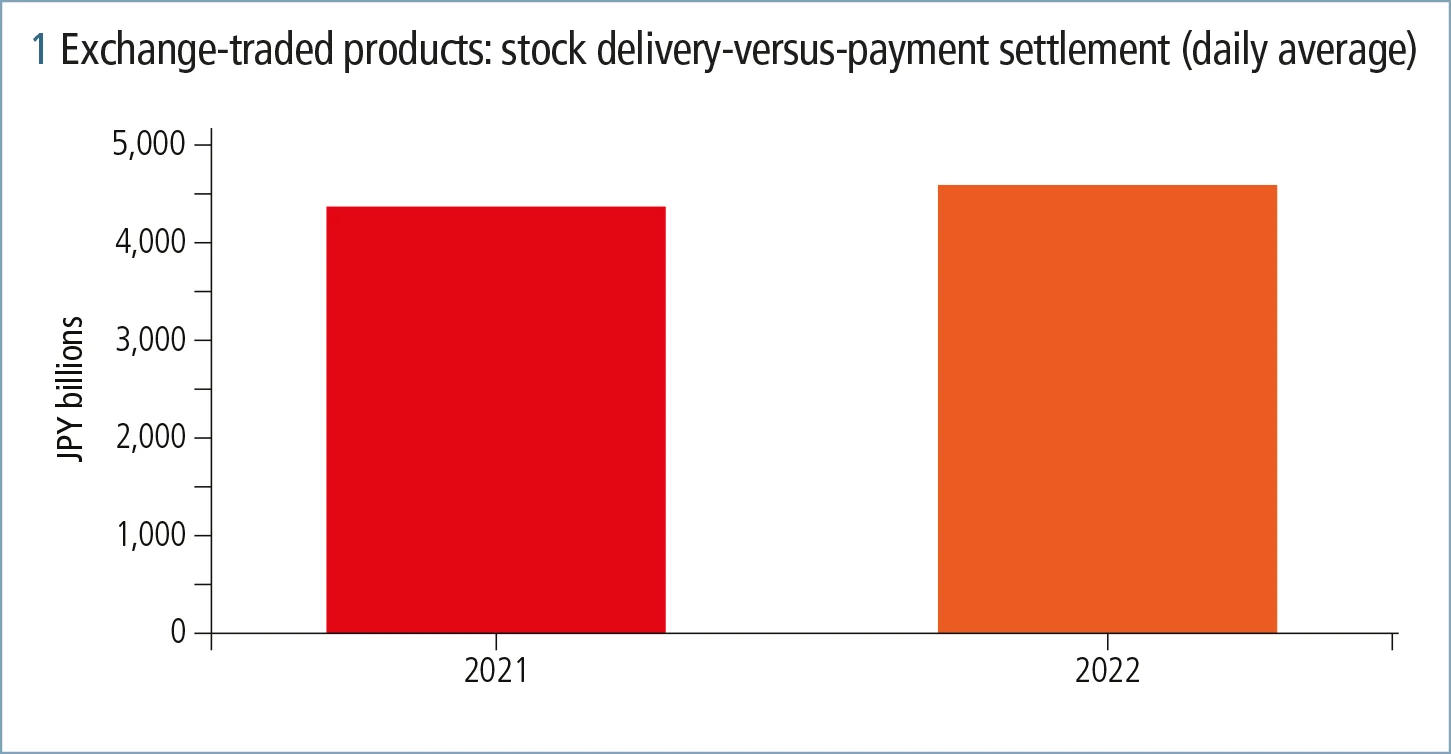

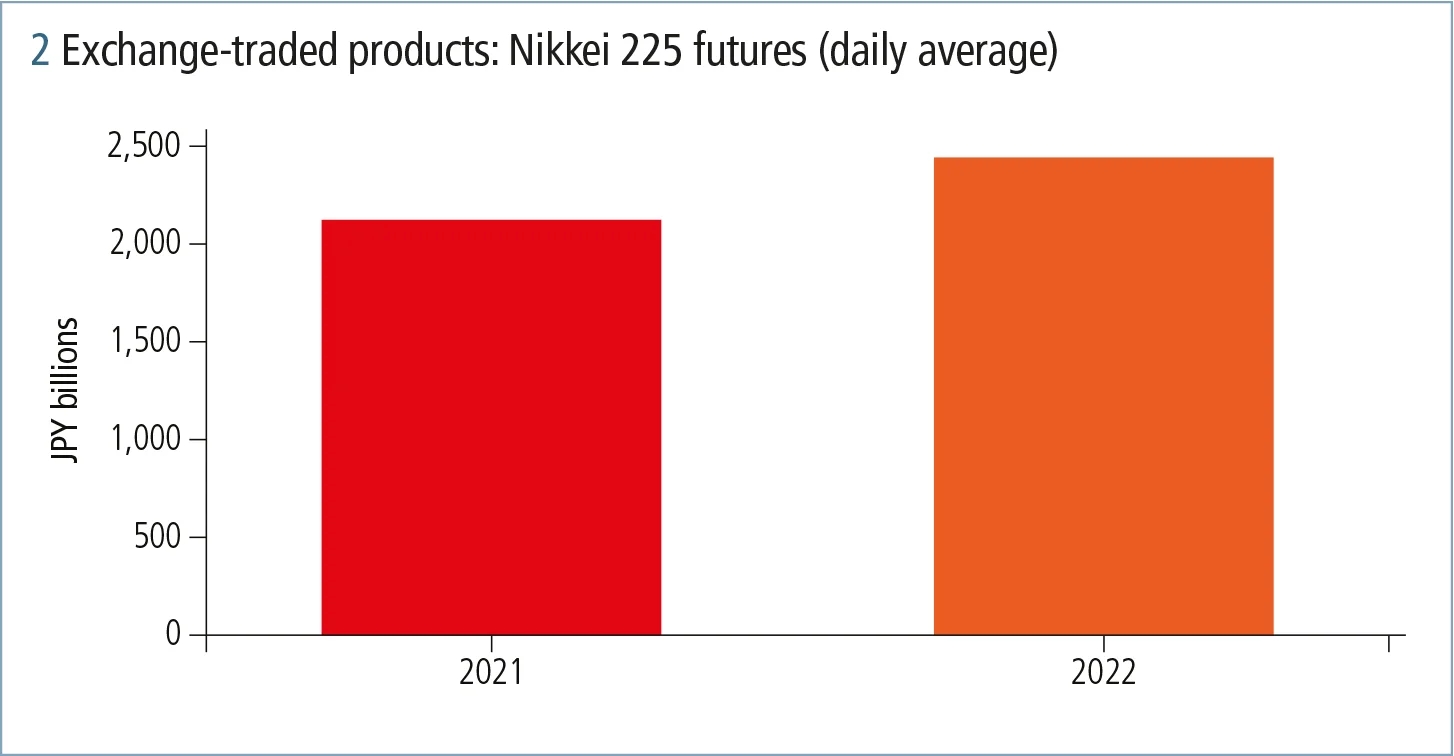

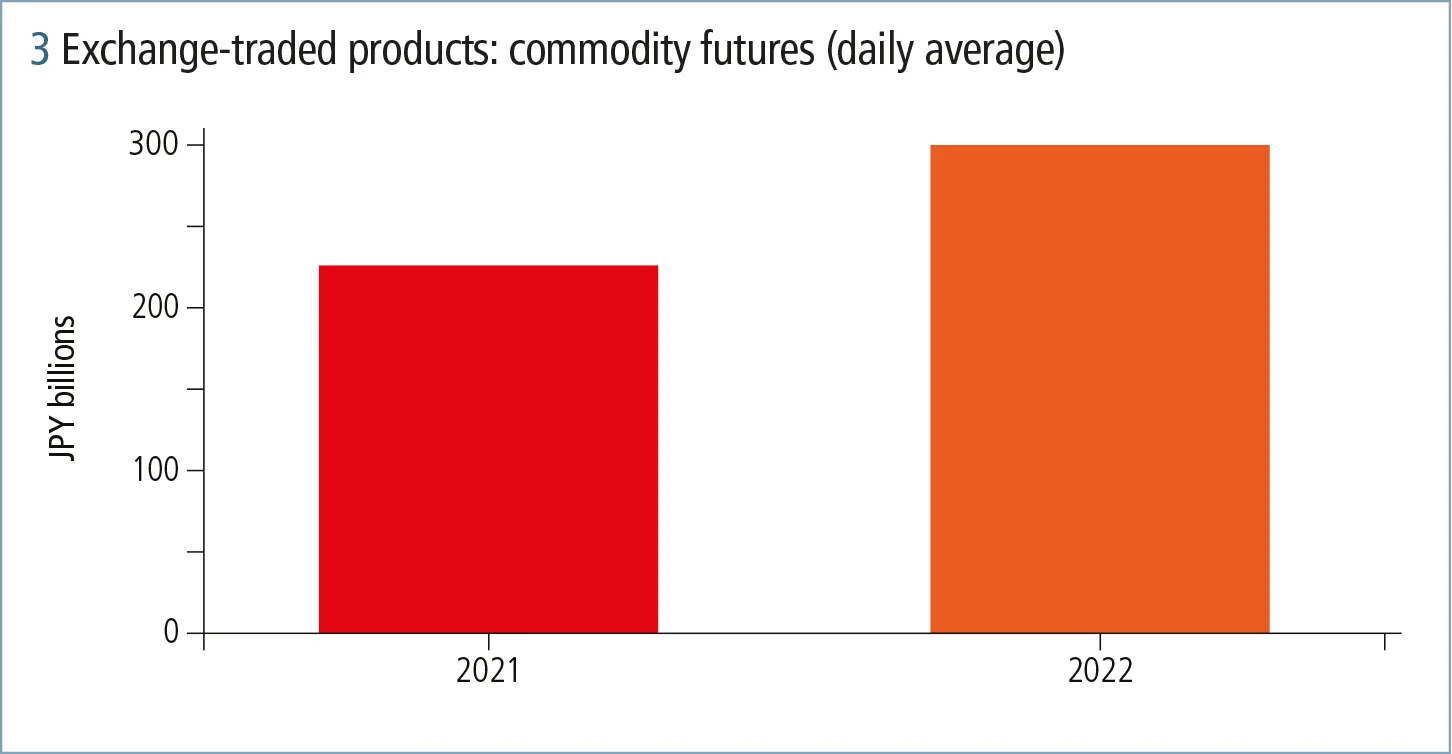

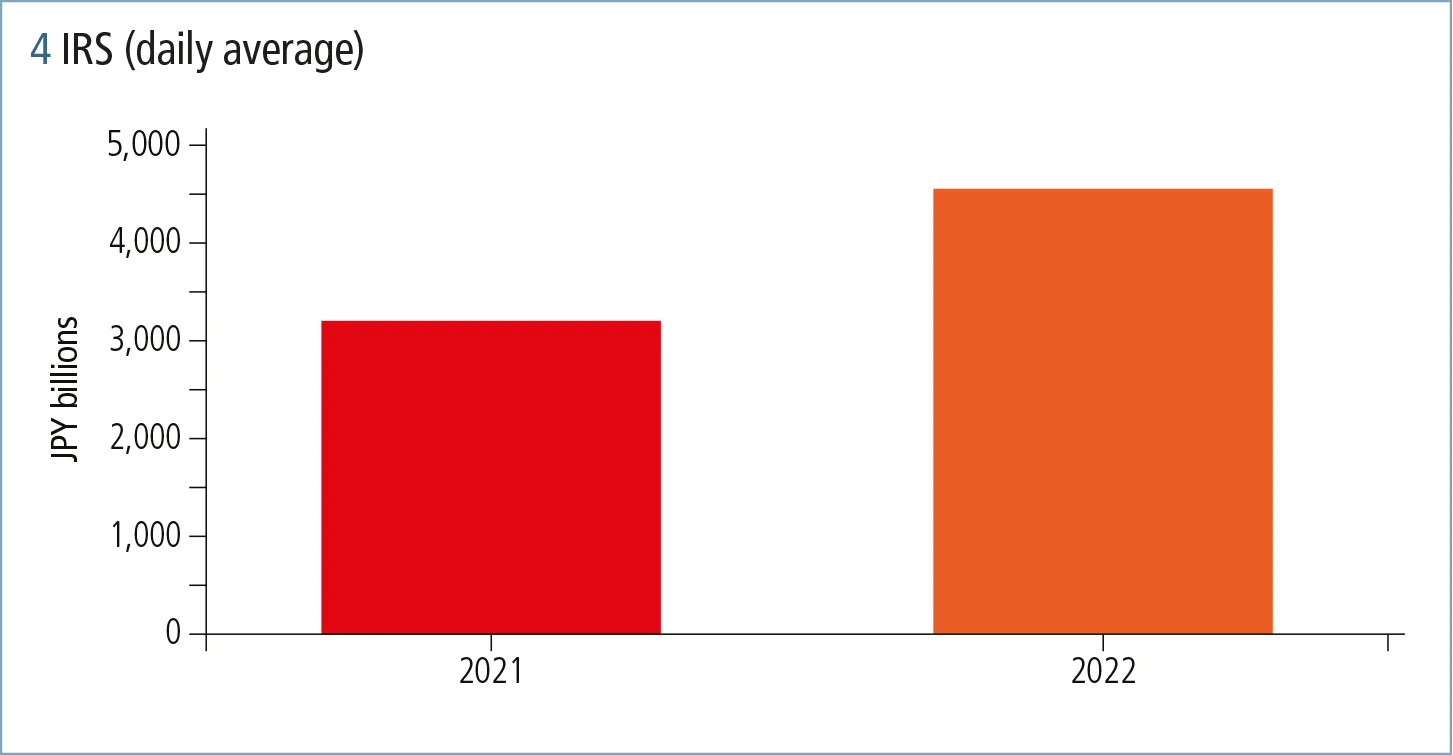

JSCC has continued to experience steady growth in cleared transactions and volumes across its full range of asset classes.

Cash equity delivery-versus-payment settlement – based on daily averages – was up 5% during the period January 2021 to December 2022, from JPY4,370 billion to JPY4,591 billion.

Nikkei 225 futures – based on daily averages – increased 15% from January 2021 to December 2022, from JPY2,124 billion to JPY2,443 billion.

Commodity futures – based on daily averages – increased 33% from January 2021 to December 2022, from JPY226 billion to JPY300 billion.

IRS – based on daily averages – increased 42% from January 2021 to December 2022, from JPY3,204 billion to JPY4,555 billion.

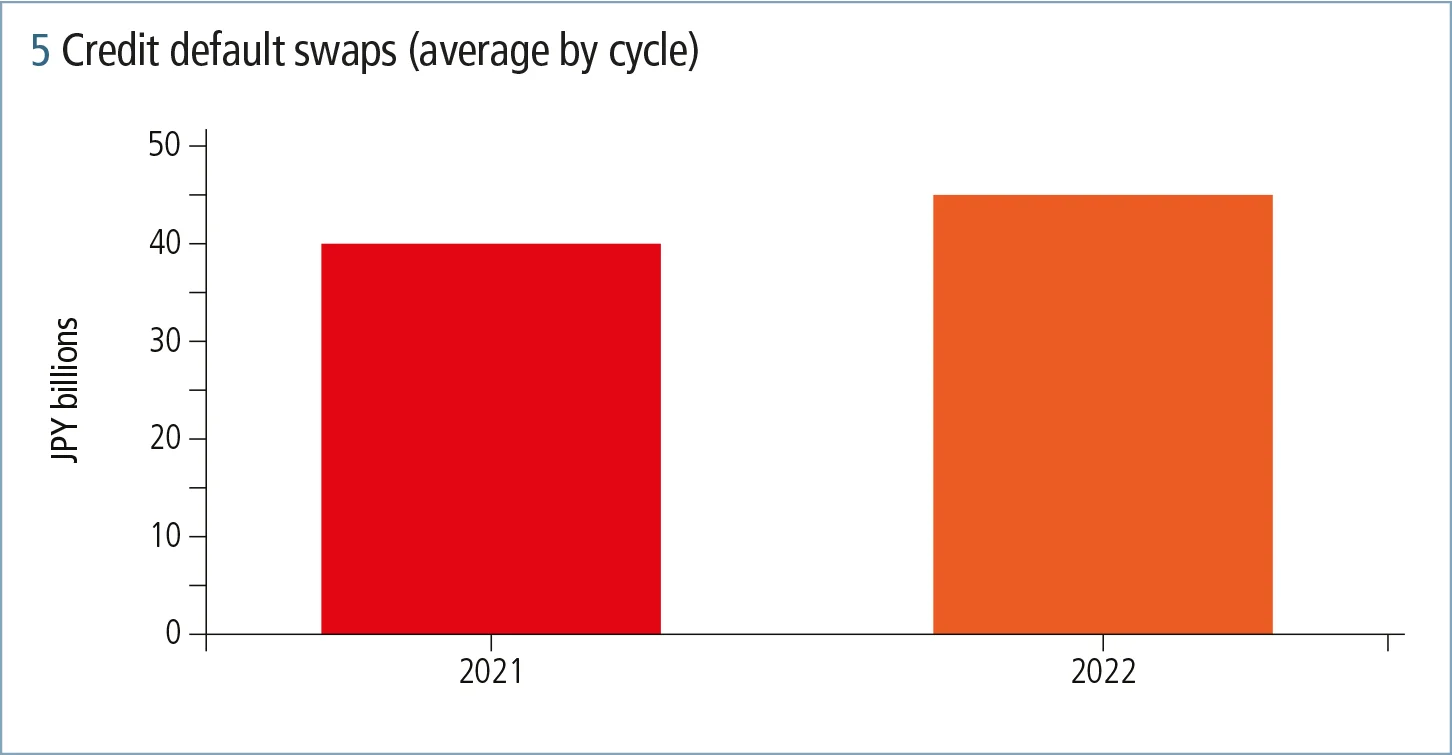

Credit default swaps – based on averages by clearing cycle – increased 12% from January 2021 to December 2022, from JPY40 billion to JPY45 billion.

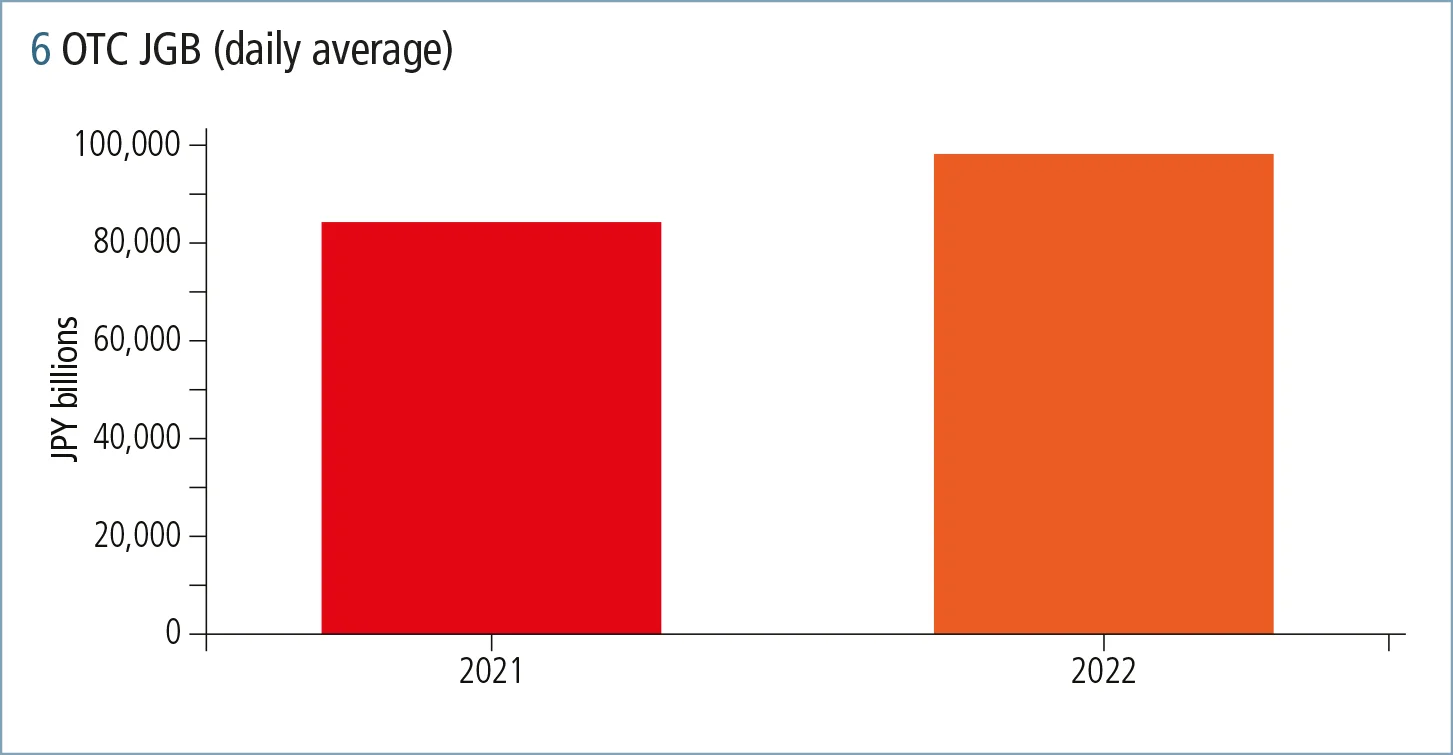

OTC JGB – based on daily averages – increased 17% from January 2021 to December 2022, from JPY84,288 billion to JPY98,223 billion.

Case study: holiday trading for listed markets

A significant enhancement to JSCC’s operations and risk management was implemented on September 23, 2022, when JSCC introduced a framework to allow trading on public holidays at both the OSE and the Tokyo Commodity Exchange. Previously, both markets were closed during public holidays and trading and settlement would not occur. This meant there was no opportunity for investors to hedge risk even when market shocks or other events occurred on holidays, such as during Japanese Golden Week – a week containing multiple Japanese holidays – in early May. Investors now have the opportunity to hedge risk during these Japanese public holidays. Meanwhile, JSCC can manage its own risk and minimise the accumulation of exposures as a scheme was implemented to increase IM requirements in advance of holiday trading days.

In the case of a holiday period lasting consecutive days – as with Japanese Golden Week – JSCC has established a holiday clearing monitoring framework. When the exposure of a clearing participant exceeds the value of posted collateral, such as IM requirements, the clearing participant will be contacted to post additional collateral or execute risk reduction trades. This convenience appears to have been well received by investors in Japanese markets, as during the first instance of holiday trading clearing volume was about 50% compared to a regular business day, based on the daily average of the previous week. This was impressive as the Japanese banking system was fully closed on these public holidays.

Future growth and opportunities

Domestic and global markets continue to evolve rapidly and JSCC stays abreast of changes by closely monitoring and managing its relationship base and information infrastructure.

Otashiro says: “JSCC continues to have ongoing dialogue with all of its users and maintain the transparency of its markets. For example, we hold quarterly calls to present JSCC risk data that is publicly accessible, and we also make this available on YouTube. We are always monitoring and assessing new and innovative risk analysis methodologies, and work closely with regulators, industry bodies and academics. Data is increasingly important, such as during stress-testing to detect warning signs for a build-up of risk. We are starting to investigate ways to optimise the use of our data to benefit all of our stakeholders.”

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net