Inflation

ECB ratchets up Pillar 2 charges across top lenders

UniCredit, BNP Paribas, SEB and Swedbank worst-hit in latest SREP round

Review of 2022: Fighting on all fronts

Macro headlines unleashed micro-horrors, as margins soared, correlations cracked and crypto markets imploded

UK banks’ CVA charges ballooned by £8bn in volatile Q3

Bank of England figures show capital requirements at highest since early pandemic readings

US mutual funds abandon inflation swaps

Counterparty Radar: Volumes dropped to new lows in Q3 as price expectations cooled

Fed hike behind $682m and $460m breaches at FICC

Clearing units for MBS and government securities hit by backtesting deficiencies on September 21

HSBC’s quarterly UK provisions rose 111% in Q3

Uncertainty around interest rates and political stability reflected in model overlays

Top US banks set aside $6bn for credit losses in Q3

Quarterly provisions highest in two years

Nordea marks down Danish mortgages by €29 million

House price declines mark ominous signal for other supercharged markets

Some euro banks modelled lower mortgage risk in H1

Italian and Belgian lenders reported steepest drops in risk density despite recessionary threat

Inflation swaps market for US funds comes to standstill

Counterparty Radar: Goldman Sachs moves to top dealer spot for non-cleared trades

Low pricing of inflation swaps takes buy side by surprise

Dealers expect inflation to peak sooner, but investors remain sceptical

Sterling interest rate ETDs plummet 28% in Q2

Investors cut open interest in futures and options contracts as crises piled up

Euro banks’ funding plans lag TLTRO repayments – EBA

Survey on funding plans shows banks don’t plan to replace ECB lines just yet

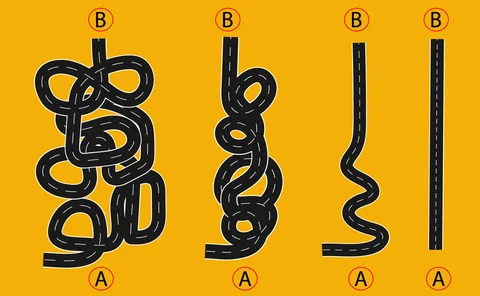

Keep risk parity simple, stupid

In times of volatility, simpler risk parity strategies may outperform more elaborate counterparts

Shifting rates throw bond investors off balance

Dearth of bond liquidity forces some traders to offload positions – but, as ever, others are waiting to pounce

Europe’s countercyclical buffers buck recession trends

Almost half of EBU’s members have set out CCyB hikes; five plan two or more before mid-2023

StanChart tackles US-China rates divergence

Talking Heads 2022: Policy changes have upended correlations in emerging markets, says rates head Lettich

EU banks add overlays as crises evade modelling

Lenders buttress provisions against unpredictable fallout from Russia's invasion of Ukraine

Looming slowdown casts doubt on countercyclical capital

Confusion over use of buffers makes bankers wonder if concept will ever be successful

Data-driven wrong-way risk

A calculation method for regulatory CVA wrong-way risk based on credit and exposure is introduced

A child of inflation: BNPP’s new macro trading unit

Talking Heads 2022: Currency and rates traders join forces at French bank as it plans to bring FX algos to US Treasury bonds

FX hedging dilemma vexes corporates as costs spiral

High volatility jacks up option prices, forcing firms to reconsider hedging activities

Growth to value, and back via quality

Inflation-fuelled stock rotations are full of complexity

BoE’s planned procyclical capital hike bewilders banks

Some doubt regulator will go through with buffer hike while forecasting recession