Greeks

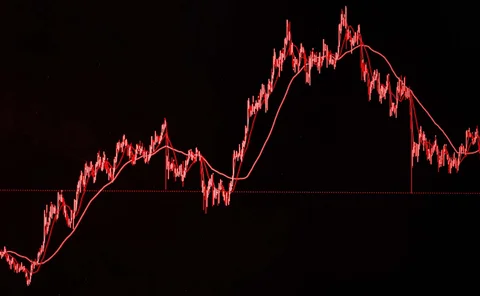

CVA sensitivities, hedging and risk

A probabilistic machine learning approach to CVA calculations is proposed

Digging deeper into deep hedging

Dynamic techniques and GenAI simulated data can push the limits of deep hedging even further, as derivatives guru John Hull and colleagues explain

Information geometry of risks and returns

An innovative product design framework and its geometric interpretation is introduced

Banks look back in anger as FRTB revives 1990s risk test

Institutions bemoan need for parallel framework to measure portfolios’ sensitivities to market moves

A risk-based internal audit methodology for Greek local government organizations

The authors propose a methodology for evaluating possible risks when preparing an audit plan in Greek municipalities, with applicability beyond this area.

Audit committee characteristics and the audit report lag in Greece

The authors review empirical studies investigating the effect of audit committee characteristics on audit report lag, using Greece as an example. and finding that committee diligence is associated with a shorter report audit lag.

Looking beyond SA-CCR

An alternative calculation of exposure at default that handles complex portfolios is presented

Vega decomposition for the LV model: an adjoint differentiation approach

Introducing an algorithm for computing vega sensitivities at all strikes and expiries

Quant house of the year: Crédit Agricole CIB

Asia Risk Awards 2022

Automatic implicit function theorem

New technique can improve use of adjoint algorithmic differentiation in calibration problems

Getting the jump on pricing dividend-protected derivatives

Morgan Stanley quants show how to avoid mispricing corporate options and convertible bonds

Reviving the lost art of perturbation for exotic pricing

Natixis quants find novel way to speed up volatility smile modelling

Chebyshev Greeks: smoothing gamma without bias

A numerical method to obtain stable deltas and gammas for complex payoffs is presented

Semi-closed-form prices of barrier options in the Hull-White model

New pricer for options with time-dependent barrier shown to be computationally efficient and stable

Three adjustments in calibrating models with neural networks

New research addresses fundamental issues with ANN approximation of pricing models

Second-order Monte Carlo sensitivities

This paper considers the problem of efficiently computing the full matrix of second-order sensitivities of a Monte Carlo price when the number of inputs is large.

Floating start date for 2020 stress test alarms EU banks

Regulator proposal could lead to less reliable market risk data, critics warn

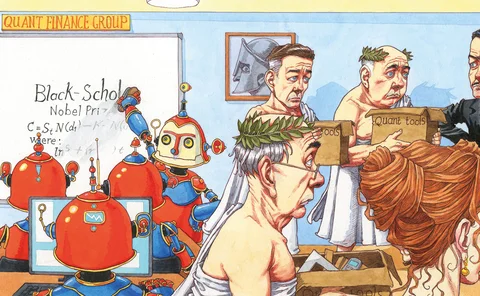

Deep hedging and the end of the Black-Scholes era

Quants are embracing the idea of ‘model free’ pricing and hedging

Podcast: Hans Buehler on deep hedging and harnessing data

Quant says a new machine learning technique could change the way banks hedge derivatives

JP Morgan turns to machine learning for options hedging

New models sidestep Black-Scholes and could slash hedging costs for some derivatives by up to 80%

Eurostoxx dislocations signal autocall hedging pain

Swings in dividends and volatility reveal year-end stress as European index slump tests “peak vega”