Currency options

StanChart sees big uptick in FX options positions

Counterparty Radar: UK bank benefits from MSIM trades as market for US mutual funds expands in Q2

FX disruption template paused due to Isda definition clash

GFMA’s close-out framework put on hold as Isda reviews 1998 FX derivatives rule book

Hedge funds ease off profitable China FX options trade

Some still hold positions but an appreciating renminbi may make them less profitable for now

MSIM revived RMB options activity in Q1

Counterparty Radar: Investment firm added $2 billion in dollar/renminbi options, mainly with JP Morgan and StanChart

Same instrument, different market

Dealer Rankings 2023: For buy-side firms, the list of banks you can trade with depends on who you are

Morgan Stanley, JP Morgan lead Risk’s first Dealer Rankings

Dealer Rankings 2023: Analysis of more than 1,000 cuts of Counterparty Radar data offers rare glimpse of sell-side pecking order

SVB salvage lands First Citizens with $18bn of FX contracts

Bank now holds seventh-largest stack of non-trading currency derivatives in the US

MSIM cuts options strategy to lowest on record

Reduced USD/CNH positions coincide with declines in fund assets

FX options hint at potential for euro shock

Months-long rally powered by ongoing hikes, but euro-bears fear economy will crack

Mutual funds dump two-thirds of FX options positions in Q4

Counterparty Radar: Morgan Stanley Investment Management leads fall in volumes with big cuts to RMB trades

Currency derivatives house of the year: BNP Paribas

Risk Awards 2023: Paris-based bank profits from dollar/offshore renminbi volatility

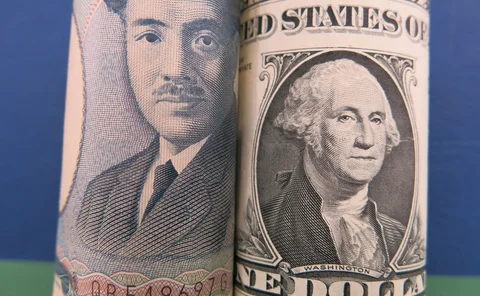

Hedge funds push yen options bets to next BoJ meeting

Target shifts as vol punts on change to rates policy fall flat

Morgan Stanley IM slashes FX options book

Counterparty Radar: Manager’s reduction tanks JP Morgan’s market share with sector

BoJ policy shift sends traders to hedge downside yen moves

Hedge funds and corporates rush to FX options following central bank move

HKD de-peg bets gather steam

Options struck outside permitted band grew this year, with some dealers recycling flows via structured products

MSIM option strategy set for payout

Manager has spent over $400 million buying options that have yet to generate returns – until now

Corporates rush to hedge emerging market currency risks

Falling forward points have reduced cost of hedging further drops in Chinese renminbi

JP Morgan increases FX options dealer lead as Goldman slips

Counterparty Radar: GSAM up five manager spots amid market decline, while MSIM holds RMB positions steady

MSIM’s baffling $400m options splurge

Funds owned or advised by the manager have spent vast sums on a USD/CNH strategy that appears not to have paid off

Yen exotics re-hedging fuelled vol surge, say traders

USD/JPY spike forced dealer stampede into call options, pushing FX vol even higher

MSIM holds half of FX options notionals among US funds

Counterparty Radar: Manager tops up on USD/RMB calls to extend lead and helps Goldman into second place among dealers

Can Clobs level the playing field in OTC FX options?

Electronification could be a “game changer” for smaller liquidity providers, say participants

Currency derivatives house of the year: UBS

Risk Awards 2022: T-Pricer platform enabled bank to gain technological edge

FXPBs wary of Turkish lira risk, say hedge funds

Primes hesitant to take big positions on embattled currency