Cross-border trading

Swaps users wary of hedge accounting hit from Brexit transfer

Uncertainty over exemption for novated trades may force hedgers to sacrifice netting benefits

Imperfect harmony: industry balks at EU foreign venue rules

Proposal could force non-EU platforms to choose between following Mifid II or ditching EU firms

Industry fears EU ‘Google tax’ will hit trading venues, CCPs

Broad wording of digital services tax could place market infrastructure in firing line

Risk of no-trade lists as banks leave Brexit plans late

European clients could face bottleneck of contract transfer requests from relocating banks

Day one of a no-deal Brexit: swaps and chaperones

Banks, trading platforms, repositories tee up EU entities – and dread the repapering crunch that would follow

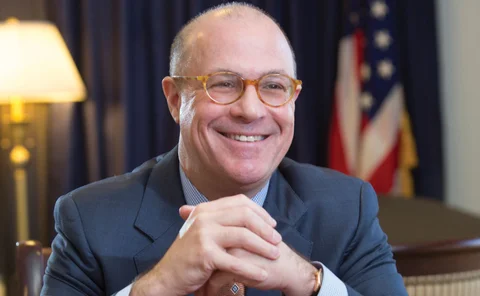

Q&A: CFTC’s Giancarlo on the race to overhaul cross-border rules

New Sef rules imminent, but deference to foreign regulators may not be completed by 2020

Dealers sour on Mifid’s systematic internaliser label

SI decisions will take account of tougher pre-trade rules, client demand and Brexit

Brexit threatens some swaptions trades

Force majeure clauses could be triggered on physically settled contracts

Japanese cross-border claims on European countries hit all-time high

Loans to entities in developed European countries outpace those to other western nations in Q1 2018

Questions remain on scope of Mifid extraterritoriality

Global firms confused about reach of trading obligation and best execution rules

Asian NDF fixings threat signals yet another deadline drama

Extraterritorial reach is not new to region, but EU Benchmarks Regulation poses real risks

French ‘bombshell’ would gut Mifir equivalence, say lawyers

Leaked non-paper would also clamp down on reverse solicitation for EU wholesale clients

US bank swaps books rebound after G-Sib reckoning

Total OTC derivative notionals across eight G-Sibs grow $28 trillion in first quarter

Maijoor defends late LEI relief amid industry frustration

Esma chairman says early Mifid relief would have removed incentives to register LEIs

EU shuts door on foreign electronic access providers

US FCMs could be barred from providing direct electronic access as member states bow to Esma

Esma navigates a Brexit maze over equivalence

Regulator offers share-trading reprieve for EU firms without relaxing rules for UK

Reporting rules key for EU-US swaps trading equivalence

Market participants welcome outcomes-based approach, but need clarity where rules differ

SGX, HKEX expect to be among first wave of Mifid II equivalence

Hong Kong should also benefit from acceleration in process of allowing trading on non-EU venues

EU-US swaps trading equivalence tipped for November

Hong Kong and Singapore unlikely to be deemed equivalent for start of Mifid II

Industry pushes CFTC to prioritise cross-border clarity

Approaching Mifid II deadline adds urgency to Giancarlo’s overhaul of Sef rules

Ashurst non-netting opinion on China splits lawyers

EU banks using opinion for margin exemption, at possible cost of capital savings

EU regulators stymied by Esma on electronic access

Treatment for third-country firms unknown until European Commission makes equivalence decision

Power struggle: EU battles for supervisory convergence

European Commission’s review of the three supervisory authorities fraught with difficulties

EU regulators consider Mifid electronic trading lock-out

Moves to restrict third-country firms from offering direct electronic access blamed on Brexit