Credit markets

Citi catapults to top credit options dealer spot for US funds

Counterparty Radar: Market for mutual funds, ETFs continues to shrink in Q4 as Pimco, PGIM further cut exposures

How Man Numeric found SVB red flags in credit data

Network analysis helps quant shop spot concentration and contagion risks

Why US bank regulation needs a system upgrade

SVB collapse shows supervisory framework is not fit for a changing industry and new systemic risks

Credit Suisse CDSs offer no reprieve for AT1 losses

Legal experts pore over credit definitions after AT1 writedown

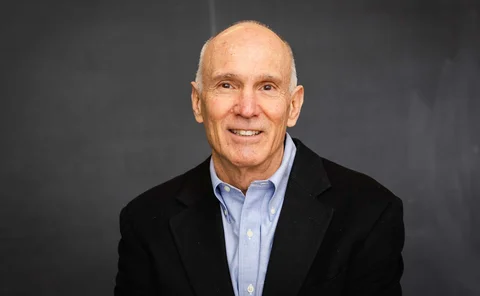

Lifetime achievement award: Stephen Kealhofer

Risk Awards 2023: KMV co-founder helped usher in a new era of credit risk analysis – at banks and investors

BofA’s DVA losses inflated to $193m in Q4

Latest hit is largest since 2020, but still leaves positive result for 2022

PGIM pares back long-bond options bets

Counterparty Radar: Barclays benefits from manager’s Q3 portfolio changes

Trends in global credit markets: the rise of credit default swap clearing in a shifting landscape

As macroeconomic and geopolitical turmoil continues, credit market participants are increasingly looking to clearing for its risk management capabilities and post-trade efficiencies. With a major shift in the clearing landscape under way, Michael Amakye,…

Credit Suisse’s new markets strategy builds on the old one

GTS is scrapped, but blueprint of connecting wealth management to markets remains intact

Pimco dumps credit options as US funds slim holdings

Counterparty Radar: Space shrinks 30% in Q2 following three consecutive quarters of growth

Credit derivatives house of the year: Credit Suisse

Asia Risk Awards 2022

PGIM increases credit hedges as funds add bought index CDSs

Counterparty Radar: Morgan Stanley added market share, but Goldman stayed top among dealers

Data-driven wrong-way risk

A calculation method for regulatory CVA wrong-way risk based on credit and exposure is introduced

Bond issues stumble on liquidity drought – Aviva treasurer

Insurer’s £500 million RT1 notes narrowly avoid market freeze as ECB ends asset purchases

Trumid, SGX Asia bonds JV faces uncertain future

Costly delays to launch of exchange sees backers slash headcount

Non-bank growth in e-credit spurs dealer algo push

As the likes of Jane Street capture more electronic business, dealers are reassessing their capabilities

EU consolidated bond tape could boost all-to-all trading

Greater confidence in pricing may also have eased Covid liquidity crunch, says Dimensional exec

The unintended consequences of ring-fencing

Rules aimed at protecting UK depositors may be putting too much froth into the credit market

Traders say BoE green bond purchase scheme could sap liquidity

Updated plan could spike market volatility – harming not only brown bonds, say dealers

Credit migration: generating generators

A stochastic time change helps the modelling of rating transition

CanDeal ideal: could Canada make a sea-change in e-trading?

E-trading firm aims to capture all Canada’s electronic fixed income trade, requiring a culture shift

Bond-CDS basis keeps investors interested

Difference between cash bond spreads and derivatives tightens but still offers value, dealers say

Libor webinar series – Big issuers

Nobody knows what will happen to Libor at the end of 2021, but the market has to be ready for anything – including the benchmark’s demise. This continues to be the message from regulators, despite the havoc caused by the Covid-19 pandemic. The coming…

Electronic bond trading stalled in volatile markets

Bid/offer spreads on bond platforms spiked in March and the buy side struggled to trade