Credit default swaps

Credit derivatives house of the year: Credit Suisse

Asia Risk Awards 2022

PGIM increases credit hedges as funds add bought index CDSs

Counterparty Radar: Morgan Stanley added market share, but Goldman stayed top among dealers

Ice Credit’s required initial margin up 18% in Q2

CCP reported highest level on record, superseding Covid-19-induced peak

Data-driven wrong-way risk

A calculation method for regulatory CVA wrong-way risk based on credit and exposure is introduced

Esma warns new foreign clearing house rules could backfire

Löber says euro swaps trading may move away from CCPs that face toughest EU scrutiny

A general firm value model under partial information

The authors propose a general structural default model combining enhanced economic relevance and affordable computational complexity.

PGIM leans into bought credit options, further boosts Barclays

Counterparty Radar: US mutual funds added $25 billion in net new positions in Q1 with purchased protection rising

Goldman retakes top dealer spot in single-name CDS trades

Counterparty Radar: Pimco, Ice increase market share as volumes decline

Pimco, Western AM buttress sold index CDS positions

Counterparty Radar: US funds grow CDX NA HY positions by $7.2 billion in Q1

At JSCC, required initial margin up 20% in Q1

The bulk of the increase came from members of the clearing service covering ETPs

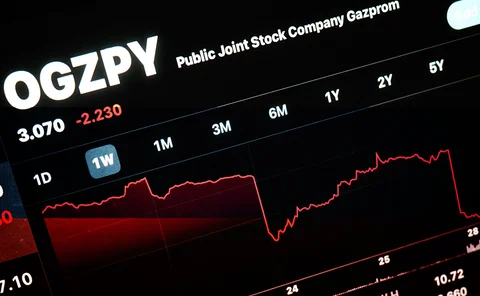

Pimco loses $400m on failed Russia CDS bets

Revised markdowns suggest bond giant has already crystallised losses on sold credit default swaps

CDS market mulls settlement options for Russia contracts

Tightened US sanctions threaten CDS default auction, leaving users a choice of imperfect alternatives

CDS notionals made a comeback in 2021

A 5% rise to highest end-year figure since 2017 driven by swaps on junk debt

Mind the gap

A default intensity model reveals the risk carried by a highly leveraged counterparty

CDS users mull ‘uniform’ price as Russia fallback

Pricing agreement could replace dealer estimates if sanctions scupper default auctions

CDSs may not cover final coupon on $149bn of Russian bonds

Some derivatives contracts expire before end of final grace period for distressed corporate bonds

Morgan Stanley bests Goldman as top US fund single-name CDS dealer

Counterparty Radar: Single-name corporate volume hits record high as Pimco increases positions

US funds continue expansion of sold CDS protection

Counterparty Radar: Pimco leads charge with $57 billion in total sold positions

Russian invasion stirs up ‘perfect storm’ for XVA desks

Declining credit quality of Russian companies and spike in inflation threaten CVA and FVA double-whammy for banks

Norway oil fund’s derivatives book balloons 192% in H2 2021

Sovereign wealth fund GPFG piled up FX and IR contracts and tapped CDS for the first time

Pimco, Franklin Templeton affiliates top for Russia exposure

Counterparty Radar: Funds had biggest long exposures to Russia across credit, rates, FX at end of Q4

CDS committee to rule on scope of eligible Russian debt

Group will determine whether bonds with ruble payment options can trigger the contracts

Credit default swaps on Russian companies face uncertain future

With CDS auctions on sanctioned companies unlikely, traders may have to rely on dealer estimates

Market set to reject SEC’s anti-fraud CDS rules ... again

Industry groups dislike retread of rules around fraud and manipulation, and want longer comment period