Covid

How does the pandemic change operational risk? Evidence from textual risk disclosures in financial reports

The authors investigate changes in operational risk profiles of the financial industry following the Covid-19 pandemic.

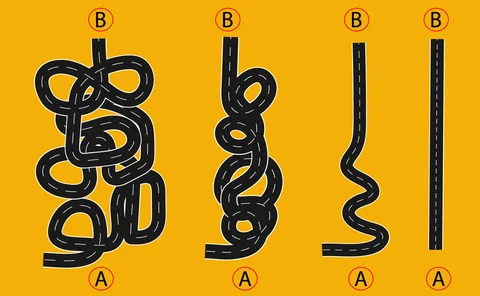

Keep risk parity simple, stupid

In times of volatility, simpler risk parity strategies may outperform more elaborate counterparts

House of the year, Malaysia: CIMB

Asia Risk Awards 2022

Risk management consultant of the year: KPMG

Asia Risk Awards 2022

Modeling systemic operational risk in the Covid-19 pandemic

This paper introduces existing and novel epidemiology models and investigates how government responses to the Covid-19 pandemic impacted these models.

StanChart tackles US-China rates divergence

Talking Heads 2022: Policy changes have upended correlations in emerging markets, says rates head Lettich

EU banks add overlays as crises evade modelling

Lenders buttress provisions against unpredictable fallout from Russia's invasion of Ukraine

Top Fed watchdog supports non-bank Sifi designation

Vice-chair Barr complains regulators lack “even basic data” on some areas of shadow banking

Quarles calls for SLR ‘recalibration’ to support Treasuries

Former vice-chair says leverage ratio gold plate was based on flawed projections of Fed reserves

Changes in operational risk and its determinants under Covid-19

The authors investigate the operational risk impact of the Covid-19 pandemic on Chinese commercial banks and the moderating effect of bank size, business diversification and regulatory records.

BoE’s planned procyclical capital hike bewilders banks

Some doubt regulator will go through with buffer hike while forecasting recession

‘Very little support’ for a US Treasury clearing mandate – Isda

Dealers and clients prefer carrot to stick in efforts to improve Treasury market liquidity

Using correlation to model op risk losses may be unsafe – study

Techniques for linking economic factors and bank losses produce varying – and sometimes contradictory – results

The ghost of Archegos returns to haunt Simm

UK regulator’s attack on Simm may have more to do with the failed family office than meets the eye

Banks temper credit loss models by editing Covid narrative

Faced with geopolitical chaos and signs of recession, expected credit loss models need to adapt fast

Risk modelling: Covid’s impact on US housing and mortgages

The Covid-19 pandemic has reshaped consumer behaviour to an extent surpassing the impact of the global financial crisis that began in 2007–08. This fact, combined with drastic policy changes by the US federal government, has effects on financial markets…

Hedge funds warn SEC dealer rule is ‘unenforceable’

Private funds say they are collateral damage of poorly drafted push to regulate PTFs

Covid chaos spurs on search for model risk aggregation

Many models failed in pandemic, but analysing them in clusters easier than whole-bank view

Why FRTB model test loves volatility, but hates hedges

Crucial P&L test for internal models easier to pass if price swings are large, or desks poorly hedged

Share of required margin increases at top EU CCP members

Number of clearing members with total requirements of €10bn and above has been increasing since 2017

Risk culture 2.0: redefining attitudes and behaviours in an era of change

The world is a very different place than it was prior to the Covid-19 pandemic. From changing work patterns and operational change to geopolitical tensions and rampant inflation, risk departments have never been under so much pressure

Thriving in the new resilience normal

While the Covid-19 pandemic may be largely behind us, new challenges emerge as firms renavigate and optimise operations in the ‘new normal’. Today the focus has shifted to making operational resilience scalable and sustainable. In a Risk.net panel…

Federated’s CIO on the fight to save prime MMFs

SEC reform proposal could be final nail in coffin for institutional prime funds

BoE: regulators could push CCPs to publish margin shocks

Russia-Ukraine war has forced a tenfold margin funding burden, says BNP; Ice says smaller hedgers face disenfranchisement