Compliance

We need a different approach to supervisory stress-testing

Confusing processes turn tests into template-filling exercise, says Garp’s Jo Paisley

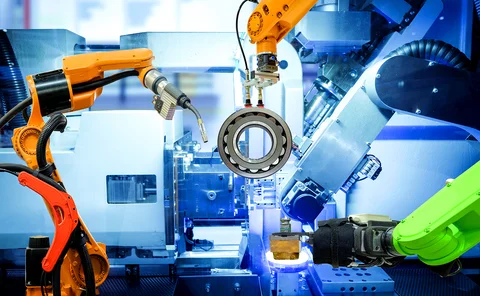

Risk Markets Technology Awards 2019: Vendors enter the pick-and-mix era

Modular tech and micro-services – plus new risk and regulatory needs – are creating openings for insurgents and incumbents

Anticipating change – How GRC teams can empower the first line of defence

Financial firms are increasingly adopting the three lines of defence framework to manage risk. But how has the model evolved to date and what does the future look like for this key risk management tool?

Asia moves: SocGen replaces China head, Goldman names new partners, and more

Latest job changes across industry

Obstacles and opportunities in adopting cloud computing

Sponsored Q&A

CFTC finds harmony harder than it sounds

James Schwartz and Chrys Carey, of counsels at Morrison & Foerster, explore the impact of a recent Commodity Futures Trading Commission white paper – including how its author’s suggestions would affect cross-jurisdictional application of its regulations …

Europe inches closer to own version of no-action relief

Five options on the table, lawmakers want case-by-case veto, firms push for power over primary laws

Cloud risk management requires a shift to the continuous compliance mindset

A comprehensive review of a firm’s GRC framework can deliver enhanced reporting and transparency, increasing the pace of innovation and adoption

Keeping up with cloud adoption

Risk.net convened a webinar in collaboration with Murex to explore how, as more financial institutions move to the cloud, they can get the most out of their technology investments

Compliance preparations amid uncertain rules

A forum of industry leaders discusses how banks will define individual trading desks under FRTB, whether BCBS 239 compliance projects can help banks meet FRTB risk data challenges, which model validation obstacles banks still face and other key topics

EU seeks US-style freedom to delay rules

Power to grant “no-action relief” appears in proposals from EU Council and Parliament

Embracing the sea change to come with FRTB

Firms have until 2021 to implement FRTB, and those yet to begin compliance efforts risk putting themselves at a disadvantage. EY‘s financial services risk partners Shaun Abueita and Sonja Koerner explore the current level of readiness within the industry…

Risk of no-trade lists as banks leave Brexit plans late

European clients could face bottleneck of contract transfer requests from relocating banks

Asia embraces intelligent automation

Asia’s adoption of new tools and processes has gained significant momentum, with increased automation now a primary focus for many financial firms. Paul Worthy, head of Japan at Tradeweb, explores how this change has come about, and how firms can use the…

Corporates fear EU will spike Emir Refit reporting relief

Delegated reporting threatened by policy-maker objections to use of foreign banks

A call to arms – How machine intelligence can help banks beat financial crime

The revolution in artificial intelligence promises new leads in banks’ fight against dirty money. Alexander Campbell of Risk.net hosted a live online forum, in association with NICE Actimize, to investigate the applications of this emergent technology

The management traits of problem banks

Former Bank of Spain supervision head discusses how to stop dangerous activities before they take hold

Preparing for the initial margin phase-in

Requirements for the mandatory exchange of initial margin are expected to be time‑consuming and laborious to implement. David White, head of sales at triResolve, discusses the lessons learned from in‑scope firms, obstacles to achieving compliance and how…

Delving into the FASB's current expected credit loss model

The Financial Accounting Standards Board's current expected credit loss rule could mean loss provisions for loans are three times higher than with International Financial Reporting Standard 9

Lessons for the next round of energy market regulation

More recognition of commodities' special features will make future regulation faster and smoother, argues energy expert