Central banks

Credit Suisse cuts exposures by 22% to match run on deposits

Bank dipped into central bank reserves and other safe assets to honour surge of withdrawals in Q4

Wanted: radical ideas for inflation modelling

Hedge funds echo Mervyn King’s calls for a new approach to inflation modelling post-2022 crisis

Sovereign risk manager of the year: Ukraine’s Ministry of Finance

Risk Awards 2023: War bonds programme and debt payment freeze raise $11.6 billion to fund defence against Russia

Bucking wider trend, Citi’s cash trove ends 2022 up 31%

Liquid balances surged 14% in the last quarter of the year alone

BoJ policy shift sends traders to hedge downside yen moves

Hedge funds and corporates rush to FX options following central bank move

Japan banks’ LCRs pull back for 4th quarter in a row

Rise in net cash outflows remains sustained as HQLAs hit plateau

Aussie banks slash quasi-HQLAs by 27%

Lenders told to cut reliance on central bank repos for liquidity coverage amid a glut of government debt

BoJ action to strengthen yen spurs FX options traders

Traders turn bearish on USD/JPY FX vol over further central bank intervention

Shifting rates throw bond investors off balance

Dearth of bond liquidity forces some traders to offload positions – but, as ever, others are waiting to pounce

A child of inflation: BNPP’s new macro trading unit

Talking Heads 2022: Currency and rates traders join forces at French bank as it plans to bring FX algos to US Treasury bonds

BoE’s planned procyclical capital hike bewilders banks

Some doubt regulator will go through with buffer hike while forecasting recession

Russian corporates stashed cash at EU banks in Q1

Deposits from non-financial corporations increased 36%, while Moscow’s central bank cut balances by 28%

Rates correlations break down amid volatility surge

Dealers say go-to hedges are now too risky as old relationships fail

How to stop stablecoins from hoarding precious collateral

Repo markets expert and crypto bank chief exec think Fed reserves are the right answer

Revival of FX carry strategy leaves quants unconvinced

Record returns in March give little comfort that strategy is ‘back’

Ice Clear Europe boosts liquidity buffer by 77%

More than half of the CCP’s loss-absorbing funds is now deposited in central bank balances

LCH turns to central banks in rejig of liquidity pools

Central bank balances hit all-time high, despite aggregate fall in liquidity buffer in Q4

Energy firms call for central bank support to cover margin spikes

EFET warns energy market participants risk being unable to meet “unprecedented margin requirements”

Russian banks draw over 3trn rubles at 1-day repo auction

Country’s central bank allotted full amount on offer, the highest amount since 2014

Regulators moot public utility to tackle FX settlement risk

Idea floated as battery of initiatives vie to address slowing use of PvP services

Single-name CDS trading bounces back

Volumes are up as Covid-driven support fuels opportunity for traders and investors

Buy-side rates traders staying on sidelines after wild October

Funds cautious after staggering collapse of the year’s steepener trade

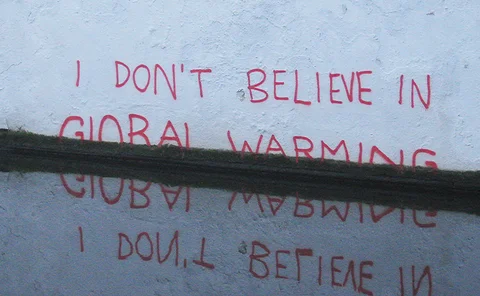

Climate risk: the writing is on the wall

For the EU financial sector, climate risk is inescapable, but it could be tamed

RMB house of the year: Standard Chartered

Asia Risk Awards 2021