Black-Scholes

CME was ill-prepared for negative oil prices, FCMs say

Bourse draws criticism over timing of options model change; delay in sending key margin file

Three adjustments in calibrating models with neural networks

New research addresses fundamental issues with ANN approximation of pricing models

Pricing American call options using the Black–Scholes equation with a nonlinear volatility function

In this paper, the authors investigate a nonlinear generalization of the Black–Scholes equation for pricing American-style call options, where the volatility term may depend on both the underlying asset price and the Gamma of the option.

The Chebyshev method for the implied volatility

In this paper, the authors propose a bivariate interpolation of the implied volatility surface based on Chebyshev polynomials. This yields a closed-form approximation of the implied volatility, which is easy to implement and to maintain.

Path independence of exotic options and convergence of binomial approximations

In this paper, the authors analyse the convergence of tree methods for pricing barrier and lookback options.

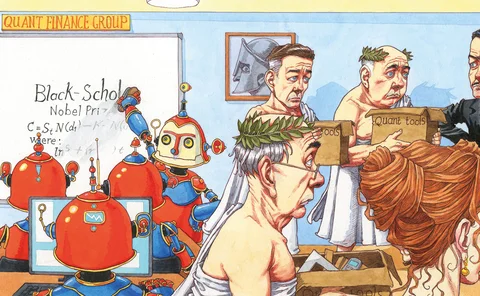

Deep hedging and the end of the Black-Scholes era

Quants are embracing the idea of ‘model free’ pricing and hedging

How AI could tear up risk modelling canon

BlackRock, MSCI, LFIS among firms looking to replace traditional, linear risk models

Podcast: Hans Buehler on deep hedging and harnessing data

Quant says a new machine learning technique could change the way banks hedge derivatives

JP Morgan turns to machine learning for options hedging

New models sidestep Black-Scholes and could slash hedging costs for some derivatives by up to 80%

Application of the Heath–Platen estimator in the Fong–Vasicek short rate model

In this paper, the authors construct a Heath-Platen-type Monte Carlo estimator that performs extraordinarily well compared with the crude Monte Carlo estimation.

Efficient conservative second-order central-upwind schemes for option-pricing problems

In this paper, the authors propose improvements to the approach of Ramírez-Espinoza and Ehrhardt (2013) for option-pricing PDEs formulated in the conservative form.

Vibrato and automatic differentiation for high-order derivatives and sensitivities of financial options

This paper deals with the computation of second-order or higher Greeks of financial securities. It combines two methods, vibrato and automatic differentiation (AD), and compares these with other methods.

Polynomial upper and lower bounds for financial derivative price functions under regime-switching

In this paper, the authors present a new approach to bounding financial derivative prices in regime-switching market models from both above and below.

Importance sampling applied to Greeks for jump–diffusion models with stochastic volatility

In this paper, the authors develop a procedure to reduce the variance when numerically computing the Greeks obtained via Malliavin calculus for jump–diffusion models with stochastic volatility.

Rogue traders versus value-at-risk and expected shortfall

VAR and ES are ineffective to deter rogue trading

Validation of profit and loss attribution models for equity derivatives

The aim of this paper is to validate profit and loss attribution generated by daily movements of option prices as seen through their Black–Scholes (Black and Scholes 1973) and Merton (1973) implied volatilities.

Pricing multidimensional financial derivatives with stochastic volatilities using the dimensional-adaptive combination technique

In this paper, the authors present a new and general approach to price derivatives based on the Black–Scholes partial differential equation (BS-PDE) in a multidimensional setting.

What financialisation means for oil: Ilia Bouchouev of Koch

Investor demand now drives oil prices as much as physical fundamentals

Quant of the year: Jean-Philippe Bouchaud

Risk Awards 2017: Physicist takes on classic models with data and empirical research

Deconstructing correlation

Peter Austing introduces an analytic or semi-analytic valuation of basket options

Cross-dependent volatility

Julien Guyon introduces cross-dependent volatility models and calibrate them to market smiles

Small banks face rate options valuation model change

Negative rates causing pricing model rethink

CVA and FVA with liability-side pricing

Wujiang Lou calculates CVA and FVA abiding by the law of one price

FX volatility – An evolutionary story

Sponsored feature: Commerzbank