United Kingdom (UK)

UK Treasury opens door to ditching Mifid open access rules

Champion of competition in derivatives clearing may throw in the towel

EU fund managers confused by new ESG designations

Vague rules leave managers unsure which categories to apply to their funds

Cherry-picking fears as banks pull negative rates commitments

As UK mulls negative rates, banks desert Isda protocol and traders warn of gaming the system

Shell bides time over Isda fallbacks

Oil major will adopt Isda protocol as “insurance policy” despite hedge accounting concerns

FCA sees ‘no case for delay’ on Libor cessation ruling

Synthetic Libor powers set for spring consultation as fallbacks become effective and IBA analyses cessation feedback

End ‘senseless’ ban on midpoint trading, asset managers urge

Investors decry European rule that forces them to trade some equities in whole tick sizes

ECB grants post-Brexit reprieve on large exposures limit

Exemption for intra-group exposures to UK will be preserved pending a decision on equivalence

BoE to test UK banks against double-dip Covid recession

Stress simulation falls short of actual coronavirus crisis shock to the UK economy

Brexit drives swaps trading to US platforms

Lack of equivalence forces dealers to shift euro and sterling swaps out of European and UK venues

BoE reassures foreign banks on post-Brexit booking models

EU banks that lost passporting rights after Brexit are unlikely to have to establish UK subsidiaries

LCH Ltd sent record €6bn VM call to one clearing member in Q3

Largest estimated payment obligation in the event of a member default also climbs quarter on quarter

Trading heads call for reform of double volume caps

Asset managers endorse UK move on caps and back changes to EU’s unloved share trading restrictions

The lonely Londoners: doubts plague UK quest for equivalence

Planned MoU won’t automatically bring equivalence, leaving firms in limbo for unknown duration

IBA, Refinitiv go live with regulated term Sonia rates

First deals linked to new benchmarks are likely to be in trade finance

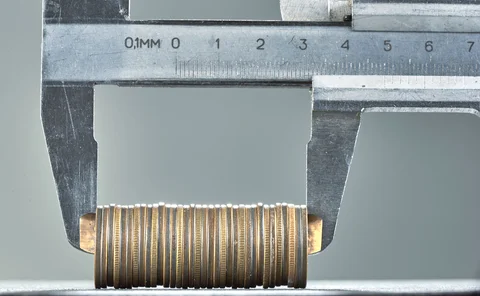

Skin in the game of top CCPs varies

The average default fund has less than 4% of total resources contributed by the host CCP itself

UK offers unlimited dark trading on lost EU stocks

FCA gives London dark pools an edge over EU rivals, but will fund managers use it?

At LCH Ltd, IM levels edged lower in Q3

Peak aggregate initial margin call for equities fund hit £3 billion

EU firms face margin threat as Brexit tips futures into OTC regime

Mid-2021 clearing, margin thresholds loom as LME, Ice futures lose exchange-traded status in EU

Inconsistent ESG scores force USS to make its own decisions

Pension fund needs ESG alternatives to bonds to help close its funding deficit

Dollar Libor reprieve sparks fallback uncertainty

Popular settings to end in June 2023; market seeks clarity over timing of fallback spread triggers

HSBC exec: measure culture through smarter surveillance

Machine learning could help gauge positive sentiment from surveillance logs, says Elhedery

Buffer stops? Why banks haven’t used Covid capital relief

Amid weak credit demand, banks haven’t availed themselves of capital buffers, but they still might

Term Sonia rivals don the same clothes

IBA mimics Refinitiv by adding Tradeweb quote data; Refinitiv denies IBA has ‘synthetic Libor’ edge

Esma warns of UK-sized hole in Europe’s fund leverage radar

Executive at hedge fund AQR also urges reform of EU leverage measures to better assess risk