Societe Generale

Europe eyes the pitfalls of Japanification

Does the cultural and demographic experience of Japan apply to a heterogeneous grouping of nations that have no common monetary policy or a unified social outlook?

Search for alpha in a volatile world

Alpha generation can be an elusive goal, particularly when trading volatility. Three different approaches to trading volatility were discussed by a panel looking at the role of systematic and carry strategies in finding profit in a high-volatility world

ESG investing: It’s not just great to be good

Investing according to environmental, social and governance (ESG) criteria can be done in various ways, with continuing development of filters and ways of analysing companies. As the market in ESG indexes and investments linked to sustainability matures,…

Among G-Sibs, Japanese and US banks see LCRs improve most

US systemic banks’ liquidity coverage still lags behind other G-Sibs

Liquidity coverage of eurozone G-Sibs diverge in first half of 2019

BNP Paribas sees LCR drop 11.6 percentage points in H1 while Deutsche Bank’s climbs 7.3 percentage points

Over two years, UK G-Sibs levered up in contrast to EU peers

But UK CRR leverage ratios still higher than eurozone rivals

Asia Risk Awards 2019: The winners

The best of the best in Asia

Credit derivatives house of the year: Societe Generale

Asia Risk Awards 2019

Interest rate derivatives house of the year: Societe Generale

Asia Risk Awards 2019

Asia structured products house of the year: Societe Generale

Asia Risk Awards 2019

Credit risk grows share of big EU banks’ RWAs

Deutsche Bank leads the field, with credit RWAs increasing share of total by 294bp year-on-year

Risk density of US systemic banks trumps that of EU peers

Ratio of RWAs to leverage exposures averages 44.7% at US G-Sibs

People moves: Deutsche hires new treasury unit head; markets role for Barclays’ Pecot; Penney leaves HSBC, and more

Latest job changes across the industry

Natixis hires Boleslawski to head equities

Long-standing SG trading head arrives at French rival

In liquidity buffer shake-up, Deutsche shuns cash

Central bank balances fall as share of liquidity buffer to 64% in Q2

Structured products – The ART of risk transfer

Exploring the risk thrown up by autocallables has created a new family of structured products, offering diversification to investors while allowing their manufacturers room to extend their portfolios, writes Manvir Nijhar, co-head of equities and equity…

Sefs stall, but more liquidity may be coming

The hoped-for competition among Sefs never was. But banks and prop traders might be facing off on swaps

EU banks increase systemic footprint

Values used for seven of 12 systemic risk indicators climb year-on-year

Natixis defers €120 million of trade profits in H1

French bank builds valuation reserve by 41% year-on-year

UK banks added OTC notionals in 2018 as EU peers cut back

Barclays, HSBC, Lloyds, Standard Chartered increased notionals by almost €15 trillion

Big EU banks’ Level 3 assets up 25% in 2018

Hard-to-value assets rise €35 billion year-on-year

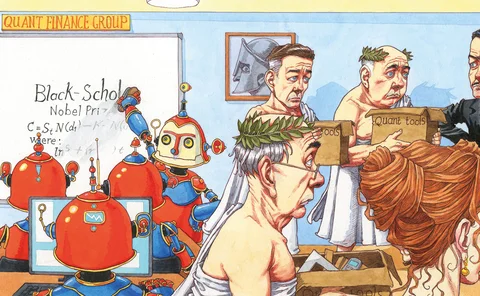

Deep hedging and the end of the Black-Scholes era

Quants are embracing the idea of ‘model free’ pricing and hedging

Restructure boosts SocGen’s capital and liquidity ratios

CET ratio hits 12%; LCR 134%