Quantifi

Fed strengthens stress tests with focus on counterparty defaults

The Fed's 2024 stress test examines how banks handle complex risks, such as WWR and jumps at default. Dmitry Pugachevsky, head of research at Quantifi, discusses how the integration of these factors into XVA calculations provides a more comprehensive…

Calibrating interest rate curves for a new era

Dmitry Pugachevsky, director of research at Quantifi, explores why building an accurate and robust interest rate curve has considerable implications for a broad range of financial operations – from setting benchmark rates to managing risk – and hinges on…

Navigating market turmoil with robust credit risk management

In today's fast-paced and ever-evolving financial world, firms must master credit risk management to navigate market volatility. This webinar explores the dynamics of credit risk management and offers insight into risk assessment techniques, challenges…

Beyond Libor: the impact of SOFR on rates, bonds and loans

Dmitry Pugachevsky, director of research at Quantifi, explores how the transition from Libor to the SOFR impacts rates, bonds and loans, alongside some of the challenges that are due to arise

ECB zeroes in on wrong-way risk as a key lesson of Archegos

Counterparty risk experts agree with focus on “long-neglected” topic after family office default

Managing inflation risk with hedging strategies

Dmitry Pugachevsky, director of research at Quantifi, explores how banks manage inflation risk using inflation swaps and inflation-linked bonds as hedging instruments

Model risk management is evolving: regulation, volatility, machine learning and AI

Thomas Oliver, head of model validation at Quantifi, explores how the model risk management (MRM) landscape is changing in response to geopolitical uncertainty, increased concerns over counterparty risk, rising interest rates and other related challenges

Navigating the volatility and complexity of commodity markets

Commodity markets have experienced significant challenges since the Covid-19 pandemic, the conflict in Ukraine and the subsequent sanctions imposed on Russia. These unprecedented events have caused fluctuations in supply and demand, disrupted global…

Leveraging data science for next-generation risk and P&L

Alexei Tchernitser, director of analytic solutions at Quantifi, discusses the impact data science has had on next-generation risk, and profit and loss (P&L)

Front-office reboot: how new technology, machine learning and data science are reshaping trading

With increasing regulatory scrutiny and market volatility, trading desks are seeking tools to help improve operational efficiency, streamline decision making and successfully manage risk. In this Risk.net webinar, viewers will learn about the front…

Vendor for system support and implementation: Quantifi

Asia Risk Awards 2022

Best AI or machine learning innovation: Quantifi

Asia Risk Awards 2022

The future is now: how data science is revolutionising risk management and finance

This webinar explores how your organisation can move beyond legacy technology, better meet investor demands and remain competitive by embracing the future of finance.

What drives the convertible bond market?

Dmitry Pugachevsky, director of research at Quantifi, provides an overview of the burgeoning convertible bond market, including approaches to modelling and its outlook in the current inflationary environment

Taking advantage of relative value credit opportunities with advanced bond analytics

Dmitry Pugachevsky, director of research at Quantifi, a provider of risk, analytics and trading solutions, explores the challenges of bond analytics and how access to the right analytics can provide opportunities for more comprehensive trading strategies

Markets Technology Awards 2022: the joy of flex

Tech users want the freedom to tweak and change their systems – not always an easy ask for rigid, legacy software

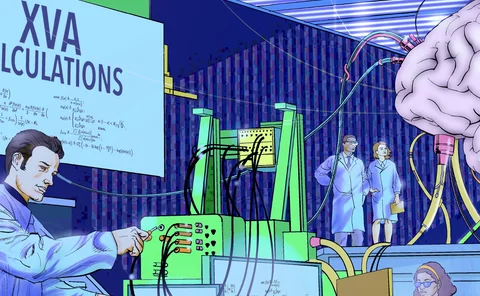

Deep XVAs and the promise of super-fast pricing

Intelligent robots can value complex derivatives in minutes rather than hours

Risk Technology Awards 2020 – Coping with Covid uncertainty

Scenarios scrapped, rules revised and holes plugged – how the winners of the Risk Technology Awards 2020 are adjusting to the Covid‑19 pandemic

Market Technology Awards 2018: New problems, new solutions

Vendors embrace cloud, alternative languages and agile approaches

Technology: banks start thinking inside the box

Monolithic capital markets systems are giving way to microservices, containers and APIs

PineBridge appoints CIO for Mena and Turkey team

People moves