This article was paid for by a contributing third party.More Information.

Fed strengthens stress tests with focus on counterparty defaults

The US Federal Reserve’s 2024 stress test examines how banks handle complex risks, such as wrong-way risk (WWR) and jumps at default. Dmitry Pugachevsky, head of research at Quantifi, discusses how the integration of these factors into valuation adjustment (XVA) calculations provides a more comprehensive picture of bank exposure

Spurred in part by last year’s bank failures, the Fed has added a default scenario and additional exploratory analysis to this year’s stress test. The latter consists of four elements, two of which are exploratory market shocks of the banking system.

The two market shocks aim to assess lenders’ abilities to withstand a broader spectrum of risks beyond those traditionally covered in the tests. Both require banks to assess losses from the default of their five biggest hedge fund counterparties. These inclusions highlight previously overlooked vulnerabilities stemming from exposures to hedge funds and could play a key role in averting a recurrence of bank losses incurred with the downfall of Archegos Capital Management in 2021.

Market vulnerabilities

The key distinction between the two scenarios lies in their scope: one concentrates on shocks localised within US markets, whereas the other assumes global disruptions. The Fed wants to assess the potential consequences by grasping a measure of the magnitude of losses across different asset classes in these distinct scenarios. Although both scenarios predict an expansion of credit spreads and a downturn in stock values, variations between the two scenarios emerge in the reaction of foreign exchange rates, interest rates and commodities.

This comprehensive Fed examination demonstrates the efforts undertaken by the Fed to thoroughly assess the resilience of banks against the effects of WWR and jumps at default, whereby a local currency may devalue in the event of a counterparty – such as a major local bank – defaulting. Both factors are key components in the calculation of XVAs within the banking sector.

Assessing and incorporating WWR and jumps at default into XVA calculations is important given they directly influence a bank’s exposure to counterparties during adverse conditions

WWR and jumps at default: effects on CVA

By analysing WWR and jumps at default, the Fed aims to gain a deeper understanding of the potential vulnerabilities within the banking system. Such insights are vital for ensuring the stability and resilience of financial institutions, particularly during periods of heightened market stress or economic turmoil. Moreover, by proactively identifying and addressing these risks, regulators and policy-makers can implement targeted measures to mitigate systemic risks and safeguard the broader financial ecosystem from potential disruptions. Thus, this examination serves as a crucial pillar in the ongoing efforts to enhance the robustness and stability of the banking sector in the face of evolving market dynamics and emerging challenges.

Furthermore, according to the Fed’s 2024 Stress Test Scenarios, the stress-testing landscape has evolved to include a counterparty default scenario in addition to the traditional severely adverse scenario. This requires banks with substantial trading or custodial operations to assess potential losses resulting from the largest counterparty defaults after the application of global market components within the severely adverse scenario. By integrating default scenarios with market dislocations, stress tests highlight the role of WWR and jumps at default in risk assessment and regulatory oversight.

This expanded framework reflects the interconnectedness and complexity of financial markets, where the failure of one counterparty can trigger a domino effect across the system. Quantifi investigated this counterparty default correlation in a white paper, Bank credit risk: how well do you know your counterparties?

By simulating scenarios that encompass market-wide disruptions and individual counterparty defaults, regulators aim to better understand the systemic implications and vulnerabilities inherent in the financial system

Moreover, the inclusion of the counterparty default scenario in the Fed’s 2024 Stress Test Scenarios underscores the importance of evaluating banks’ exposures to counterparties and their ability to withstand shocks arising from such events.

It also demonstrates the importance of a holistic approach to risk management, where factors such as WWR and jumps at default are integrated into regulatory frameworks to ensure the stability and soundness of the financial system. Overall, the incorporation of the counterparty default scenario represents a significant advancement in stress-testing methodologies, reflecting a proactive stance towards identifying and mitigating systemic risks in the banking sector.

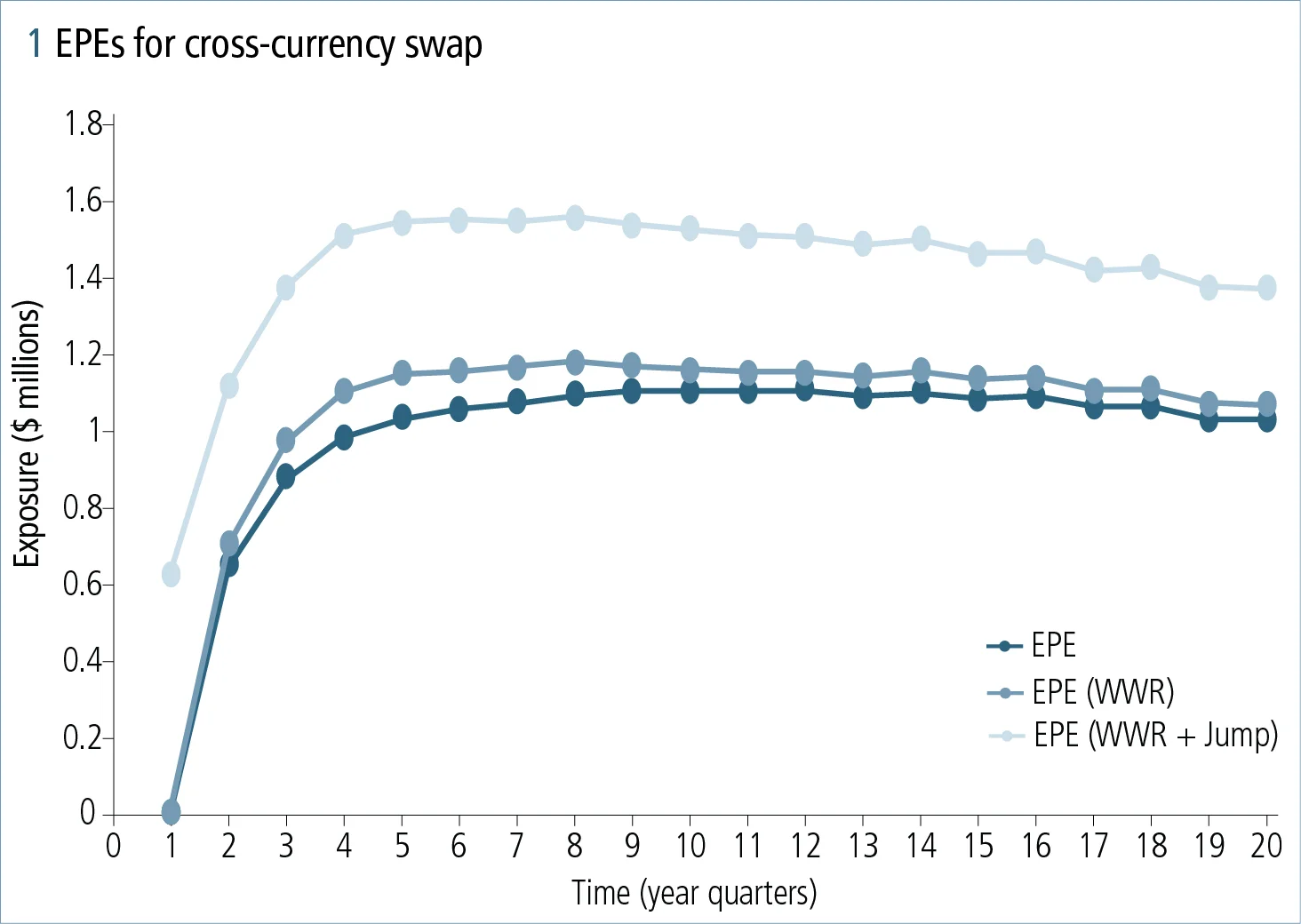

The WWR between credit and market factors is probably most pronounced in cross-currency swaps, particularly those that are not resettable (effectively, not marked-to-market). These have significant FX risk because of a large payment at maturity. Another scenario significantly affecting such trades is jumps at default. Figure 1 illustrates the importance of WWR and especially of jumps at default. The calculations are performed for an at-the-money five-year non-resettable cross-currency swap with $10 million notional. With regular credit valuation adjustment (CVA) equal to -1.5%, WWR CVA increases 6% to -1.6% of notional. Even 5% devaluation at default increases CVA another 35% to -2.15% of notional.

This shows expected positive exposures (EPEs) for each of the three cases: regular, WWR and WWR with 5% devaluation. Note that WWR could be significantly higher depending on the volatilities of FX and counterparty credit and the correlation between them.

Overcoming XVA complexity

Some large banks, which commonly have comprehensive XVA solutions, cannot accurately calculate WWR or jumps at default as they lack infrastructure, expertise or sophisticated models. Smaller banks may not have dedicated XVA desks or advanced solutions like their larger counterparts, but may still manage similar risks on a smaller scale, often using simpler methods or relying on third-party solutions.

Building a solution from the ground up is a demanding and time-consuming process, requiring several years to construct an efficient XVA Monte Carlo solution

Hence, buying third-party solutions can prove to be a more cost-effective and faster option.

Quantifi has successfully implemented its XVA solution at several sell-side and buy-side firms, with all of the features described in this article implemented and used by the clients. The high-performance calculation engine and sophisticated analytics support Monte Carlo simulations and path-wise pricing necessary for XVA.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net