European Union (EU)

'No-deal' Brexit would add risk weights to EU government bonds

HSBC has most sovereign exposures that could attract higher capital charges among big UK banks

Own goal: Mifid II reduces transparency in some EU markets

New rules replace voluntary arrangements in ETFs and Nordic bonds, fragmenting post-trade data

Poor Mifid data could condemn OTC market to the dark

Many derivatives likely to fail first full liquidity test and escape EU transparency obligations

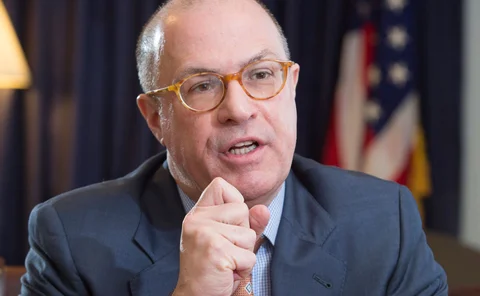

Q&A: EU’s Hübner on Brexit and future of equivalence

Top EU lawmaker discusses improvements to equivalence, contract continuity and clearing relocation

French banks’ leverage ratios rally on EU court win

Improvements of 10 to 30 basis points follow change to leverage measure

Benchmark bother: Europe frets over new risk-free rate

Unsecured fixing from ECB faces off against two repo-based rates, as 2020 benchmark deadline looms large

CLS seeking legal fix for Brexit settlement threat

Market infrastructure firm wants EU27 to protect trades in insolvency by tweaking local laws

Regulatory arbitrage: a crime, or a warning?

It could be unwise to ignore disproportionate regulatory impacts on specific business lines

ECB mulls response to French leverage ratio exemption

Supervisor could rewrite justification annulled by EU General Court, or appeal the ruling

Oversight row could block EU firms from US clearing – Giancarlo

Europe’s planned post-Brexit CCP reforms “irreconcilable” with US rules, says CFTC chief

Leverage ratio redux: the fallout from French bank court win

EU countries could seek to benefit from exclusion of state-backed deposits from leverage ratio

SOFR, leverage and life after London

The week on Risk.net, July 14-20, 2018

EU banks get different MREL levels and deadlines

Average bail-in requirement is 28% of RWAs

Nordea plumps bail-in buffers as it moves to Finland

Nordic bank plans €10 billion senior non-preferred debt issue by 2021

FCA could kill off Libor, says Bailey

Warning breaks new ground, provoking immediate responses at CFTC meeting

EU trading venues warn over looming end of LEI relief

Expelling issuers with no legal entity identifiers could hurt liquidity and investor strategies

Seeing red: EU banks swamped by stress test demands

Banks’ stress test submissions receiving tens of thousands of error messages from local supervisors

Isin database users oppose further fee increase

Derivatives Service Bureau may hike fees for top users to cover cost of proposed additional services

European banks face ‘bottleneck’ to complete EBA stress test

New accounting rules and supervisor demands squeeze teams prepping for 2018’s exercise

EC official offers hope to prop traders on capital rules

Official sees problems in draft regulation, says EU council and parliament are discussing them

Asian NDF fixings threat signals yet another deadline drama

Extraterritorial reach is not new to region, but EU Benchmarks Regulation poses real risks

Replacing too big to fail with too small to survive

Subordinated debt requirement will hit smaller banks hardest

US CVA charges over seven times higher than EU

Huge disparity appears to result from EU exemption for corporate trades

EU close to granting swaps-trading equivalence to Singapore

Planned MAS trading obligation would otherwise seal off local traders from global liquidity