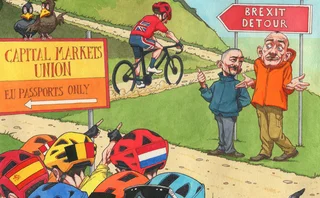

Why bankers should embrace the Brexit political theatre

Treating equivalence as purely technical might not have the outcome that financial firms want

Act one of the UK’s departure from the European Union gave audiences an exhilarating show. Not only did vital negotiations between politicians turn sour and almost end in failure, but spectators had the thrill of knowing that whatever the outcome, they had to live with it. Fortunately, a disastrous no-deal exit was averted.

For act two, banks want a calmer experience. Ideally, they think that would mean leaving the political drama out of decisions on whether regulations in the EU and UK are equivalent. Viewed objectively, it is easy to decide whether rules in the two jurisdictions have the same outcome – and it is the best way to avoid major market disruption for both parties.

One area where bankers are hoping for the verdict to be treated as a technicality is prudential standards for banks and some investment firms, known as the Capital Requirements Regulation (CRR).

If the jurisdictions are not deemed equivalent, the risk weights assigned to EU banks’ exposure to their UK peers – and vice-versa – would jump, ending up the same as those assigned to unregulated corporate exposures. This would potentially make some interbank financing or derivatives activity uneconomical.

Bankers argue this is not a political matter because it does not involve giving something away. CRR equivalence on its own does not allow UK entities to access EU clients, or vice-versa, in the way that, for example, the Markets in Financial Instruments Regulation (Mifir) does. CRR recognition avoids disruption where entities from the two jurisdictions face each other and lays the groundwork for other equivalence decisions.

This would potentially make some interbank financing or derivatives activity uneconomical

But marking equivalence decisions as “technical” rather than “political” might not have the effect that financial services firms are seeking. On the surface, the two jurisdictions would appear equivalent, because the UK has transposed EU rules into their own legislation.

But they are only identical for the moment. Taking a purely technical approach could make it harder to justify equivalence in the future if the two jurisdictions diverge.

UK bank supervisors have questioned what they would do if the EU relaxes capital laws or doesn’t implement internationally agreed standards. The chief executive of the Prudential Regulation Authority recently indicated that he finds proposed changes to the EU treatment of bank software assets ‘dubious’ and may not want to apply this approach in the UK.

Basel bites

Soon, the EU and UK will both implement the most recent Basel III capital rules, agreed with other jurisdictions at the Basel Committee on Banking Supervision. EU banks and some lawmakers object to the agreed accords, especially a floor on capital requirements calculated using internal models. EU banks may be able to sway lawmakers to deviate from the agreement.

Click for more on Brexit equivalence

“If, as a case, they don’t implement the Basel Accords properly, what do we do about it in terms of the equivalence judgement that we have to make?” asked Andrew Bailey, chief executive of the UK’s Financial Conduct Authority, speaking in a hearing at the House of Lords on February 12. Bailey will leave the post and become governor of the Bank of England in March.

If the UK decides the answer to that question is to deny or threaten to deny equivalence on technical grounds for CRR, Europe’s politicians will be quick to factor this into other equivalence decisions.

For example, granting equivalence to allow cross-border trading with clients under Mifir is seen as a gift the EU would give to the UK. Some EU members, especially France, are already reluctant, and if the UK gets tough on technical grounds for other regulations, the EU would be even more disinclined to grant equivalence under Mifir.

In fact, a new equivalence framework for Mifir, designed in response to the UK’s decision to leave the EU, requires jurisdictions to be deemed equivalent by the European Commission under CRR to obtain Mifir equivalence. The EC will not be granting the UK equivalence under CRR if the UK doesn’t reciprocate.

But, on common-sense grounds, both the EU and UK would find it difficult to justify refusing each other equivalence for their capital rules. So far, the EU has granted equivalence to 24 jurisdictions, some of which have rules far less similar to the EU’s than those in the UK. And, logically, why should UK bank trades with Deutsche Bank or UniCredit be treated as if they were corporate exposures?

As a former bank capital manager remarks, authorities would get “pilloried” if that situation were to unfold. Which suggests that perhaps bankers would be better served to keep the equivalence debate squarely in the political domain, and hope EU and UK politicians can settle their differences on a post-Brexit deal, just as they did over the withdrawal agreement.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Our take

Talking Heads 2024: All eyes on US equities

How the tech-driven S&P 500 surge has impacted thinking at five market participants

Beware the macro elephant that could stomp on stocks

Macro risks have the potential to shake equities more than investors might be anticipating

Podcast: Piterbarg and Nowaczyk on running better backtests

Quants discuss new way to extract independent samples from correlated datasets

Should trend followers lower their horizons?

August’s volatility blip benefited hedge funds that use short-term trend signals

Low FX vol regime fuels exotics expansion

Interest is growing in the products as a way to squeeze juice out of a flat market

Can pod shops channel ‘organisational alpha’?

The tension between a firm and its managers can drag on returns. So far, there’s no perfect fix

CDS market revamp aims to fix the (de)faults

Proposed makeover for determinations committees tackles concerns over conflicts of interest

BofA quants propose new model for when to hold, when to sell

Closed-form formula helps market-makers optimise exit strategies