FVC review: Barclays dual-index autocall pays monthly coupons

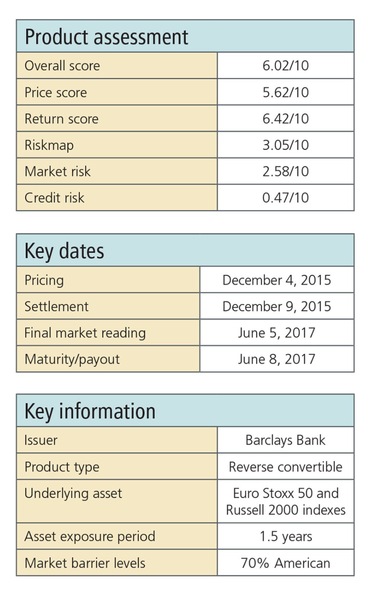

Barclays has issued an 18-month worst-of structured product tied to the Euro Stoxx 50 and Russell 2000 indexes. The income-paying autocallable offers annual coupons of 6.83%

Barclays has issued an 18-month worst-of structured product tied to the Euro Stoxx 50 and Russell 2000 indexes. The product is an income-paying autocallable that delivers fixed coupons of 6.83% per annum. The coupons are paid monthly at a rate of 0.57% each.

The product can mature early, paying investors their initial capital back plus the coupon for the period if both underlyings are at or above 100% of their initials on a given observation date.

Points for

1. High income of 6.83% paid monthly (0.57% per payment) until autocall is triggered or the end of the product term.

2. Income stream not dependent on the performance of the assets.

Points against

1. Principal is at risk if the closing-day barrier of 70% is breached during the monitoring period.

2. The return is limited to the income payments and fixed principal repayment.

3. There is no participation in any appreciation in the value of the multiple underlyings.

It features an American-style closing-day barrier, which will be breached if the closing level of the worst-performing index is below 70% of its initial level on any business day. If the index does not recover to its initial level by the maturity date, investors' capital will be lost at a rate of 1% for each percentage point the worst-performing index finishes below its starting level.

For example, if the American barrier is breached and the final level of the index is 60% of its initial value, investors will be repaid 60% of their initial capital - a loss of 40%. Payment of the fixed coupons throughout the product term will help to offset any loss of capital, however.

The Russell 2000 is a major US small-cap equity index that tracks the smallest 2,000 stocks in terms of market capitalisation within the broader Russell 3000 index. By contrast, the Euro Stoxx 50 tracks the largest 50 stocks by market capitalisation in the eurozone.

The Russell 2000 is a major US small-cap equity index that tracks the smallest 2,000 stocks in terms of market capitalisation within the broader Russell 3000 index. By contrast, the Euro Stoxx 50 tracks the largest 50 stocks by market capitalisation in the eurozone.

When a worst-of feature is used in a structured product the choice of correlated underlying assets reduces the chances of a barrier being hit, as the two underlyings generally follow similar paths: it is less likely that one will perform well and the other poorly. It also increases the chances of the product kicking out and returning investors' capital before any barrier can be breached.

The one-year historic correlation between the Euro Stoxx 50 and the Russell 2000 is roughly 63% - not that high when compared to other index pairs such as the FTSE 100 and the S&P 500, which have a historic correlation of around 90%. This is partly down to the two indexes tracking companies of different sizes: the Euro Stoxx 50 includes stocks with market capitalisations of almost $200 billion in its ranks - an enormous figure compared to the Russell 2000, where the all stocks have a market capitalisation of less than $14.5 billion.

Another major factor is geography. It is not surprising that an index of large stocks trading in Europe is not fully correlated to index of smaller stocks listed in the US.

The product has a relatively short 18-month term, with call dates starting after one year. As of early January 2016, neither index had dropped below 85% of its initial level at any point over the preceding 18 months - although the Euro Stoxx 50 experienced a range of closing values almost 30% apart over this period, demonstrating that a fall of the size required to breach the American barrier is certainly possible.

The 18-month historic volatility figure for the Euro Stoxx 50 is 22.38%, which is more than five percentage points higher than the 16.62% for the Russell 2000. Based on these figures, the Euro Stoxx 50 has a higher typical variance in index values, which in general makes it the index most likely to breach the barrier.

This type of product will suit investors who require fixed coupon payments and are willing to take on a reasonable degree of risk. The worst-of feature and the American barrier both increase the risk that investors are taking, but historical performance indicates there is a good chance that neither index will drop by more than 30% at any point during the product's life span. In addition, the call dates offer extra opportunities for capital to be returned early, and the fixed coupons will help reduce any potential losses that investors might incur.

The information in this analysis is taken from sources which Future Value Consultants Limited deems reliable but no guarantee is made that the information is complete or accurate and it should not be relied upon as such. Any opinions in the analyses represent those of Future Value Consultants Limited at the time of writing but are subject to change. All valuations and prices shown are indicative only and do not imply an offer or commitment of any kind. The analysis does not constitute advice or recommendations nor should it be relied upon for any purpose. No liability whatsoever is accepted by Future Value Consultants Limited or Incisive Risk Information Limited for any loss or expense incurred from using this analysis.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Structured products

A guide to home equity investments: the untapped real estate asset class

This report covers the investment opportunity in untapped home equity and the growth of HEIs, and outlines why the current macroeconomic environment presents a unique inflection point for credit-oriented investors to invest in HEIs

Podcast: Claudio Albanese on how bad models survive

Darwin’s theory of natural selection could help quants detect flawed models and strategies

Range accruals under spotlight as Taiwan prepares for FRTB

Taiwanese banks review viability of products offering options on long-dated rates

Structured products gain favour among Chinese enterprises

The Chinese government’s flagship national strategy for the advancement of regional connectivity – the Belt and Road Initiative – continues to encourage the outward expansion of Chinese state-owned enterprises (SOEs). Here, Guotai Junan International…

Structured notes – Transforming risk into opportunities

Global markets have experienced a period of extreme volatility in response to acute concerns over the economic impact of the Covid‑19 pandemic. Numerix explores what this means for traders, issuers, risk managers and investors as the structured products…

Structured products – Transforming risk into opportunities

The structured product market is one of the most dynamic and complex of all, offering a multitude of benefits to investors. But increased regulation, intense competition and heightened volatility have become the new normal in financial markets, creating…

Increased adoption and innovation are driving the structured products market

To help better understand the challenges and opportunities a range of firms face when operating in this business, the current trends and future of structured products, and how the digital evolution is impacting the market, Numerix’s Ilja Faerman, senior…

Structured products – The ART of risk transfer

Exploring the risk thrown up by autocallables has created a new family of structured products, offering diversification to investors while allowing their manufacturers room to extend their portfolios, writes Manvir Nijhar, co-head of equities and equity…