Structured products

WHAT IS THIS? Structured products are investments that have multiple components. For retail investors, the most common form is a bond plus an option – these tend to be standardised, sold in small tickets and large volumes. Managing the risks of large structured products portfolios is one of the biggest challenges dealers face.

Why vol markets shrugged off Nvidia rout

Gamma, autocalls and stock dispersion helped prevent a broader market meltdown

China’s snowballs hit by new regulatory clampdown

Restrictions on structured note issuance by securities houses blocks key distribution channel

Goldman’s unmatched sold credit protection up 15% in Q3

Written notionals not hedged by buying identical protection on riskiest names jumped 85%

Bank risk manager of the year: Intesa Sanpaolo

Risk Awards 2025: Market risk team developed new tools that helped overcome the challenge of FRTB internal models

Structured products house of the year: UBS

Risk Awards 2025: bulked-up structuring team is more than just the sum of its parts

Best structured products support system: Goldhorse Capital – Extramile

Goldhorse Capital – a Hong Kong-headquartered fintech platform now making waves across Asia’s structured products market – wins Best structured products support system at this year’s Asia Risk Awards

Supply chain decoupling fires up alpha focus at BofA

Talking Heads: Stock dispersion sees funds gross up on long/short baskets, while US structured notes come of age

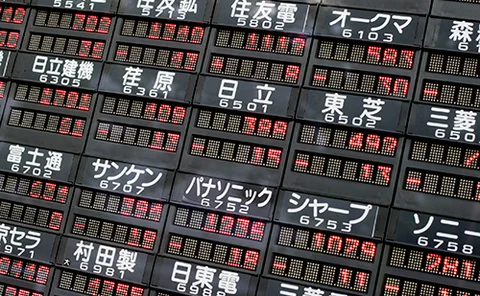

Vega peak was foothill in historic Nikkei selloff

JFSA scrutiny has curbed issuance of autocallables, so stock plunge generated light re-hedging

Gamma jitters from defined outcome funds

Tumbling equity markets could flip dealers’ exposure to gamma from long to short, leading to hedging losses

Asia moves: Senior hires at HKEX, UBS and more

Latest job news from across the industry

T+1 shift sparks dividend chaos in HK structured products

Products staying on T+2 leave providers scrambling to deal with ex-dividend dates caught inbetween

DVAs inflate US banks’ liabilities by $4.9bn

Credit spread retrenchment since last year’s crisis comes with flipside of larger structured-product liabilities

Regulatory crackdown puts Korea autocalls in deep freeze

Mis-selling fears see distributors pull back, leading to 40% issuance fall in a month

Options market still searching for cause of the Vix plunge

BIS paper blames yield-enhancing structured products, but market participants are unconvinced

Canada’s FRTB pioneers get snowed on fund-linked trades

As Basel capital reforms go live, risk managers eye early adopters’ progress and push to improve capital treatment of fund-linked products

How China’s equities intervention caused a quant fund quake

Popular leveraged market-neutral trade crumbled after government stepped in to support major indexes in February

China snowball knock-ins fuel futures sell-off

Market participants say issuer re-hedging has helped drive Chinese equity indexes lower

Corporates eye FX options as hedging costs shrink

With hedge ratios tipped to rise, dealers say treasurers are increasingly open to optionality

First Korean issuer joins Hong Kong warrants market

Kisa anticipates warrant and autocallable hedging synergies

At US banks, paper losses on HTM securities hit new high

Bank of America leads way as mortgage-backed securities drive aggregate rise in Q3

Huatai launches its first Hong Kong CBBC

Two more securities houses set to follow Chinese firm into Hong Kong’s listed structured products market