Indian corporates count forex losses from rupee depreciation

A sharp fall in the value of the rupee has left Indian exporters reluctant to hedge. With many corporates saddled with large-scale US dollar borrowings, mark-to-market losses on the balance sheet are also a concern – if those losses are realised

During the period following the financial crisis, the Indian rupee was a beneficiary of capital inflows with the Indian economy averaging growth of 8% per year while the West was experiencing negative growth. Successive bouts of quantitative easing from the US pushed the dollar lower and led to hot money flowing into Asia.

Over the past few months a number of factors have caused a reversal in this dynamic, pushing the rupee to a historic low of 60.8 versus the dollar on June 26, a depreciation of 10% in six weeks since the start of May when it was trading at 54.

The suggestion that the US Federal Reserve is seeking to taper its bond purchasing programme later this year – earlier than markets expected – has resulted in foreign institutional investment being pulled from India. Data from the National Stock Exchange of India shows that 20.7 billion rupees ($347.1 million) of India listed shares were sold on June 20 alone, marking their biggest single day of selling in at least a year.

"All Asian countries have registered capital outflows this month, with total equity outflows of $10.2 billion registered, led by South Korea and Taiwan. The bigger concern is for deficit countries including India and Indonesia, with their currencies remaining particularly vulnerable to capital outflows," says Mitul Kotecha, global head of foreign exchange strategy at Crédit Agricole in Hong Kong.

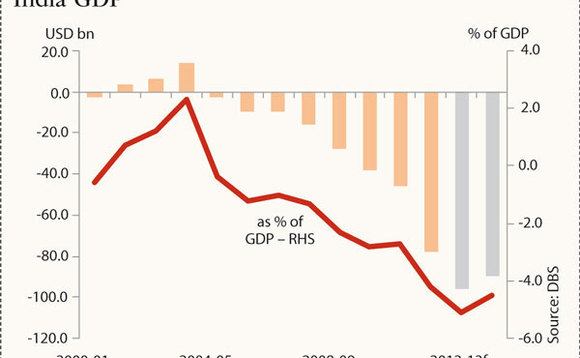

Indeed, India's long-standing structural problems have worsened. Its current account deficit moved from $78.2 billion in 2011 to $87.9 billion last year according to the Asian Development Bank. India is also suffering competitiveness issues due to erratic electricity availability and antiquated infrastructure.

In addition, industries set up to reduce reliance on imports and potentially narrow the deficit, such as coal and fertiliser, have also been affected by the structural factors that have weakened the investment climate, making India still heavily dependent on imports in certain sectors.

Significantly, as the majority of export and import contracts are denominated in foreign currency, with more than 80% of Indian corporates' exposure in US dollar, large currency swings can play havoc for onshore corporations.

Rahul Badhwar, head of corporate sales Asia-Pacific at HSBC, says that despite the multiple factors leading to the recent decline, clients weren't ready for it. "The sell-off in Indian rupee has taken the market by surprise and the move was more exaggerated as it happened on thin volumes," he says.

He adds that the average exporter is not in a hurry to hedge when markets move rapidly because of the high costs involved. "The forward premium for six-month USD/INR is 1.6 rupees and dollar/rupee moved more than that in two days."

"Hedging activity by exporters has been limited as they try and come to terms with the magnitude of the move and try and understand the reasoning behind the fall. Needless to say a number of exporters who had sold when the rupee fell to 55 in April, its lowest level since the start of the year, are now sitting with hedges that are out of the money. Exporters are thus keen to capitalise on the opportunity that the current sell-off in the rupee is providing them with, but are likely to proceed with caution," he says.

However, Reserve Bank of India (RBI) rules don't permit companies to cancel and rebook their hedges in order to prevent trading of the currency. The rules were loosened six months ago to allow exporters to rebook up to 50% of cancelled contracts but the ban in cancelling and rebooking remains in place for importers.

On the sidelines

Sushir Lohia, regional head at Barclays in Mumbai, agrees that the difficulty of hedging in a fast-paced market has meant that many exporters are staying on the sidelines. "The pace of decline has been unprecedented and we have seen historic lows for the rupee against the dollar. When markets are volatile and move in large trends, corporates stay away. There is a lot of nervousness and unwillingness to enter the market in any meaningful way," says Lohia.

Another senior Mumbai-based banker says the last spike was from 45 to 55 in 2011 and this is the second big leg-up. "With people getting used to this depreciation and memories being short, the hedging strategy of exporters is to stay light on hedge ratios and hedge short term around their trade cycle," he says.

For some economies such as Japan, the recent yen depreciation has been a boon to Japanese exporters as its products have become more competitive in international markets. The same is not true for India as many of its exports such as jewellery manufacturing and petroleum refining have high import components, which neutralises some of the benefit of a weaker currency.

Importers have been increasing their hedging activity recently and while this would be expected when it costs more to pay for dollar-based goods, dealers say large importers that weren't previously hedging are now starting to buy dollars if they foresee further weakness in the rupee.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Currency markets

Charting volatility: strategic insights on Apac monetary policy divergence and market dynamics

A webinar covering key drivers of market fluctuations, the impact of currency and interest rate differentials, technology-driven strategies for risk mitigation in portfolio management, as well as innovations in asset and liability management during uncertain environments

BofA extends ‘guaranteed rate’ window to a year

US bank holds spot FX rates for longer period to give alternative hedging tools to smaller clients

FXSpotStream looks to growth products beyond spot

New chief exec Jeff Ward highlights NDFs and FX swaps as next boom area for the venue

FX options traders rethink vol drivers amid macro uncertainty

Market-makers believe more and more events will influence options pricing as political risk bubbles up during 2024

As T+1 looms, non-US firms consider out-of-hours trading

Pruned settlement cycle forces foreign buy-siders to explore automating the FX leg of securities trades

In a bit of a fix: Refinitiv seeks ideas to improve WM/R

Operator launches consultation following criticism of 4pm fixing rate