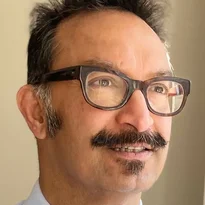

Manmohan Singh

Manmohan is a Senior Economist with the International Monetary Fund, in Washington DC. He writes extensively on topical issues including rehypothecation and collateral velocity, monetary policy and collateral, shadow banking, and under-collateralisation in the OTC derivatives market. More recently Manmohan has focussed on digital money and stablecoins, and how they will impact central bank operations and balance sheet. He has written a book with our sister brand, Risk Books, titled "Collateral and Financial Plumbing" now in its third edition, that examines the above themes from the lens of financial collateral. The book is now also available in Chinese edition. Manmohan has led workshops for the IMF to official sector policymakers on strategic asset allocation and the impact of regulations on financial markets. He has also worked and written policy notes on several countries including Japan, India, U.S., U.K., Eurozone etc. He holds a PhD and MBA from the University of Illinois at Urbana-Champaign and a B.S. from Allegheny College.

Disclaimer: Any contributions to the JFMI, including views expressed, are done in a personal capacity and should not be reported as representing the views of the IMF or IMF policy

Follow Manmohan

Book contributions by Manmohan Singh

Articles by Manmohan Singh

Collateral markets in need of rewiring

New data suggests a tech upgrade is needed to avoid a large central bank footprint in markets

Why central banks shouldn’t ignore stablecoins

Rapid growth of stablecoins could impair monetary policy transmission

Why fears about quantitative tightening are overblown

The benefits of collateral availability may outweigh the monetary liquidity withdrawn by central banks

Hedge funds and the rebound in collateral velocity

Reuse rate of collateral points to growing fragility and interconnectedness in financial markets

Net losers? Benefits of clearing US Treasuries are cloudy

Practical obstacles and questionable netting benefits muddy the path to a clearing mandate, argues economist

Collateral must be part of monetary policy equation

Incorporating collateral efficiency into IS-LM model reveals side-effects of QE

Leverage is underestimated

Off-balance sheet funding is large, rising and not fully accounted for in leverage metrics

How collateral scarcity reshaped the US yield curve

QE and demand for high-quality liquid assets have suppressed short-term rates, argue IMF economists

The case for draining excess reserves

The financial system can operate efficiently with $500 billion or less in reserves after normalisation

Central counterparty resolution: an unresolved problem

This paper describes the current policy for recovery and resolution of CCPs and assesses the tool kit for resolution of them.

Collateral flows and balance sheet(s) space

This paper looks at securities-lending, derivatives and prime-brokerage markets as suppliers of collateral.